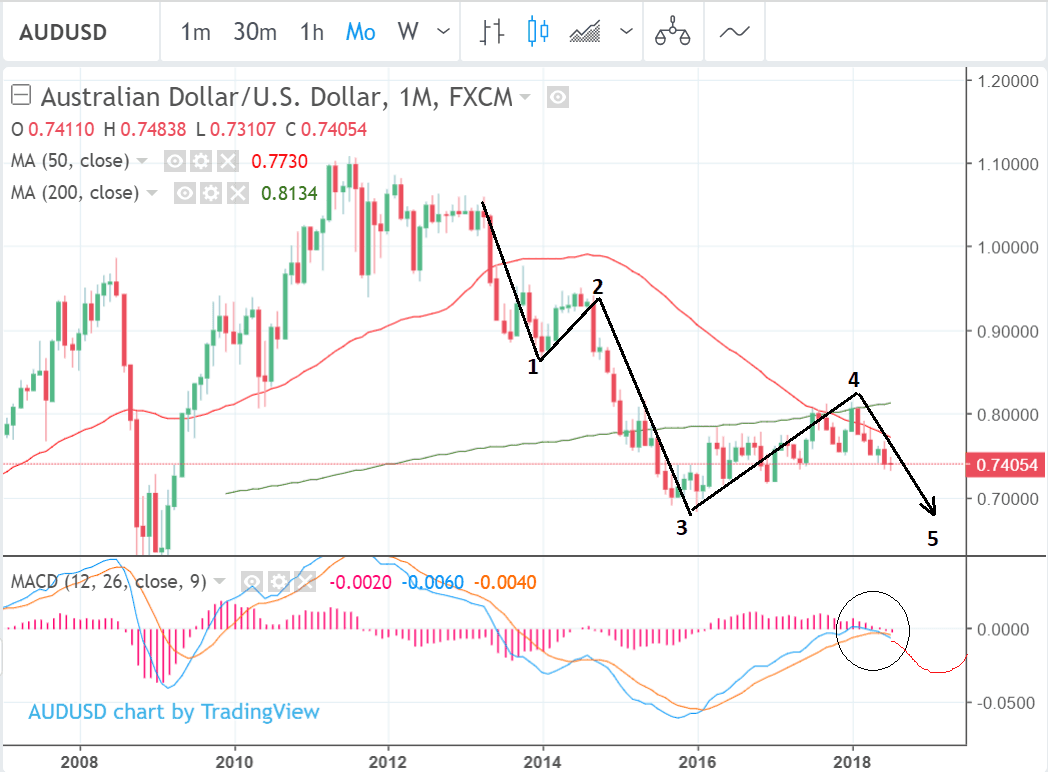

AUD/USD Showing Compelling Signs it May Retest 2016 Lows

- Large Elliot wave pattern recommends lower exchange rate over medium-term

- AUD/USD will probably retest 2016 lows

- Bearish monetary policy outlook and negative impact of rising global trade tensions support technical call

A long-term bearish Elliot wave cycle on AUD/USD suggests the potential for a retest of the 0.68 lows.

The Elliot wave, which began in circa 2013, looks like it is currently completing a final 5th wave lower, which will probably retest the previous January 2016 lows at 0.6827 - the end of wave 3.

Research shows wave 5's almost always retest the lows of wave 3s.

The configuration of the MACD indicator in the bottom panel is further evidence supporting the expectation prices will fall in a final wave lower.

After forming a deep trough during the formation of Wave 3, the MACD has risen back up above the zero line (circled), which is the corroborating indicator Elliot wave analysts use to confirm wave 4s have finished.

This indicates AUD/USD is in a final wave 5 down, in line with the broader bear trend. The MACD is now expected to form another trough which is shallower than the previous one, thus setting up a convergence for the recovery after the 5-wave structure has finished.

The Elliot wave overall suggests a marked bias for a weaker AUD.

From a fundamental perspective, this falls in line with the view that the currency is vulnerable to an escalation in global trade tensions due to its heavy reliance on commodity exports.

The lack of upside expectations for Australian interest rates, compared to most other jurisdictions is a further headwind for the Aussie Dollar.

Higher interest rates support currencies as they attract greater inflows of foreign capital drawn by the promise of higher returns; and vis-versa for lower relative interest rates.

The Reserve Bank of Australia (RBA), the authority charged with setting interest rates, is currently adopting a neutral, no-change, stance, whilst in the US the Fed has indicated it will be raising interest rates further, possibly as frequently as one 0.25% increase per quarter until the end of 2019. The widening divergence is likely to propel AUD lower versus USD, and backs up the bearish Elliot wave analysis.

Elliot Wave analysis, is a form of cycle analysis which sees the market as moving in five wave cycles of buying and selling interspersed by three wave corrections:

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

GBP

GBP EUR

EUR USD

USD AUD

AUD NZD

NZD ZAR

ZAR CAD

CAD CHF

CHF JPY

JPY