The Case for Euro Resilience Builds

- Written by: Gary Howes

File image of Isabel Schnabel. Image copyright and distribution: ECB.

The European Central Bank (ECB) is close to pausing its interest rate cutting cycle, which will put a backstop under Euro exchange rate weakness.

"We are getting closer to the point where we may have to pause or halt our rate cuts," prominent ECB board member Isabel Schnabel told the Financial Times midweek.

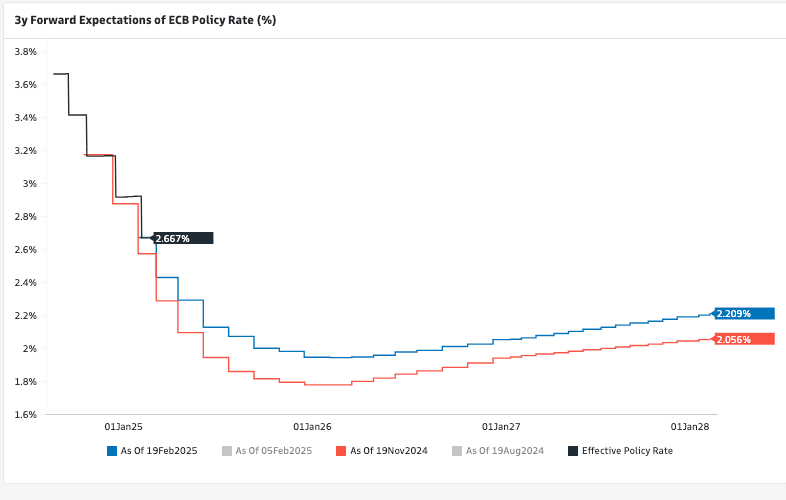

The comments caused a readjustment in market expectations as forward curves now show that the ECB has less than three interest rate cuts left in the year.

As of November, the pricing was far more generous, with the market priced for as many as five cuts this year.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Her comments have opened up the debate in the long run-up to the March meeting. We expect the rate cut then to be followed by a pause at least through April, ending the back-to-back sequence since September," says Mathias Van der Jeugt, an economist at KBC Bank.

The readjustment in expectations coincides with a recovery by the Euro against the Dollar through much of January and into February. The repricing in ECB expectations helped fortify the Euro against the Pound in the midweek session, limiting losses following a strong UK inflation report.

Interest rate expectations feed bond valuations, an important determinant of global capital flows. The Euro stands to appreciate if the Eurozone's rate differential with the likes of the UK and U.S. shrinks.

"ECB executive board member Schnabel is the first to suggest that the direction of travel (of monetary policy) is not so clear anymore," says Mathias Van der Jeugt, an analyst at KBC Bank.

The ECB has cut rates five times since June as policymakers worried about slow eurozone economic growth, but with a trade war on the horizon, concerns about inflation have returned.

Above: Market expectations for the depth of ECB rate cuts have reached a nadir and are climbing again.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Schnabel's comments are the latest in a trend change in ECB communications, in place since December's policy meeting, leading markets to no longer fully 'price in' an April rate cut.

"We need to start that discussion," she said, adding, "we can no longer say with confidence that our monetary policy is still restrictive."

A third ECB rate cut is priced at 88%, meaning there is scope for this to reduce further, providing scope for an additional 'hawkish' adjustment in expectations in favour of the Euro.

"Even though another rate cut is still widely expected at the next meeting in two weeks’ time, there’s now more doubt among investors about whether that’ll be followed up by many more," says Henry Allen, a macro strategist at Deutsche Bank.