Inflation Runs Hotter than Expected

- Written by: Gary Howes

Image © Pound Sterling Live

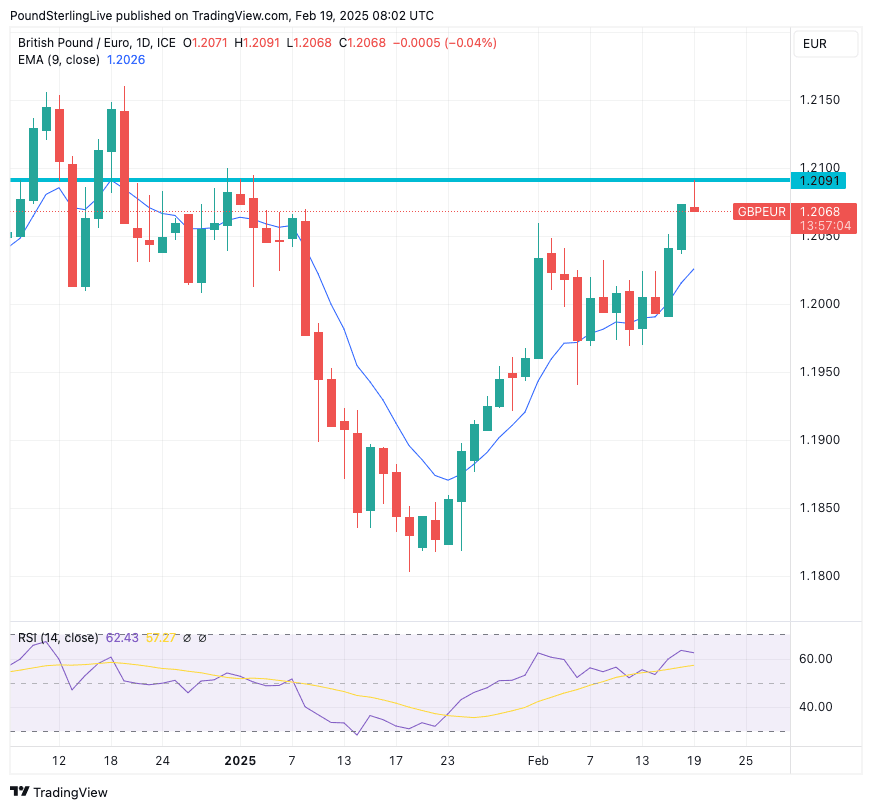

Pound Sterling's outlook against the Euro is bolstered by the release of an above-consensus UK inflation reading that limits the scope for further Bank of England rate cuts.

The Pound-to-Euro exchange rate is on the cusp of printing new 2025 highs at 1.2070 after the ONS said Britain's consumer price inflation (CPI) rose to 3.0% in January 2025, up from 2.5% in December, driven by higher costs in transport, food, and education.

This means euro buyers are looking at the best exchange rate since January 02.

The print easily surpassed the 2.8% reading expected by economists and raises concerns about the Bank of England's stated desire to cut interest rates further in 2025.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

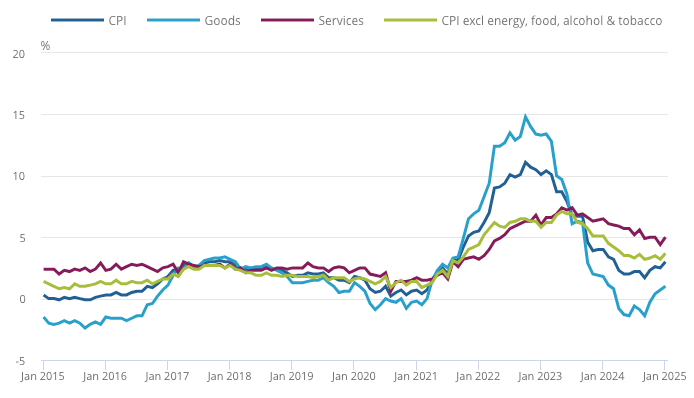

The increase comes as services inflation jumped to 5.0%, its highest level since August 2024, suggesting persistent price pressures in labour-intensive sectors.

This figure will be particularly concerning for the Bank of England, which says it is particularly focused on services inflation, judging that its failure to return to 2.0% is preventing CPI inflation from falling sustainably to the 2.0% target.

Core CPI, which excludes volatile energy, food, alcohol, and tobacco prices, also rose to 3.7% from 3.2%, indicating that underlying inflationary trends remain strong.

"Transport services, particularly air fares, saw significant increases, along with education costs," the ONS said in its report. Food prices also contributed to the upward trend, while housing and household services exerted downward pressure on the index.

Above: GBPEUR at daily intervals. The exchange rate is at its highest level since January 02.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

On a monthly basis, CPI fell by 0.1%, compared with a 0.6% decline in January 2024, but this was smaller than the -0.3% number the market was looking for.

The data is likely to complicate the Bank of England’s interest rate outlook as policymakers weigh the need to cool inflation against risks to economic growth. The central bank recently lowered rates to 4.5% from 4.75% but signalled a cautious approach to further cuts amid lingering inflation concerns.

With inflationary pressures still elevated, market expectations for aggressive rate cuts this year may be dialed back, analysts say.

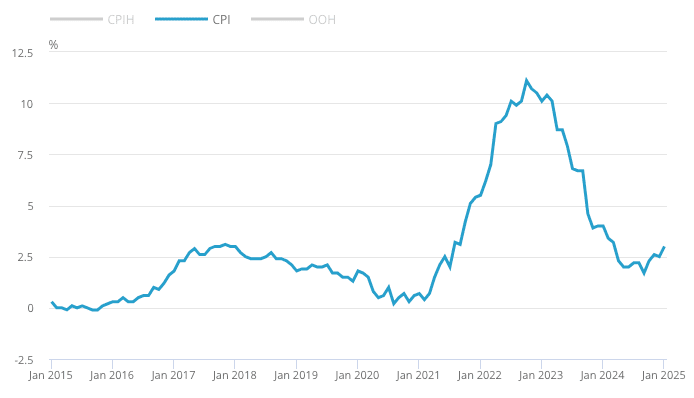

Above: UK CPI inflation is ticking higher again, confirming a sustained fall to 2.0% remains elusive.

"Persistent wage growth this year, together with an expansionary fiscal policy and exchange rate depreciation, will all act to limit the scope for monetary loosening this year. We therefore anticipate just one further rate cut in 2025," says the NIESR.

Such developments will underpin UK bond yields, which feed into a firmer British Pound. For the Pound-Euro exchange rate, these data will allow the uptrend that has been in place since mid-January to extend.

The next inflation report is due on March 26, 2025.

Above: Services inflation is sticky and too high, unless it falls, the headline CPI rate of inflation won't fall to the 2.0% target.

Inflation Could Rise to 4.0%, Forcing a Pause at the Bank of England

Inflation is marching higher, say economists, with many now anticipating the year's peak to easily surpass the Bank of England's forecast of 3.7%. "On the road to 4% inflation," says Andrew Wishart, Chief UK Economist at Berenberg Bank. "The big picture is that the disinflation process is stalling."

In the spring, UK businesses will have to contend with significant tax increases and minimum wage rises, with many indicating they will pass on the costs to consumers.

"Strong pay growth and the increase in employers National Insurance Contributions (NICs), a UK payroll tax, at a time when productivity is flatlining means that firms are facing a large increase in labour costs. Reasonable domestic demand will allow companies to pass much of the increase in costs they face onto customers in the form of higher prices," adds Pickering.

According to ONS data, the labour market remains a source of inflationary pressure, which showed regular pay rose 5.9% year-on-year in December, even as growth figures show the economy has flatlined around 0% since Labour took power.

Rising wages and stagnant supply mean prices must rise.

"UK labour market data once again highlighted that the Bank of England (BoE) must be extra careful when considering further monetary policy easing," says Illiana Jain, an Economist at Westpac.

Meanwhile, rising household energy prices will mean energy switches from weighing on inflation to boosting it.

"Together, that is likely to push CPI inflation up to c4% in September and cause the BoE to take a long pause after lowering bank rate from 4.50% to 4.25% in May," says Pickering.