Festive Jobs Blowout Sends Pound Sterling Higher

- Written by: Gary Howes

Image © Adobe Images

A strong set of employment figures took pressure off the Bank of England to cut interest rates next month, boosting the British Pound in the process.

The Pound-to-Euro exchange rate rose to 1.2050 in the minutes after the ONS said the UK unemployment unexpectedly held steady at 4.4% in December, which is below the consensus expectation and the Bank of England's forecast of 4.5%.

This was after employment accelerated to 107K in the three months to December, from 36K in November, beating the consensus estimate for +48K.

Reflecting the tight labour market, regular pay rose 5.9% year-on-year in December, meeting expectations but representing the fastest increase since April 2024. Overall pay, which includes bonuses, rose 6.0%, ahead of expectations for 5.9% and the fastest increase since November 2023.

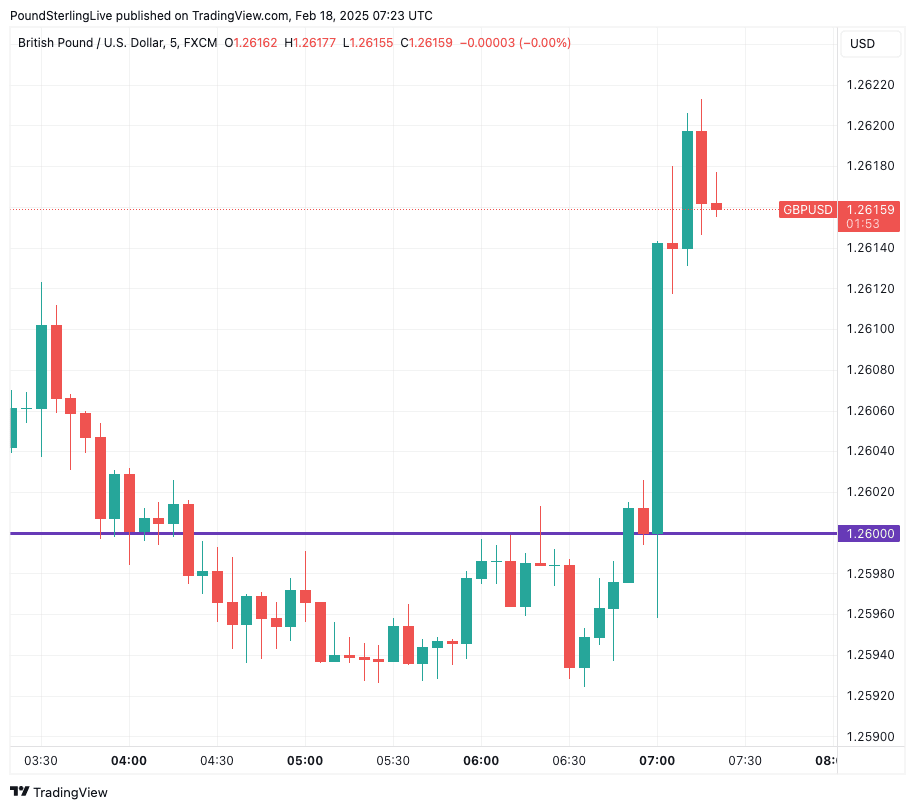

The Pound-to-Dollar exchange rate rose to 1.2619 in the minutes of the release.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

“The UK Labour market tightened a bit more than expected over the Christmas period, with unemployment lower than feared and wages rising. However, we worry that this proves a final festive blowout ahead of a painful Spring," says Nicholas Hyett, Investment Manager at Wealth Club.

The financial market reaction suggests these data will increase the pressure on the Bank of England to cut interest rates again next month, raising the odds that the next cut will occur in the second quarter.

"This report is a reminder that the Bank of England's job is not done and there is still some way to go in eradicating inflationary persistence. 6% wage growth in a period of negative productivity growth is self-evidently inflationary," says Kyle Chapman, FX Markets Analyst at Ballinger Group.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Markets had been prepared for a weaker set of figures owing to a steady deterioration in labour market dynamics reported by various surveys.

This month saw the Bank of England cut interest rates by 25 basis points and two members of the voting committee opt for a 50bp cut, judging the economy was deteriorating faster than expected.

However, Tuesday's numbers will give a reason for ongoing caution at the central bank, as the strong wage pressures imply ongoing inflationary forces are in play.

Above: GBPUSD at five-minute intervals following the release of UK wage and employment data.

These labour market figures confirm then UK saw a strong turn to the year, but economists warn the real test looms as a series of minimum wage hikes and increases to employer taxes come into effect.

"The supermarket sector has already reported job losses, and others are expected to follow as the changes approach," says Hyett.

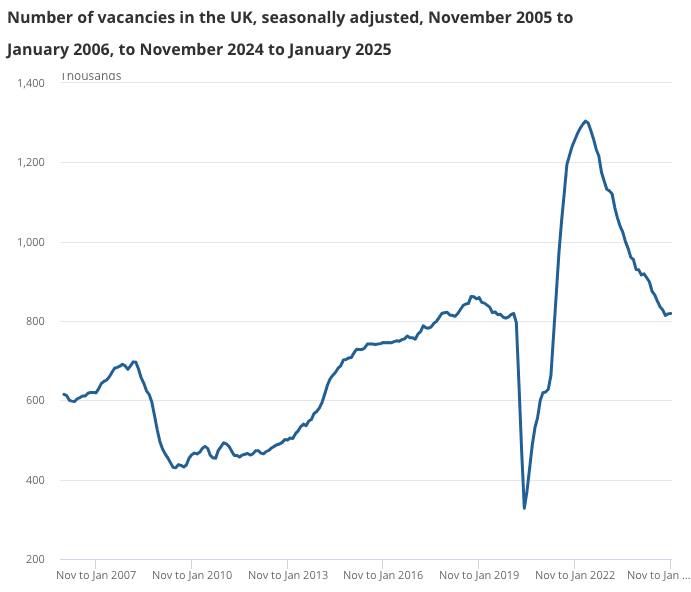

Highlighting waning demand for staff, the ONS says vacancies available in the economy fell by 9,000 in the month to January to 819K.

"The continued decline in job vacancies points to low business confidence in hiring new staff," says Alex Hall-Chen, Principal Policy Advisor for Employment at the Institute of Directors.

"The cumulative impact of recent employment reforms, coupled with upcoming increases to employer National Insurance Contributions and the National Living Wage, is significantly weakening the business case for hiring," he adds.

However, analysts at Pantheon Macroeconomics think the labour market is proving more resilient than many of the economic surveys had hinted.

"We expect structural labour market changes to keep private pay growth still running above 4% year-over-year at the end of this year," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics.

Given this, Pantheon Macroeconomics join peers that warn the Bank of England won't be in a position to cut interest rates much farther.

"We look for the MPC to be cautious, cutting rates only two more times this year, in May and November," says Wood.

This cautious approach will ensure ongoing support for UK bond yields, which would mechanically support Pound exchange rates, fortifying the currency's outlook.