Pound Sterling Faces Up to Budget Risks

- Written by: Gary Howes

Picture by Kirsty O’Connor / Treasury.

Reeves won't do enough to stem the UK's balooning debt, warn economists ahead of the Spring Statement.

It's back to politics for the British Pound as the UK's balooning debt burden and falling growth rates come into focus at the Spring Statement.

What was supposed to be a simple update of forecasts from the Office for Budget Responsibility will instead be another budget, where cuts to spending will be announced.

"I think the market is underappreciating the risk on the UK budget," says W. Brad Bechtel, Global Head of FX at Jefferies LLC.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Rising debt, falling growth and the promise of further tax hikes in future budgets are hardly fertile grounds in which to plant the seeds of a sustained rally in the Pound.

"GBP/USD had started to move lower off of the recent 1.3000 area highs but is now holding in around 1.2950, not too far from YTD highs. Risk is to the downside here," says Bechtel.

Rachel Reeves, the chancellor, is preparing to announce about £15 billion worth of cuts to public spending in her spring statement alongside a significant downgrade to the country's growth forecasts.

Tax hikes announced in October are blamed for falling growth and disappointing tax revenues in recent months. At the same time, rising debt servicing costs mean the government won't meet its debt rules unless it either raises taxes further still or cuts spending.

"The UK is suffering from low growth and a rising bill for welfare and health care," says Steven Bell, Economist at Columbia Threadneedle.

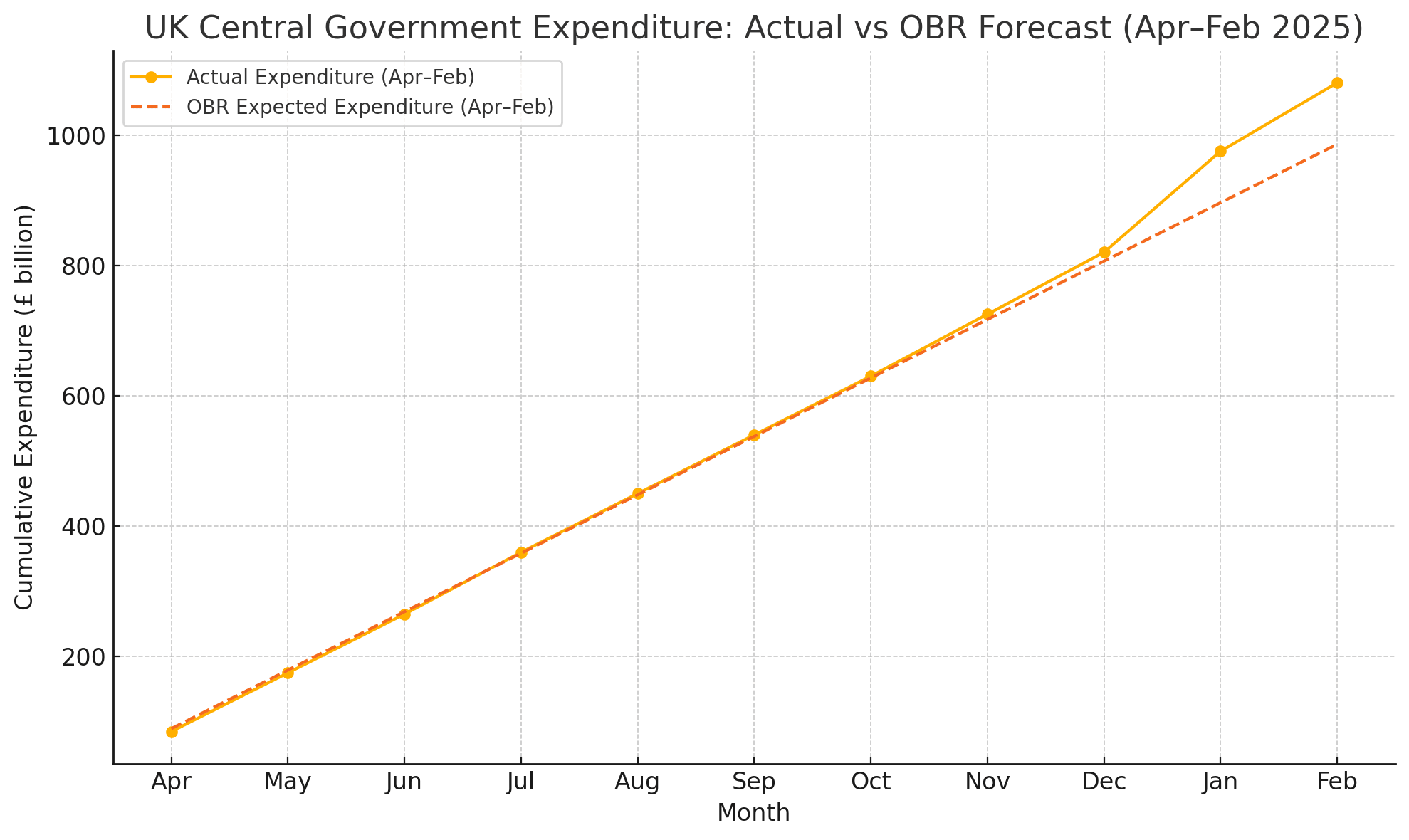

Above: Recent public finances data shows the government is borrowing more than was forecast by the OBR.

Reeves has targeted some welfare spending for cuts, but the risk is she won't go far enough as she is expected to merely reduce public spending increases from 1.3% a year over the course of this parliament to about 1.1%, which will save about £5 billion.

"The £5BN in cuts announced last week is merely a reduction in the increase. To restore it to the level of 4 years ago would require £20BN in cuts," says Steve Bell, an economist at Columbia Threadneedle.

"More reform is needed. It is painful but the UK has seen similar reductions before. Moreover, reform would mean more people in work which would further improve public finances," he adds.

Ahead of the Spring Statement, the Pound-to-Euro exchange rate is at 1.1964, in the middle of a range it has been in since last October. The Pound-to-Dollar exchange rate is at 1.2910 and looks to be paring recent advances.

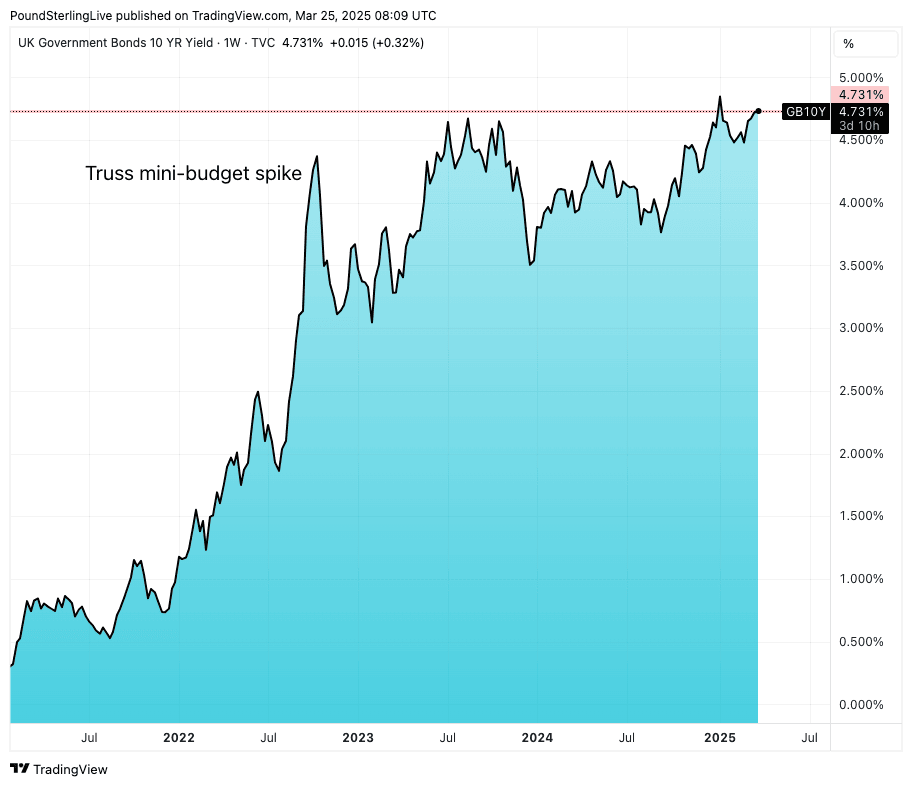

UK debt costs have risen amidst the recognition that inflation is rising and the UK will issue significant amounts of debt to fund its spending. Unless Reeves convinces the market she will contain spending, there is a risk of debt costs spiral, and the UK will enter a fiscal emergency.

Most analysts agree Wednesday's Spring Statement is too soon to see such a deterioration, but that inaction will nevertheless confirm a reckoning is coming.

"Reeves will be announcing several billion GBP of cuts to public spending and welfare in the spring statement on the budget, but will it be enough? Not sure we get a Liz Truss moment again, but it feels like we are very close once again," says Bechtel.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Typically, rising bond yields support the currency as it means foreign investors will see better returns on their capital, but during the Liz Truss 'mini-budget', we saw yields surge and the Pound drop.

This breakdown in correlation reflected collapsing confidence in the UK's fiscal picture, and Reeves will be wary of a similar outcome.

For this reason, she will move cautiously. Some economists warn that this caution means bigger decisions will have to be made down the road.

On taking Power, Reeves and Prime Minister Keir Starmer immediately began the task of laying the groundwork for a series of significant tax hikes, with economists saying the messaging triggered an immediate drop in confidence amongst households and businesses.

This caution meant the UK economy dropped from the fastest growing in the G7 when Labour took over to one of the laggards.

Above: The ten-year bond yield - crucial benchmark of UK borrowing costs - is higher now than it was following Liz Truss's mini-budget.

And there is little sign of recovery: a new survey from KPMG released on the eve of the Spring Statement shows households are increasingly pessimistic about the state of the economy.

More than half of the public now believe the economy is worsening, and just one in 10 believe growth is improving, according to KPMG. 58% of people surveyed said the economy was going in the wrong direction, up from 43% before Christmas.

Households are now cutting back spending and saving more, which will further damage growth prospects. Respondents said they were eating out less, spending less on clothing, and ordering fewer takeaways.

The Bank of England forecasts inflation will rise further in the coming weeks but notes upside risks to its forecasts as it is unsure about the extent to which businesses will pass on the cost of higher taxes to consumers.

From next week, firms will pay higher National Insurance (NI) and minimum wage bills, while facing the prospect of new U.S. import tariffs. 82% of firms will be impacted by just the NI rise, warns the British Chambers of Commerce (BCC).

"Businesses are feeling battered and bruised by the heavy cost pressures looming within days," says Shevaun Haviland, Director General of the BCC.

"I’m afraid to say that the outlook for the UK is grim. High taxes will go up further, the health and welfare bill will squeeze other public spending, growth may improve a little in the medium term but will remain subdued. Inflation should fall substantially in 2026, and interest rates should go down too but it'll be a hard grind," says Bell.