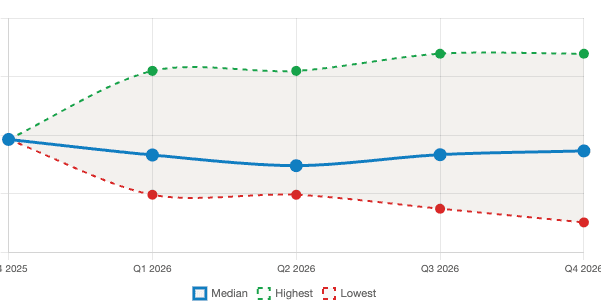

GBP/EUR Consensus Forecasts: Year-Ahead 2026

Request Your Forecast from Horizon Currency Today

The survey of over 30 investment bank forecasts was conducted by Pound Sterling Live for Horizon Currency.

📈 Rely on aggregated projections from major banks like HSBC, Goldman Sachs, and Barclays to anchor your expectations

- 🎯 See the median, highest and lowest forecast targets from over 30 investment banks.

🔥 See what the most accurate bank forecasters predict for the next three months.

💬 A member of Horizon Currency will verify your details over the phone to ensure you are a real person.

ℹ️ The document is distributed at our discretion, and your data won't be stored in the event your request is unsuccessful.