Pound Sterling Up Against Euro & Dollar On 6-month PMI High

- Written by: Gary Howes

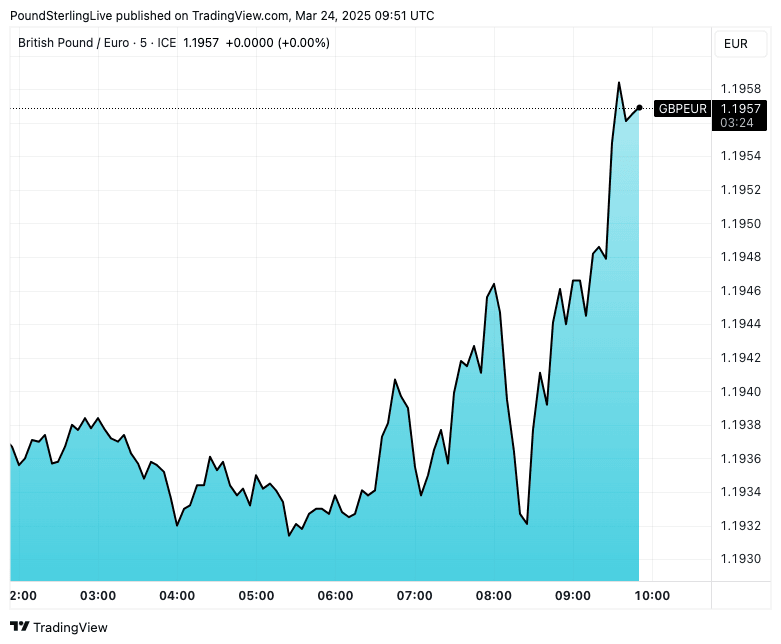

Above: GBP/EUR at 5-minute intervals.

The British Pound starts the new week bid against the Euro and Dollar.

Helping the UK currency higher is an above-consensus PMI reading, which suggests the economy is performing better than many had expected ahead of a rise in business tax and costs due to be implemented in April.

The Pound-to-Euro exchange rate extended a gain to 1.1960 after S&P Global's services PMI rose to 53.2, easily beating estimates for 51.2 and marking a notable uptick from February's 51.

Manufacturing is, nevertheless, in trouble, with the Manufacturing PMI slumping to 44.6 from 46.9.

However, because manufacturing now represents a small portion of the broader economy, the composite PMI, which gives a sector-adjust reading, read at 52. This is a marked increase on February's 50.5 and is the biggest rise in six months.

“An upturn in business activity in March brings some good news for the government ahead of the Chancellor’s Spring Statement,” said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence. “However, one good PMI doesn’t signal a recovery. The economy is eking out modest growth, with employment still falling and confidence close to two-year lows.”

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Employment across the private sector fell for the sixth straight month, though at a slower pace. Companies pointed to restructuring, rising payroll costs, and automation as key factors behind ongoing job shedding - especially in manufacturing.

The UK will witness a significant rise in employment taxes in April as National Insurance contributions rise. A rise in the minimum wage will also raise the cost of employment.

Cost pressures eased slightly in March, though input price inflation remained elevated compared to historical norms. Wage-related costs drove a steeper rise in service sector inputs, while manufacturers reported rising raw material prices, particularly in metals.

Output prices remained high across the board. While services inflation cooled slightly, factory gate prices rose at the fastest rate since April 2023, with businesses preparing for April’s increases in National Insurance contributions and the National Minimum Wage.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Looking ahead, business sentiment remained subdued. Manufacturers reported the weakest confidence levels since November 2022, largely due to global market volatility and tariff concerns. Service sector optimism improved modestly on expectations for organic growth and demand in consumer-facing industries.

The March PMI data suggests that UK GDP is likely to expand by just 0.1% in the first quarter of 2025.

“Worryingly, these headwinds are likely to grow in force,” Williamson added, pointing to fiscal tightening and the upcoming 2 April review of US tariff policy.