Reeves Presides Over "Massive Overrun in Public Spending"

- Written by: Gary Howes

File image of Rachel Reeves. Picture by Kirsty O’Connor / Treasury.

Falling tax receipts and public sector pay inflation drive a staggering deterioration in Britain's finances.

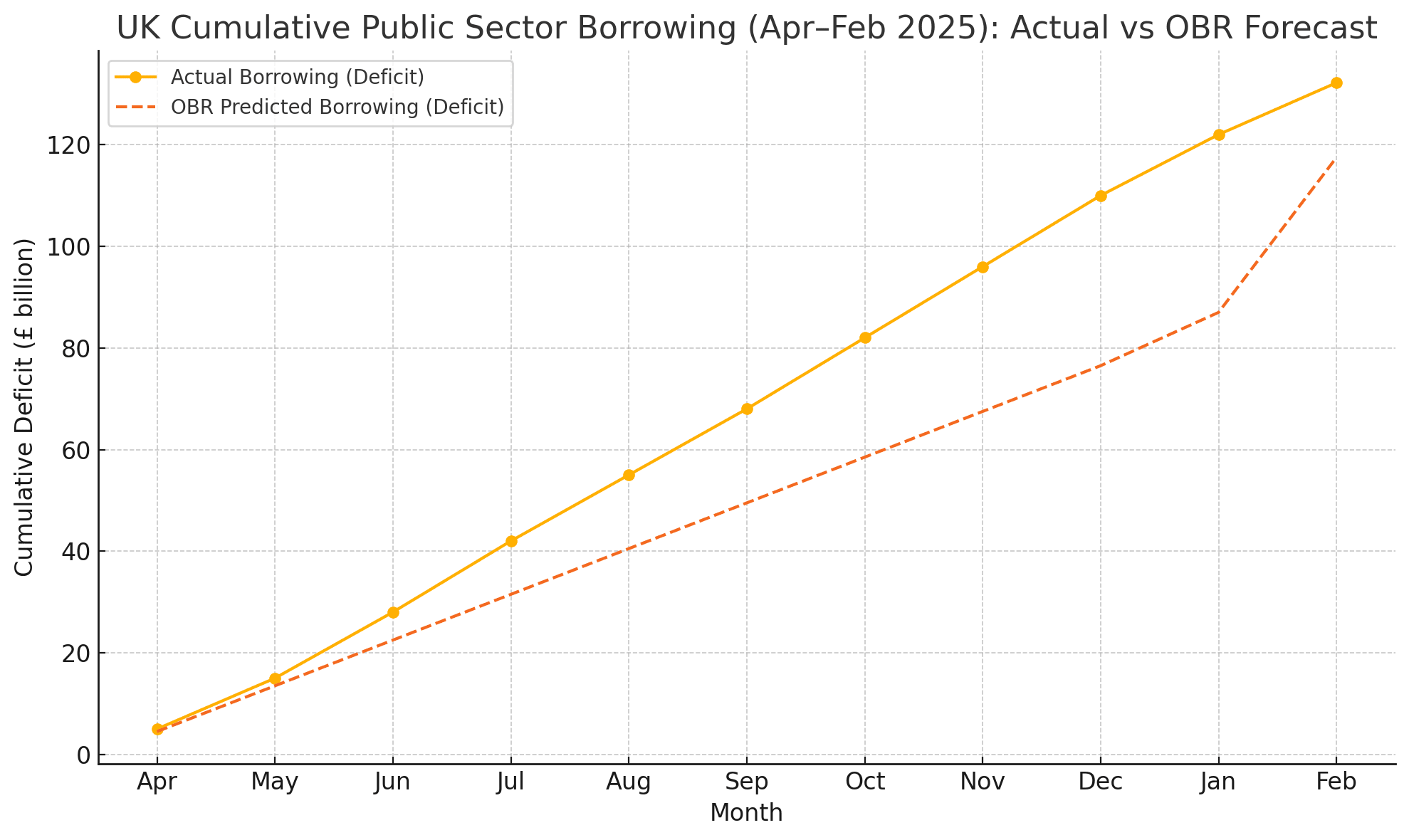

Public sector net borrowing in February 2025 was £10.7 billion, up £0.1BN from February 2024. This is the fourth-highest February borrowing on record since 1993, according to the ONS.

Year-to-date borrowing of £132.2 billion already exceeds the Office for Budget Responsibility (OBR) forecast (£127.5BN) for FY 2024/25 by £4.7 billion.

"A pretty downcast set of UK public finance data for February with YTD borrowing up to £132bn, £20bn more than the OBR expected back in October. Softness in capital gains and NI tax receipts, and public sector pay inflation the big contributors," says Simon French, Chief Economist and Head of Research at Panmure Liberum.

The data comes ahead of the Spring Statement, where Chancellor Rachel Reeves is expected to announce cuts to public spending to ensure she meets her rules to ensure debt stays under control.

However, the scale of the deterioration in the UK's domestic 'bank account' will need more than a tinkering around the edges.

"Public borrowing in the UK is now set to be £140-150bn in 2024/5, over 5pc of GDP. In the March Budget, it was forecast at just over 3pc of GDP. The main reason is a massive over-run in public spending presided over by this government, which is over £50bn in the past 6 months, or £100bn a year!" says Andrew Sentance, a former member of the Bank of England's Monetary Policy Committee.

Economists say Labour's policies since taking office have caused growth to slow and undershoot previous estimates, which means tax take will also undershoot.

Indeed, tax receipts totalled £87.7BN in February, £2.9BN below the OBR’s £90.6B forecast.

"The public finances continued to deteriorate in February as an underperformance in receipts, combined with revisions to January’s data drove government borrowing further above profile," says Elliott Jordan-Doak, Senior UK Economist at Pantheon Macroeconomics.

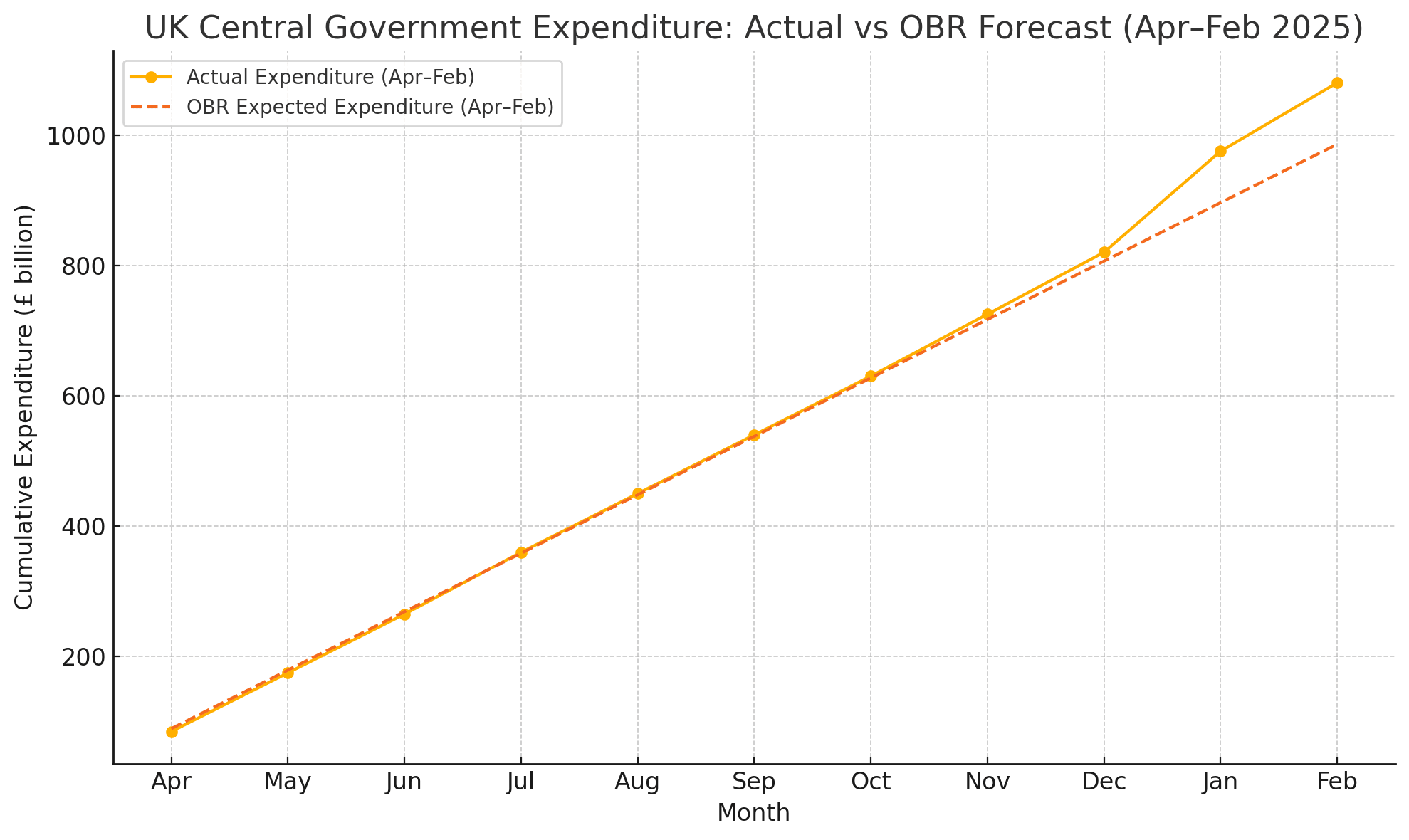

The £4.7BN overshoot in public sector borrowing (compared to the OBR’s forecast for FY 2024/25) was primarily driven by higher-than-expected spending despite strong tax revenues.

Tax receipts are up year-on-year by £39.8BN, with Income Tax, VAT, and Corporation Tax performing strongly.

However, social contributions (mostly National Insurance) are down by £8.3BN.

Despite rising nominal tax intake, overall public spending growth (particularly departmental spending and benefits) has outpaced receipts, contributing to the borrowing overshoot.

Above: The deficit widens.

Total expenditure of £1,080.0BN is £41.7BN more than in the same period in 2023/24.

Main spending increases were driven by pay rises in the public sector and inflation, increasing operational costs.

Social benefits (e.g. pensions, Universal Credit) were up £12.2BN to £280.1BN largely due to inflation-linked benefit uprating.

"The February public finances didn’t make for good reading this morning ahead of next week’s Spring Forecast," says Sam Hill, Head of Market Insights at Lloyds Bank.

Hill says bond markets - where the government issues debt to fund borrowing - will be nervous about the amounts the government will ask for in the coming year.

"For a nervous gilt market waiting to learn the size of the 2025-26 funding remit after the Chancellor’s statement next Wednesday the initial takeaway is that there are upside risks to existing estimates," he explains.

"There are plenty of quirks in the public finances so on closer inspection the story might evolve, but the initial take is that there appears to be upside risk to our estimate that gilt sales will be £315bn in 2025-26," adds Hill.