Rabobank Hikes Euro-to-Dollar Forecast

- Written by: Gary Howes

Image © Cyclone Bill, Reproduced under CC licensing

One of Europe's biggest commercial banks says the lift to its Euro forecast after Germany’s "whatever it takes moment."

"We have argued for some time that Germany’s structural economic issues means that the country has a need for a weak exchange rate. The prospect of a large fiscal injection weakens this argument considerably," says Jane Foley, Senior FX Strategist at Rabobank.

Rabobank has long argued that Germany’s structural economic issues mean that the country has a need for a weak exchange rate. "The prospect of a large fiscal injection weakens this argument considerably," says Foley.

"We have revised up our expectations for the EUR across the board," she adds.

Previously, Euro-Dollar was seen falling to parity, but the new forecast shows an uplift of approximately 500 pips.

The new targets are available to view in this exclusive download, which was updated on March 18 to reflect some key shifts in investment bank forecast changes following recent events.

Directionally, Rabobank thinks the recent rebound is now looking a little overbaked and thinks there is scope for a pullback into the Northern Hemisphere spring.

However, the rally that ensues into year-end could see it surpassing the recent highs and breaking into the 1.10-1.20 range.

"Germany could change Europe’s economic landscape further with its 10-year plan to support its crumbling infrastructure. Some commentators have likened the coalition’s fiscal plan to the splurge that followed German re-unification," says Foley.

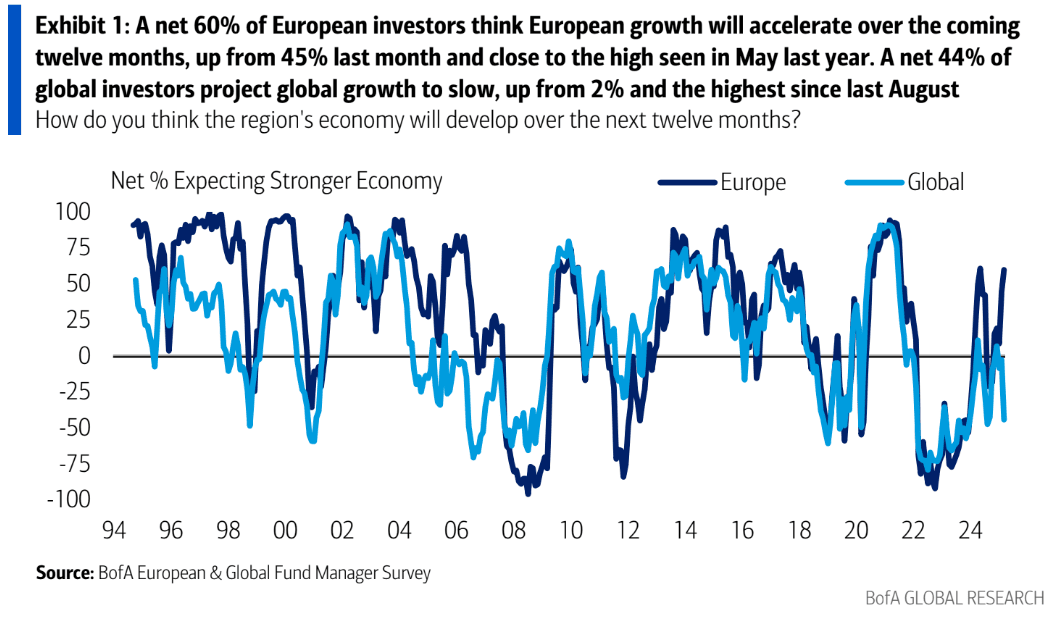

Above: German confidence is on the rise.

This week Germany voted through constitutional changes to allow it to borrow above the 'debt brake' limit, with some saying over €1 trillion could be spent in the next decade.

The plans have already prompted a shift in sentiment in Germany, with the ZEW survey showing a sharp improvement in future expectations.

At the same time, global capital is flowing away from the U.S. and into Eurozone stock markets as perceptions of U.S. outperformance fade.

This adjustment can continue, posing further upside for the Euro over the coming years.

"The market has also been re-evaluating the economic outlook for the US. Trump’s tendency to pull back on tariff threats suggests that the market may have over-estimated the inflationary impact of these policies. At the same time, in recent weeks the market has been contemplating the possibility that US growth is finally slowing," says Foley.

To view the full set of EUR/USD, GBP/USD and GBP/EUR predictions from Rabobank, please see here.