Euro-Dollar Powered Higher By Biggest Shift From U.S. to European Equities on Record

- Written by: Gary Howes

Image © Adobe Images

The Euro benefits from a massive switch from U.S. to Eurozone stocks.

Investors are pulling out of U.S. equities at an unprecedented pace and rotating into European markets, according to Bank of America’s latest European Fund Manager Survey.

The report shows the largest recorded shift in global equity positioning, with a net 39% of investors overweight European equities—up from just 12% last month—while a net 23% are now underweight U.S. equities, a dramatic reversal from February.

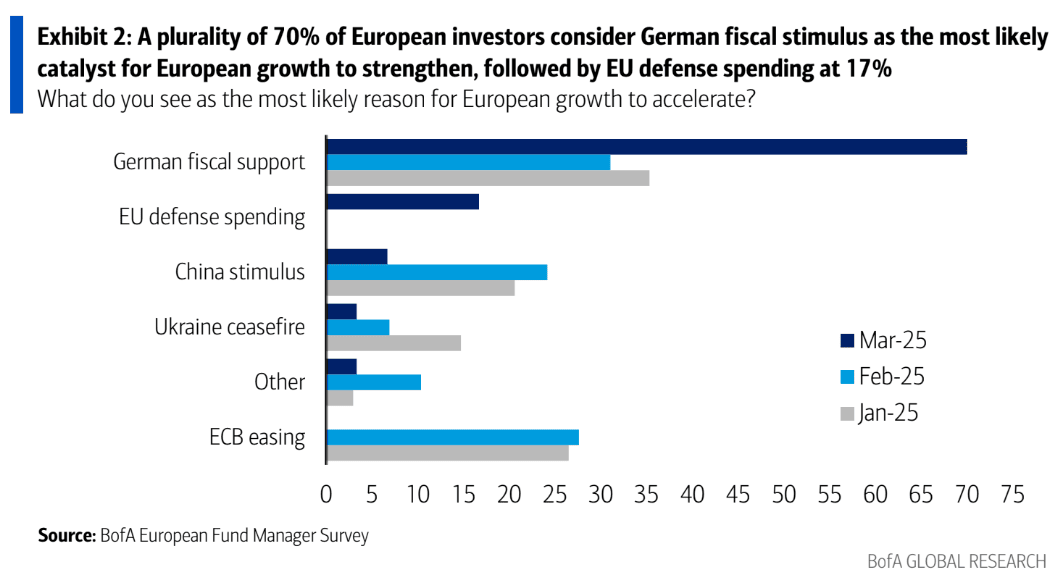

The survey, conducted from March 7-13, highlights growing optimism for European growth, fuelled by German fiscal stimulus and increased EU defence spending, even as concerns mount over a slowdown in the U.S. economy.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

The flows into European equities underpin a 5.50% surge in the Euro-to-Dollar exchange rate during March, and there is scope for further gains if the rotation trade continues. In response, investment banks have raised their forecasts for the pair in the coming quarters.

Goldman Sachs is also seeing evidence of a strong rotation into European stocks. "By some measures, the inflows into Europe have been historically large. The last four weeks of flows into European equities are in total the largest we have seen since 2015," says Isabella Rosenberg, an economist at Goldman Sachs.

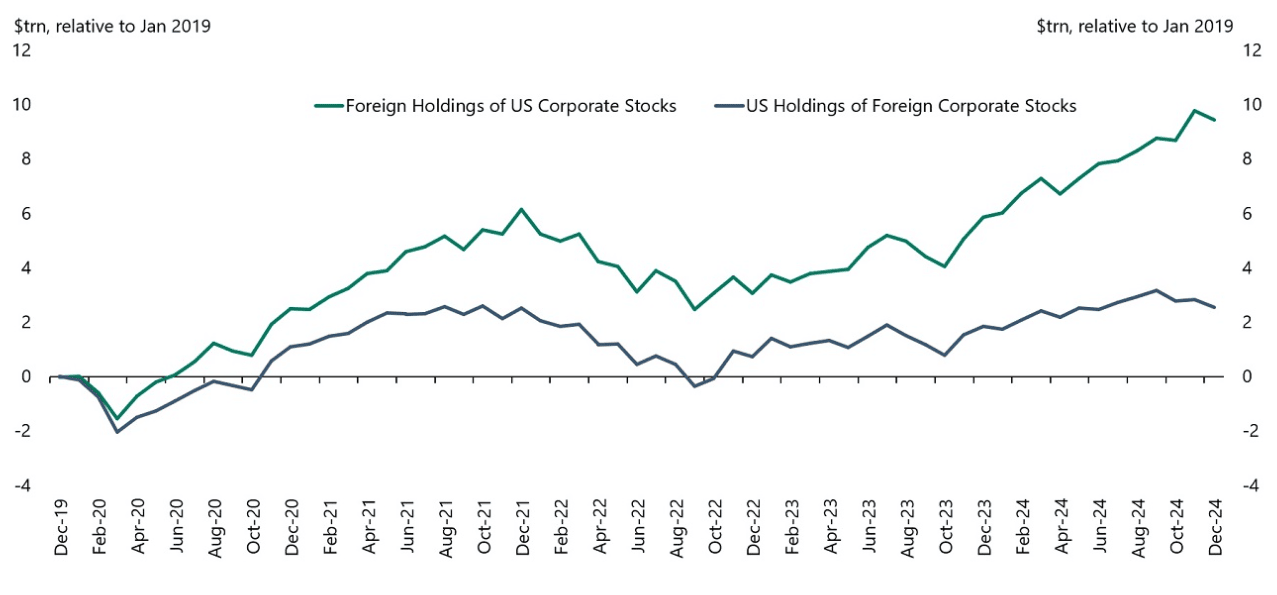

According to Torsten Slok at Apollo Asset Management, the U.S. market is highly susceptible to the withdrawal of foreign funds.

He says the U.S. market has benefited from significant inflows from abroad, and foreign investors are now significantly overweight U.S. equities.

"Combined with the dollar’s decline and the ongoing overvaluation of the Magnificent 7, the downside risks to the S&P 500 as a result of foreigners selling are significant," he says.

Above: Significant rise in foreign holdings of U.S. equities.

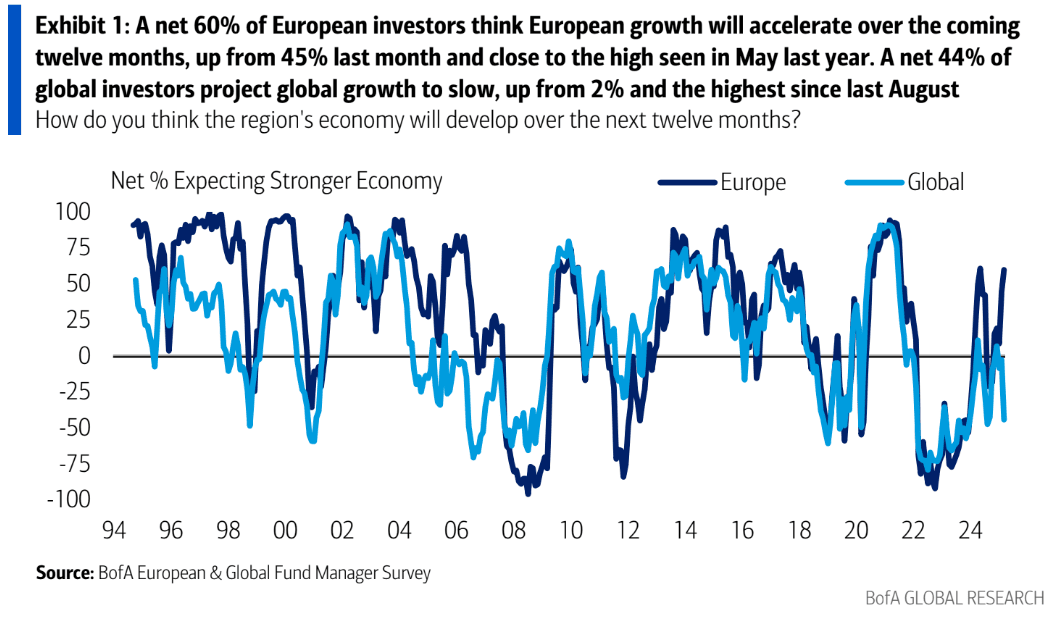

According to Bank of America's survey, a net 60% of investors expect stronger European growth over the next 12 months, a sharp increase from 9% in January.

In contrast, a net 44% of global investors expect the global economy to weaken, with the U.S. seen as the main drag.

"If diminished 'U.S. Exceptionalism' gives way to finished, the Dollar can fall a long way and the Euro stands to be a key beneficiary," says Kamakshya Trivedi, a currency analyst at Goldman Sachs.

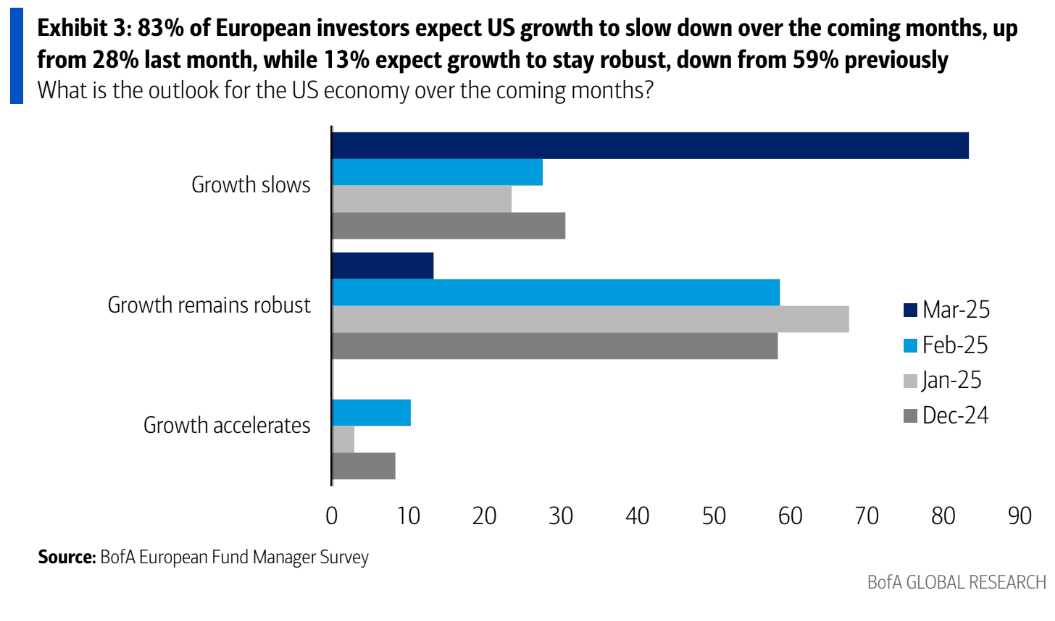

Bank of America's data marks the biggest shift away from U.S. stocks and into Europe since the survey began tracking such moves in 1999. Investor sentiment toward the U.S. has shifted dramatically, with 83% expecting U.S. growth to slow in the near term, up from 28% last month.

Concerns over the impact of the Trump administration’s expected policies are adding to the bearish outlook on U.S. assets.

A majority of investors believe a second Trump term will have a negative impact on growth while driving up inflation, raising fears of stagflation.

Despite the record rotation into European equities, bullish sentiment on absolute performance has moderated. A net 30% of investors expect near-term gains for European stocks, down from 66% last month, while a net 67% foresee gains over the next 12 months, a slight drop from 76%.

Germany remains the most preferred market, followed by Italy, while Switzerland and Spain are the least favoured among fund managers. Industrials and financials are the sectors seeing the most increased exposure, while retail, media, and autos remain the biggest underweights.

Cyclical Shift and Portfolio Adjustments

Investors are increasingly positioning toward cyclicals and financials, with a net 50% favouring cyclicals over defensives, up from 28% last month. Small caps are also gaining traction, with a net 37% expecting them to outperform large caps—the highest reading in more than three years.

Cash positions among European investors have risen to 3.8%, up from 3.0% in February, as fund managers adjust portfolios amid shifting global growth expectations. At the same time, bearish sentiment toward the U.S. dollar has surged, with a net 48% expecting the currency to weaken over the next 12 months.

Despite Europe’s improving growth outlook, global investors remain wary of potential macroeconomic headwinds. A plurality of 55% of investors consider a global trade war the biggest risk to markets, while concerns over central bank policy remain elevated.

In the bond market, a net 12% of global investors expect higher 10-year bond yields, the highest reading since August 2022, signalling expectations of rising borrowing costs.