Strong Wage Growth to Tie Bank of England's Hands

- Written by: Gary Howes

Image © Adobe Images

UK labour market data released hours ahead of the Bank of England's decision show no chance of an interest rate cut being announced.

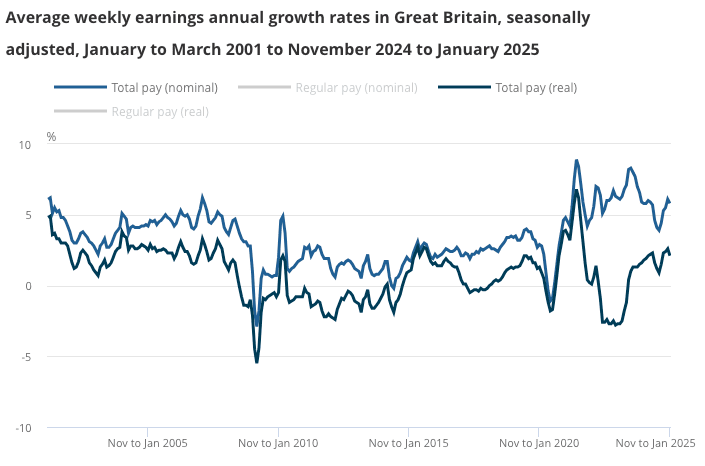

According to the ONS, average weekly earnings (excluding bonuses) grew by 5.9% year-on-year in the three months to January 2025.

This figure was in line with expectations and is consistent with wages being an inflationary force in the economy.

The Bank's decision is due at mid-day, and it will struggle to justify the need to cut interest rates further given these data and expectations that UK inflation will soon surpass 3.0%.

All signs continue to point to inflation going in the wrong direction.

Above: UK wage growth remains strong.

According to the ONS, real wage growth (adjusted for inflation using CPIH) was 2.2% for regular pay (excluding bonuses) and 2.1% for total pay (including bonuses).

That being said, the unemployment rate increased to 4.4%, up from 4.3% in the previous period.

This could give ammunition to members of the Bank's Monetary Policy Committee who support cutting rates.

At least two members of the nine-member MPC are expected to vote to cut rates, as they will argue that the economy is deteriorating.

The ONS reported that vacancy numbers are broadly unchanged on a quarter-to-quarter basis, and early estimates actually show a small increase of just 1,000 (0.1%) vacancies to 816,000 in the three months to February 2025.

This could mean the longer-term fall in vacancies we have seen since 2022 might be fading.

Signs of stabilisation in the vacancies data will calm nerves ahead of the April employer tax increase, which the Bank thinks could raise UK unemployment.

Should the labour market ride out the April jobs tax increase, the Bank will have little scope to accelerate the pace it cuts rates from its currently preferred quarterly pace.