Retail Sales Can Help a Q1 Growth Rebound

- Written by: Gary Howes

Image © Adobe Images

Improving retail sales points to a growth rebound, say economists.

UK retail sales volumes rose for the second consecutive month in February, signalling a rebound in consumer activity driven by strong performance in non-food sectors and a notable uptick in online sales, according to the latest data from the Office for National Statistics (ONS).

Retail sales volumes climbed 1.0% in February 2025, following an upwardly revised 1.4% increase in January.

This exceeded the consensus expectation of -0.4%.

"Retail sales continue their rebound after the Budget knocked confidence for a couple of months. Retail sales volumes have been trending up pretty solidly since late-2023 and 3m year-over-year growth reached the highest since March 2022. GDP growth will rebound in Q1," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics.

It marks the highest monthly sales level since July 2022, indicating growing consumer confidence despite ongoing cost-of-living pressures. On an annual basis, sales volumes were up 2.2% compared to February 2024.

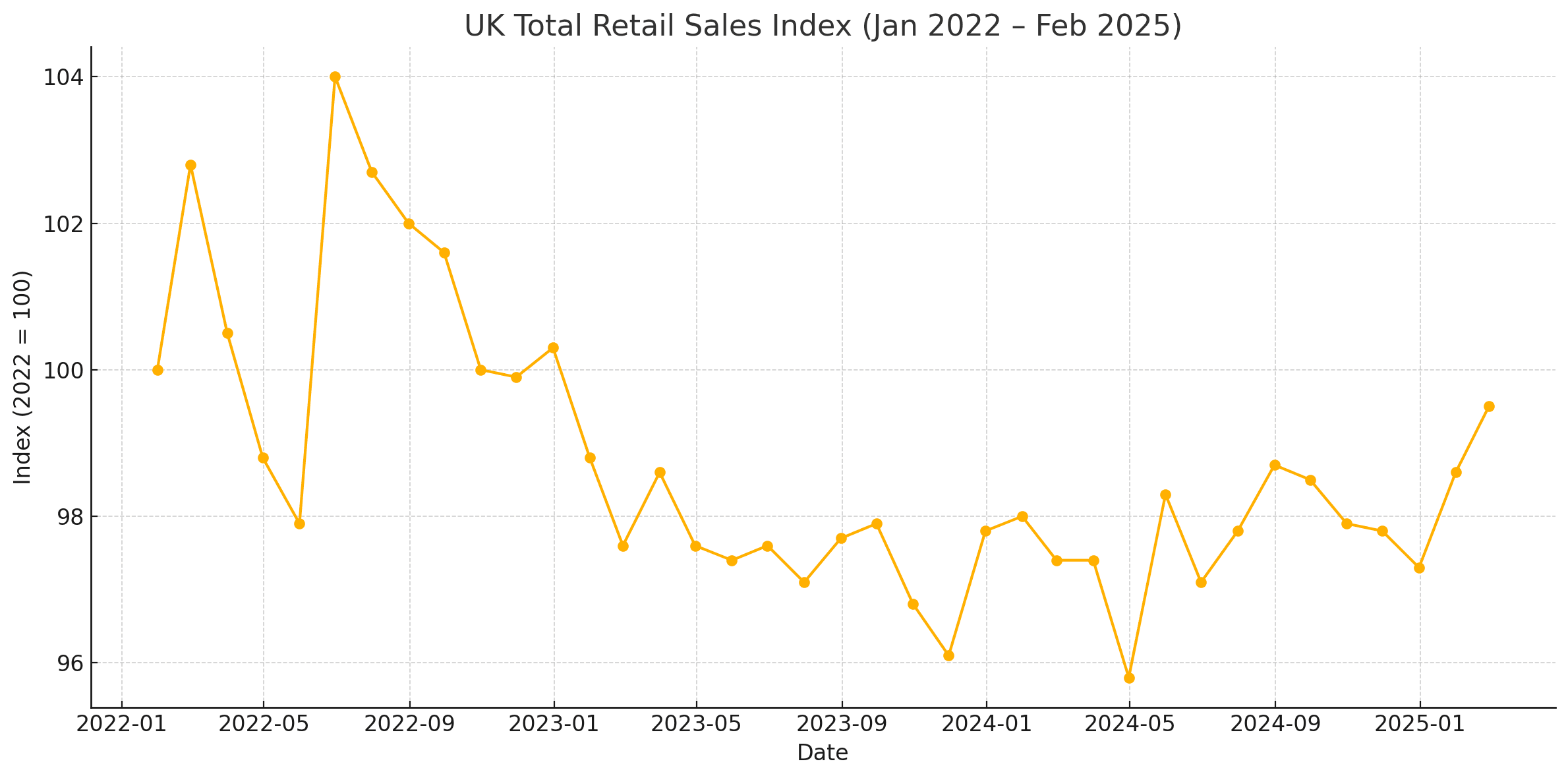

The UK’s total retail sales index from January 2022 to February 2025. The index is seasonally adjusted and uses 2022 as the base year (Index = 100).

Non-Food Stores Lead the Charge

The standout contributor to February’s rise was the non-food store sector, which posted a robust 3.1% monthly increase. All sub-sectors — including department stores, clothing retailers, household goods, and other non-food outlets — saw gains. In particular, household goods sales soared by 6.8%, the strongest monthly performance since April 2021, fuelled by a surge in hardware store activity.

Demand for luxury goods also surged, with jewellery and watch retailers reporting higher sales amid increased consumer interest in gold as an inflation hedge.

Clothing stores bounced back after a 2.7% drop in January, helped by widespread discounting and falling prices, though sales have not yet fully recovered to previous levels.

Food Sales Pull Back

In contrast, food store sales volumes declined by 2.0%, unwinding part of January’s sharp 4.8% jump. Supermarkets were the main drag, with retailers pointing to persistent cost pressures and price sensitivity among shoppers.

Broader Trends and Online Spending

Over the three months to February, sales volumes rose 0.3% compared with the previous three months, and 2.0% year-on-year — evidence of a strengthening retail recovery after a subdued 2023.

Online retail also regained momentum. The value of internet sales rose 3.3% in February after a weak January, with increases recorded across all retail categories. The share of retail spending conducted online edged up to 26.5%, from 25.8% the previous month.

Despite the monthly boost, online spending over the three-month period to February was still down 3.1% compared with the preceding three months, highlighting lingering volatility in consumer patterns.

Cautious Outlook Says Lloyds Bank

February's figures suggest UK consumers remain resilient, with discretionary spending showing signs of revival. The gains in non-food retail — especially in big-ticket items and luxury goods — may hint at renewed optimism or strategic consumer behaviour amid economic uncertainty.

However, the drop in food sales and the continued pressure from inflation signal that challenges remain. Retailers will now look to sustain momentum into the spring, with March data due for release on 25 April 2025.

The ONS also released quarterly national accounts today, which revealed an increase in the household savings ratio to 12.0% from 10.3%, suggesting a cautious consumer

"On that basis, it is questionable whether too much should be read into the much stronger than expected retail sales figures for February," says Sam Hill, Head of Market Insights at Lloyds Bank.

Hill says some of the upside in these retail sales data is also likely to be a function of unfavourable revisions to January influencing the arithmetic and the price deflator dipping.