Budget Will Unravel "Badly" Says Economics Veteran

- Written by: Gary Howes

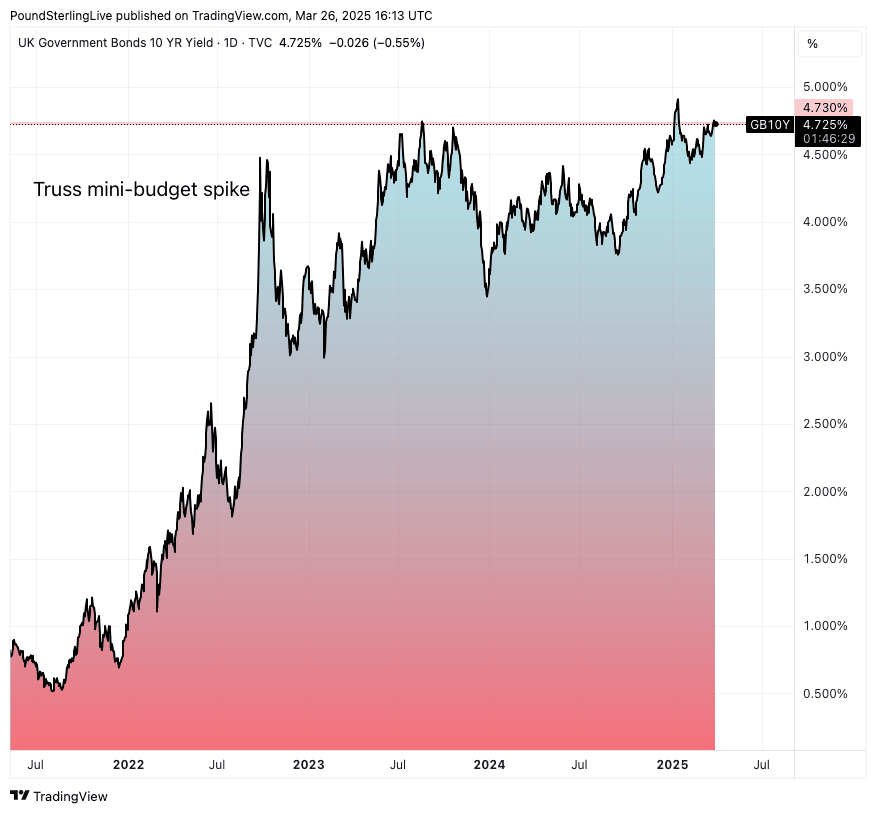

Above: The UK ten-year bond shows the cost of borrowing is above levels that followed Liz Truss's abandoned mini-budget announcement.

One of Britain's most esteemed economists has warned the Government's fiscal plans will unravel.

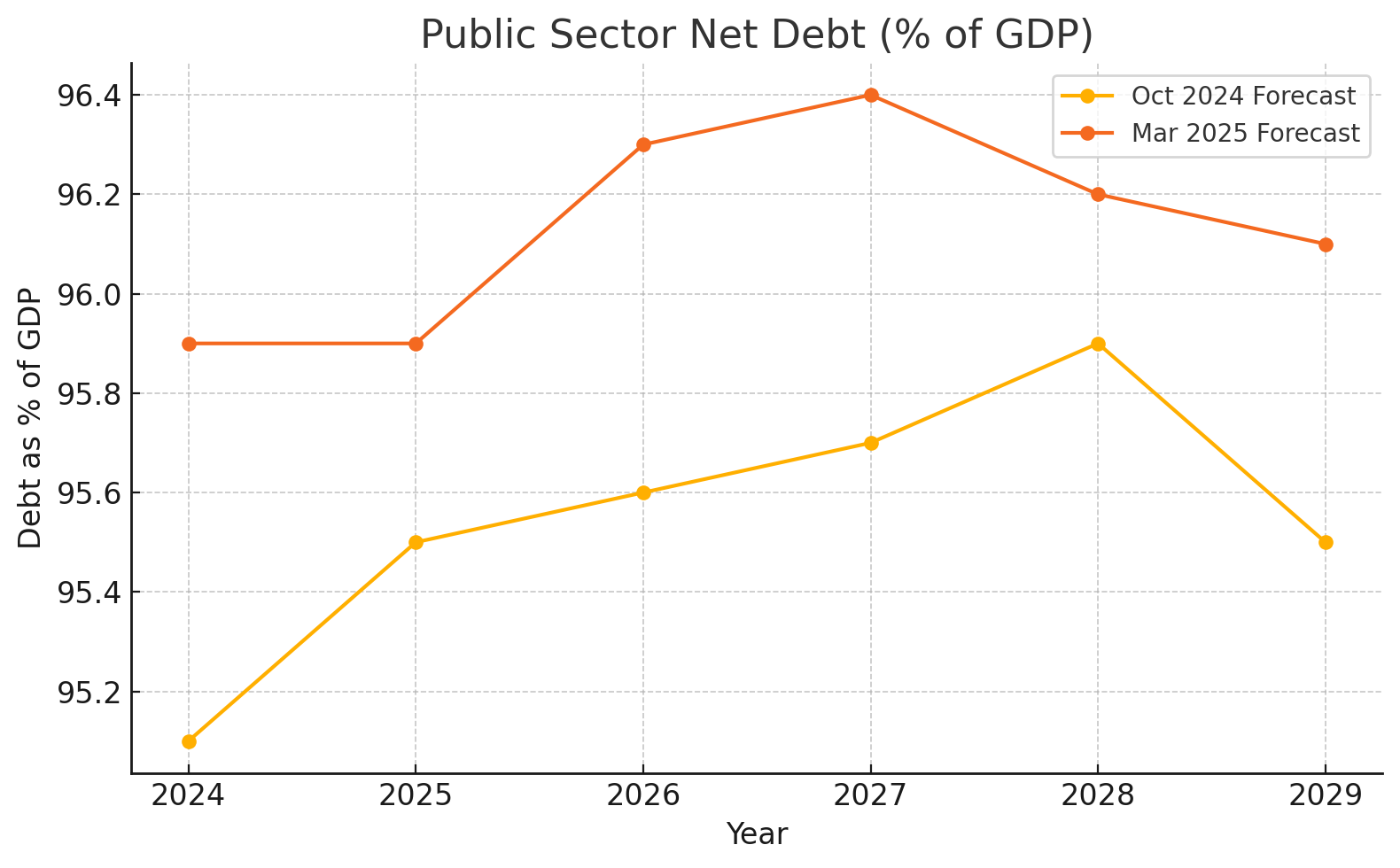

Chancellor Rachel Reeves announced a cut of £4.8BN to welfare handouts as she sought to keep the UK's debt load on a sustainable footing and ensure financial markets stay onside.

"We needed minimum £50BN spending cuts," says Douglas McWilliams, the founder of Centre for Economics and Business Research (CEBR).

He is currently Deputy Chairman of the CEBR, a member of the Council of the Institute for Fiscal Studies and Economic Adviser to the Chartered Institute of Marketing.

"I'm not sure that the political commentators realise quite how badly this budget is going to unravel. Unless I'm badly wrong (which I have been before but normally am not), the moment it appears that growth is running way below 2%, we are close to IMF territory," he warns.

McWilliams is talking about a moment in the future when buyers of UK government debt go on strike on fears that the UK's debt burden is unsustainable.

When investors stop funding the government's borrowing, it will have to turn to major global institutions, such as the IMF, for a bailout.

McWilliams explains this point will come once markets see the economy trending down, and not up, as predicted by the Office for Budget Responsibility.

"In today’s media coverage of the Spring Statement, no-one is asking the crucial question: If the OBR has made such a hash of forecasting this year’s GDP growth, why should we believe any of their revised forecasts - for this year and the next 4 years?" queries Andrew Sentance, an economist and former member of the Bank of England's Monetary Policy Committee.

Investors lend to the government over multi-year timeframes on the understanding that economic growth ultimately guarantees their debts.

When growth disappoints, tax revenues ultimately undershoot, meaning more money must be borrowed to cover the shortfall.

The risk is that the government then swamps debt markets with new debt, which invariably sees investors demanding higher interest rates, further piling costs onto the government.

To guarantee market confidence, spending must be cut, as tax hikes will offer diminishing rates of returns.

In 2025-26, taxes will rise to 36.8% of GDP, and by 2026-27, they'll climb to 37.4%, topping a post-war record set in 1948.

For tax takes to increase, the size of the economic pie must grow at pace.

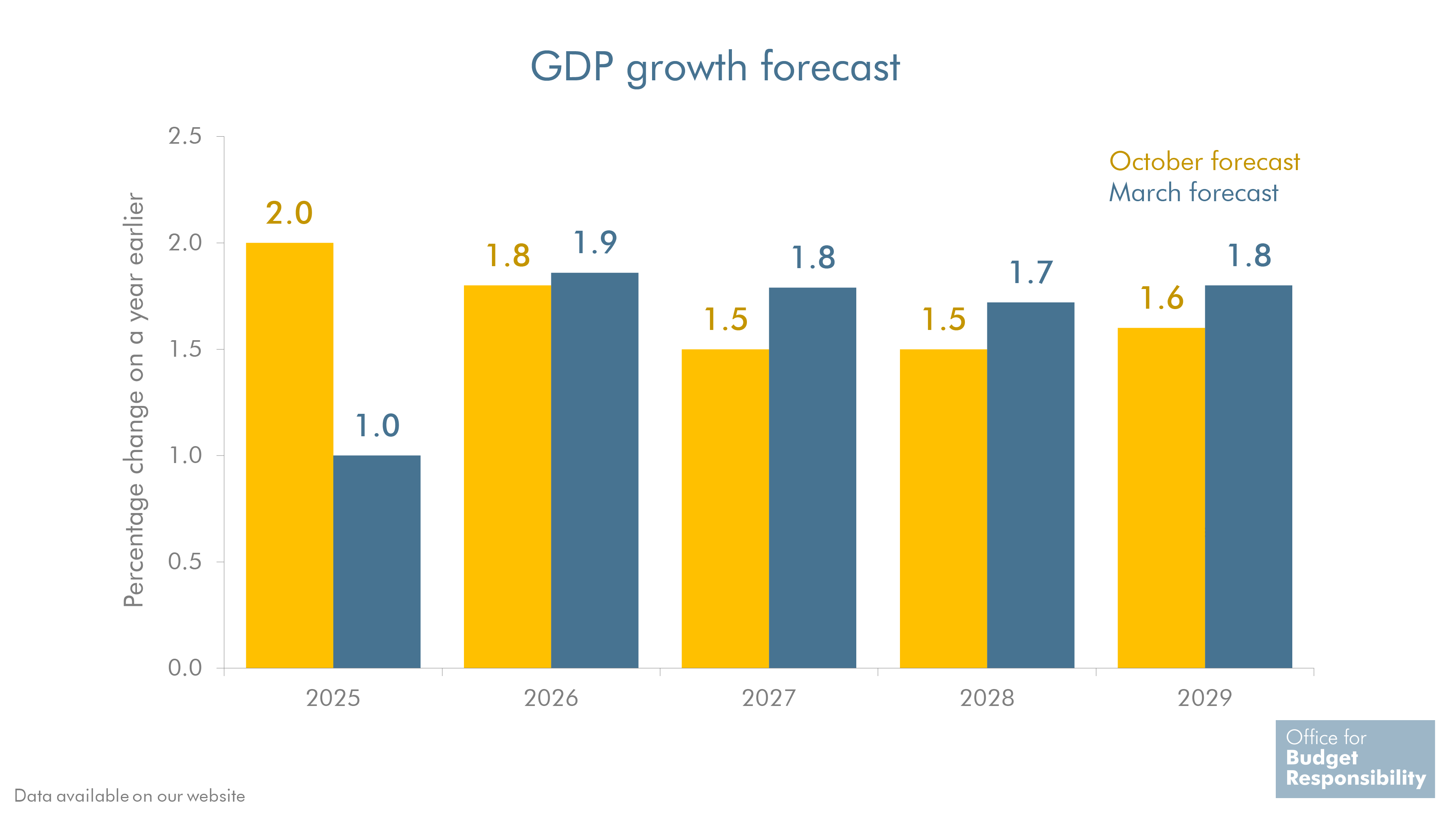

Unfortunately for Reeves, real GDP growth in 2025 was downgraded sharply to 1.0% from the 2.0% predicted in the OBR's October 2024 forecast.

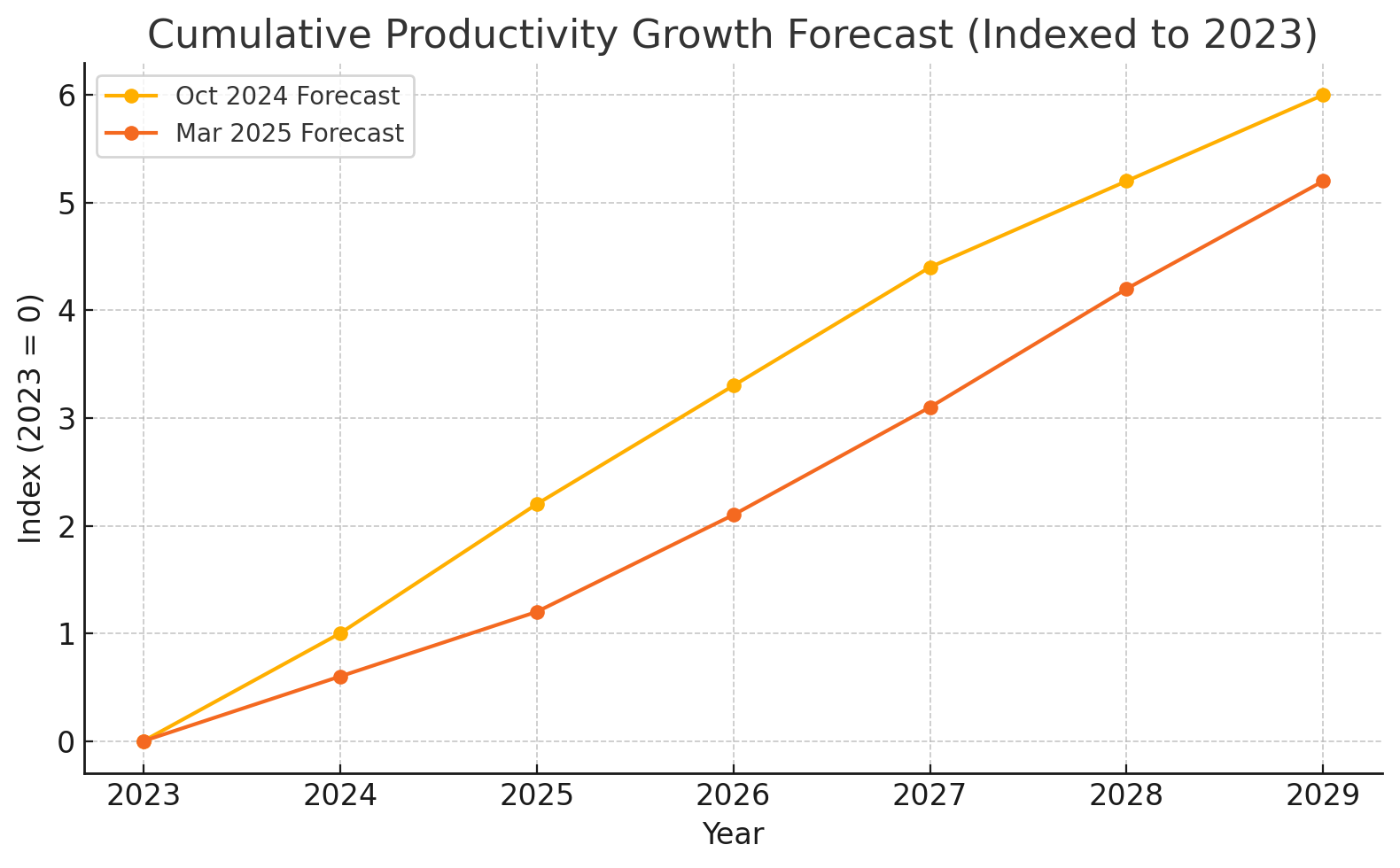

One-third of the downgrade is due to structural issues, especially weaker productivity, which is directly linked to government economic policy.

Two-thirds are attributed to cyclical factors like tighter monetary policy, rising energy costs, and economic uncertainty.

Growth rebounds to 1.9% in 2026, then averages 1.75% over the remainder of the decade, never cracking the 2.0% level.

Real GDP per person is forecast to grow by 0.3% in 2025 and then 1.4% annually from 2026–2029.