Reeves & Trump Sink the UK Economy

- Written by: Gary Howes

File image of Chancellor Rachel Reeves. Picture by Kirsty O’Connor / Treasury.

The UK economy suffers a surprising contraction in April, and businesses blame new government policies and international trade uncertainty.

The rise in employer National Insurance Contributions and the mandatory hike to the minimum wage, the hallmarks of Chancellor Rachel Reeves' fiscal policy, pushed the UK economy into contraction in April.

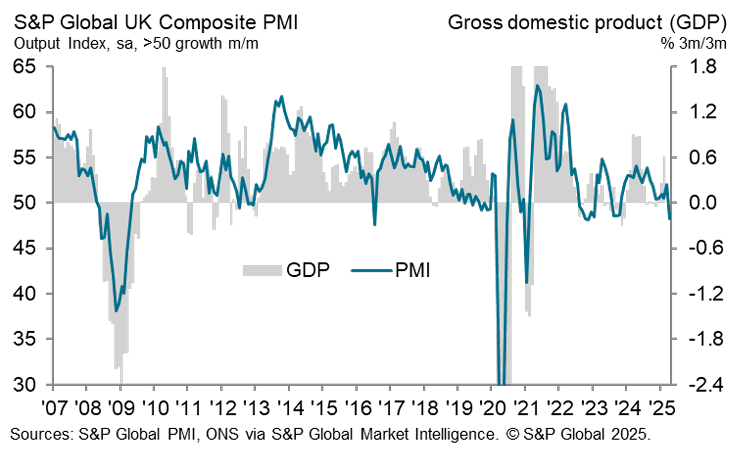

The S&P Global PMI survey of the UK's private sector reported a composite reading of 48.2, putting it below 50, which marks the watershed between contraction and expansion.

This represents a notable slowdown from March's healthy 51.5 and disappointed a market consensus that expected a reading of 50.4. In fact, the fall in output was the largest recorded for nearly two and a half years.

"Businesses are reporting more of a struggle to keep their heads above water in April," says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

S&P Global reckon the decline represents a quarterly slump of 0.3% in GDP.

Cost rises are laid at the door of Downing Street, with businesses telling the S&P Global survey that higher National Insurance Contributions and a rise in the National Living Wage are responsible.

"Average cost burdens increased at a sharp and accelerated pace in April. The overall rate of input cost inflation was the fastest since February 2023," said S&P Global.

In April 2025, employers' National Insurance Contributions (NICs) increased from 13.8% to 15% and the secondary threshold, below which employers don't pay NICs dropped from £9,100 to £5,000.

The National Living Wage, for those aged 21 and over, increased to £12.21 per hour on April 1.

Williamson says the survey revealed job cutting is at "aggressive" levels.

Optimism about the outlook has meanwhile collapsed to a two-and-a-half-year low, taking it to one of the lowest levels yet recorded by the survey, even surpassing the low seen in the immediate aftermath of the Brexit vote in 2016.

"The collapse in confidence and drop in output during April raise red flags as to the near-term economic outlook," says Williamson.

Weaker demand from international markets also weighed on business activity in both the manufacturing and service sectors.

The latest figures indicated that total new work from abroad decreased sharply and at the fastest pace for nearly five years.

The surprising weakness of the survey triggered a knee-jerk move lower in the value of the Pound, although the currency will remain far more attuned to global developments in the current environment.

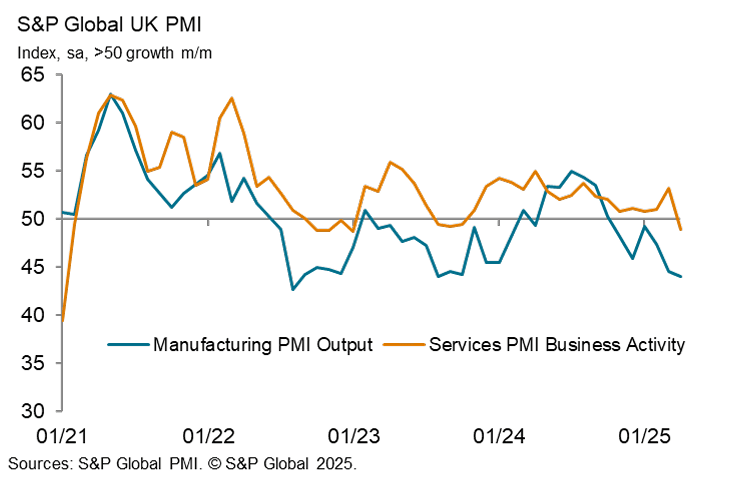

April's composite PMI weakness was driven by a slump in the UK's dominant services sector, where a reading of 48.9 was reported, down from 52.5 and below expectations for 51.5.

Manufacturing is struggling under the burden of some of the highest electricity costs in the world and tariff uncertainty, printing at 44, which places the sector firmly in recessionary territory.

The slowing economy would typically hint at the prospect of an accelerated pace of interest rate cuts at the Bank of England in an attempt to stimulate the economy.

However, S&P's findings show the Bank might be unable to come to the rescue as businesses confirm the policies introduced by Chancellor Rachel Reeves is proving inflationary.