UK Spending "Out of Control"

- Written by: Gary Howes

Chancellor Rachel Reeves leaves No 11 Downing Street to deliver her Spring Statement. Picture by Alecsandra Dragoi / Treasury.

The UK ratcheted up £16.4BN in debt last month.

According to ONS data, this makes for the third highest March figure since records began.

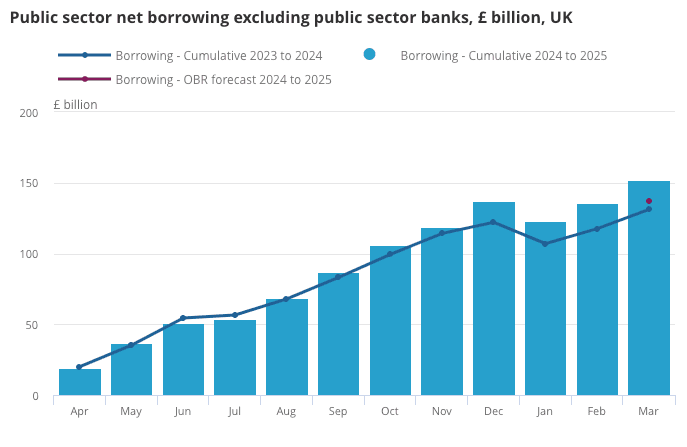

Borrowing reached £152BN in the year to March, up £21BN from the year before, and much higher than the £137BN predicted by the Office for Budget Responsibility, the government's official forecaster.

The deterioration in the figures means that unless UK economic growth rebounds significantly, Chancellor Rachel Reeves will be obliged to raise taxes and/or cut spending again in the Autumn.

"UK public borrowing is running out of control," says Andrew Sentance, an independent business economist and former member of the Bank of England's Monetary Policy Committee.

"The Chancellor has presided over a massive surge in spending/borrowing since July. Shocking!" he adds.

If Reeves is to avoid politically unsavoury spending cuts and tax rises, she will need growth to pick up significantly, as this would boost the tax take and lower spending requirements.

But the Public Sector Finances data is released on the same day that S&P Global's PMI survey showed the economy likely shrank in April under the weight of April 01 business tax hikes and minimum wage increases.

Donald Trump's April 02 tariff announcements have meanwhile stalled foreign demand for UK exports.

The public sector finance figures showed government spending on public services, benefits and debt interest increased £56.8BN compared with 2024. However, growth in central government tax receipts rose by £36BN.

Veteran political commentator Andrew Neil says this shows the government is enjoying elevated tax revenues, but borrowing is too high.

He says this gives a "made-in-Downing Street" flavour to the problem the country now faces.

"Despite a substantial boost in tax revenues, state spending rose by more, largely due to inflation-related costs, including higher pay and benefit increases. And there you have the made-in-Downing Street reason borrowing is so high," he explains.