Canadian Dollar: Data Collapse Signals Recession

- Written by: Gary Howes

Image © Adobe Images

Canadian economic data surveys show collapsing activity.

The Canadian Dollar is underperforming and is unlikely to turn the corner soon as economic survey data points to downside surprises in upcoming official data prints.

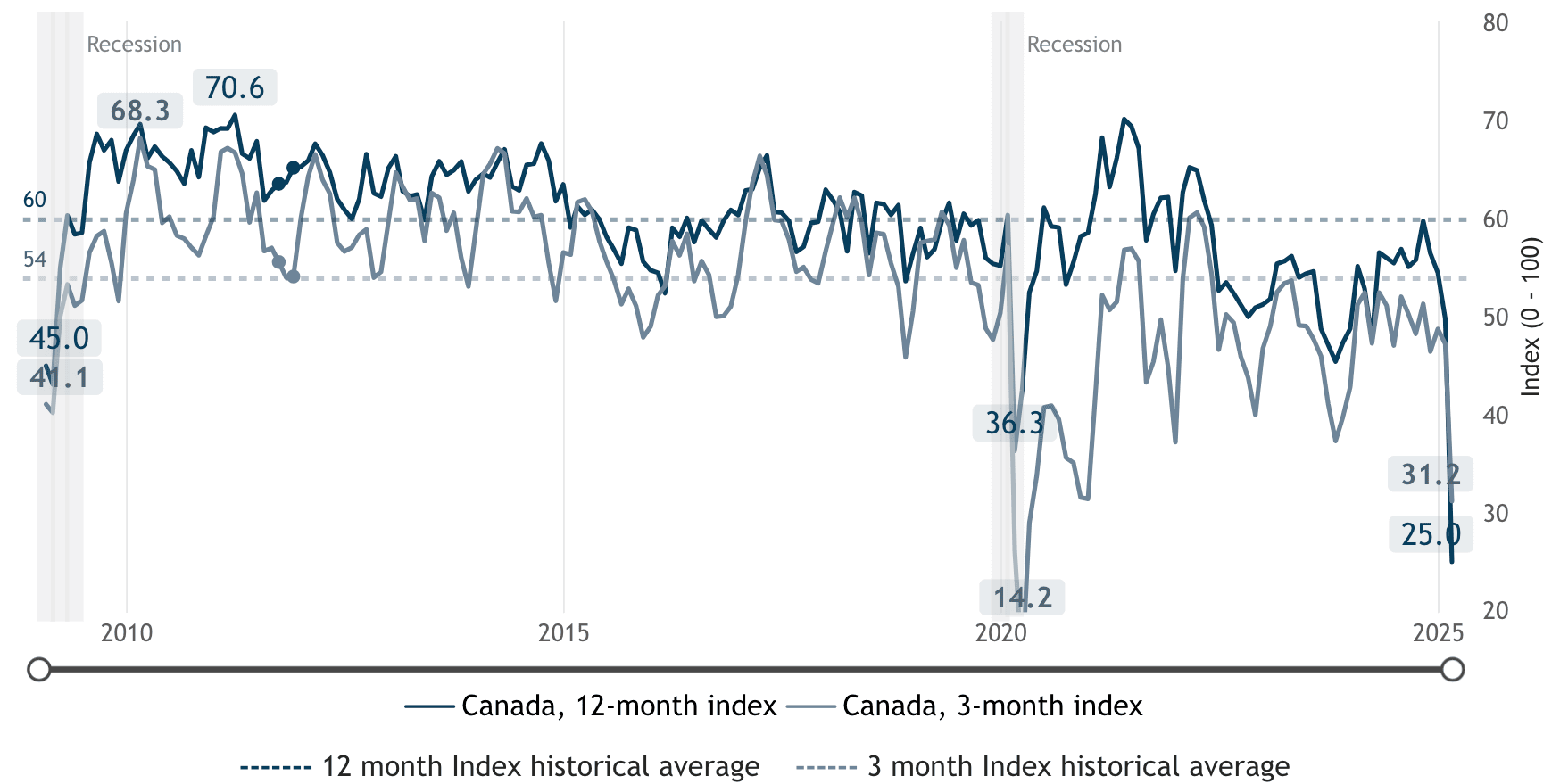

The CFIB Monthly Business Barometer showed a 24.8% drop in business confidence in March (year-on-year) and a 16.1% drop on a three-month basis.

"No, CFIB Business Barometer headlines today were not a typo," says Taylor Schleich, an economist at National Bank of Canada, of the March 20 data release.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

"The nearly 25-year-old small business sentiment indicator really just collapsed to an all-time low, consistent with recent consumer surveys that are equally depressing," he adds.

The figures are approaching Covid-crash lows and are entirely consistent with a Canadian economic recession:

The CFIB reports that small business optimism is at its lowest it has ever been since 2000 and that businesses were reporting "very weak employment plans."

This points to a sharp slowdown in economic output and employment, which raises the prospect that the Bank of Canada will cut interest rates by more than markets currently anticipate in order to help support the economy.

In doing so, they would pressure Canadian bond yields lower, which would weigh on the Canadian Dollar and see a stretch of weakness extend.

The Canadian Dollar is struggling against non-North American currencies, confirming the 'tariff factor' is at play. It is down 6.20% against the Pound in 2025, down 5.50% against the Euro and flat against the U.S. Dollar.

"The source of souring sentiment is easy to identify. It’s President Trump and his tariffs/threats," says Schleich.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

The U.S. in March imposed a 25% tariff on imports from Canada that do not satisfy USMCA rules of origin, as well as a 10% tariff on energy-related goods. The U.S. also imposed a 25% import tariff on all aluminium and steel imports, including those from Canada.

In retaliation, Canada imposed a 25% tariff on U.S. goods worth approximately CAD 29.8 billion (USD 20 billion).

Tariffs are inherently inflationary, which poses more economic headwinds for Canadians. However, higher inflation complicates the Bank of Canada's job, as it constrains its ability to cut interest rates.

"For a forward-looking central bank, this is worrying and would typically lead to a steady dose of pre-emptive rate relief. The problem is that this weakness comes alongside a sharp increase in pricing plans as firms intend to raise prices at the fastest pace since early 2023," says Schleich.

The next major risk event for the Canadian Dollar, and global currencies in general, is the April 02 U.S. tariff announcement, which will be the biggest of Trump's second presidency.