Bank of England Running Out of Road

- Written by: Gary Howes

Image © Adobe Images

The Bank of England might be about to abandon a quarterly run-rate of interest rate cuts.

Money markets show investors are priced at about a two-thirds chance of a May interest rate cut of 25 basis points.

"There was no presumption that monetary policy was on a pre-set path over the next few meetings," says the Bank's minutes.

"Saying policy is not on a pre-set path gives the MPC the option to skip a cut at May’s meeting," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics. "The MPC gave themselves the flexibility to skip a quarterly cut. This fits our view; we continue to look for only two more reductions to Bank Rate this year."

With inflation set to reach 4.0% in the coming months, there is a worry at the Bank of England that its existing forecasts for a steady retreat in inflation back to the 2.0% target in 2026 won't transpire.

Unsupportive data and the inflationary nature of a global tariff war will leave the Bank unable to justify a steady pace of cuts going forward.

"It is not a done deal that the BoE will stick to the current path of quarterly rate cuts by lowering rates by a further 25bps in May," says Lee Hardman, FX analyst at MUFG Bank Ltd.

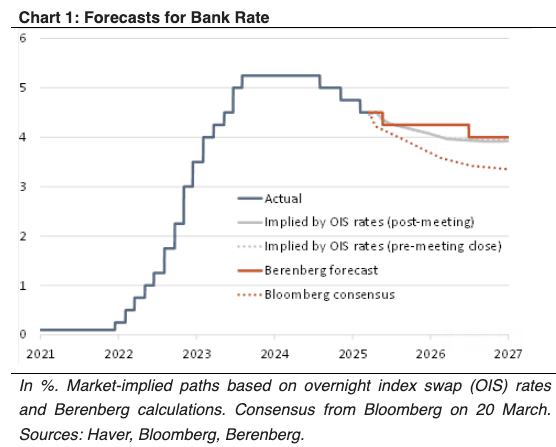

Image courtesy of Berenberg.

Economist Andrew Wishart at Berenberg Bank says the emphasis of the debate has shifted towards the risk that inflation proves more sticky than expected.

"Rate setters need to see a continued decline in underlying inflation to proceed with interest rate cuts," he explains. "But there was “little change in underlying services price inflation between December and January” and household and business inflation expectations have risen."

Berenberg doubts that the downward trend in services price growth that has been in place since late-2023 can continue. Disinflation stopping would prevent further rate cuts.

Wishart looks for another cut in May but warns this could mark the end of the cycle.

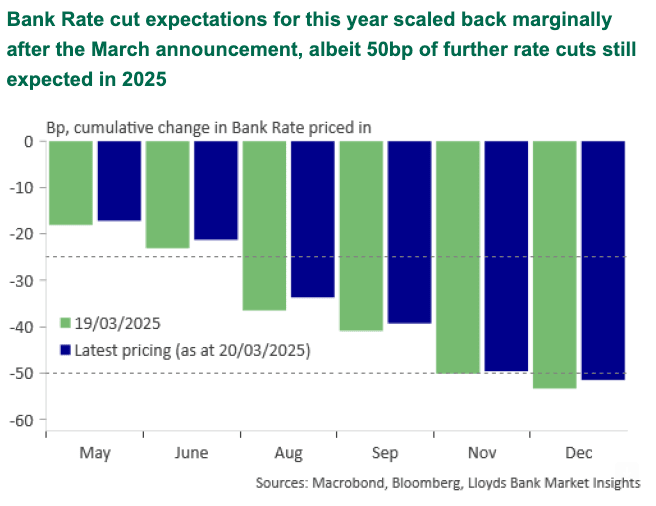

Image courtesy of Lloyds Bank.

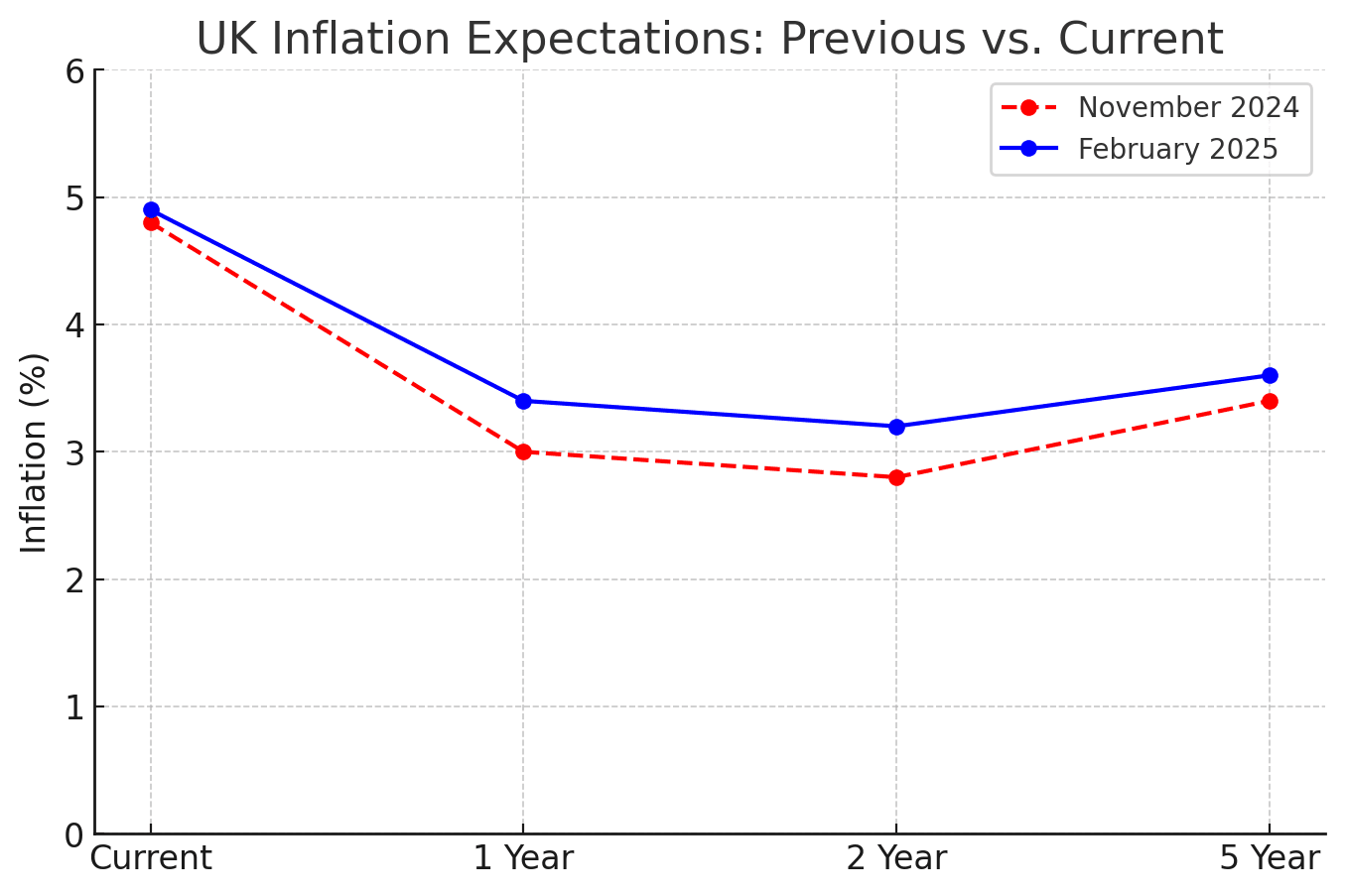

The March policy decision follows the release of the Bank of England's inflation expectations survey, something it watches closely, which reveals a clear rise in expectations of an inflationary pickup.

One-year inflation expectations surged to 3.4%, up from 3% in November 2024. Two-year inflation expectation rose to 3.2%, up from 2.8% in the previous survey and the long-term inflation expectation (Five Years) rose to 3.6%, up from 3.4%.

Inflation expectations are crucial for monetary policy: if consumers, workers and businesses think inflation is set to rise, they engage in behaviour that fuels inflation.

"What is clearly a concern for the MPC is the rise in inflation expectations, both on the household and business side," says Ellie Henderson, an economist at Investec.

Investec thinks the Bank will cut again in May but acknowledges another big question mark hangs over the meeting that could see that cut being abandoned.

"This is a deeply uncertain time," says Henderson. "The May meeting is also important as we should have more clarity over US trade policy, given President Trump’s threat to impose reciprocal tariffs on April 2."

She says that as events unfold, these forecasts may have to change, as does the Bank’s approach. "The MPC will not just have to be gradual and cautious when it comes to policy decisions, but also flexible, prepared to adapt to the rapidly evolving backdrop."

MUFG thinks that the Bank will still cut rates in May, but the quarterly spell will be nevertheless soon be broken.

This would be in line with current market-implied pricing, where a May cut is priced at a two-thirds chance, but an August cut is at 50/50.

"We expect this probability to be scaled back further unless backed up by more evidence of softening UK labour market conditions, including slowing wage growth in the coming months," says MUFG's Hardman.

"The BoE will deliver another 25bps rate cut in May. We believe there is a higher risk that the BoE could skip a quarterly rate cut in August when there is expected to be bigger inflation overshoot," says MUFG's Hardman.

However, Andrew Goodwin, Chief UK Economist at Oxford Economics, thinks that the bar to abandoning the quarterly pace "is high."

"Bank Rate is still comfortably in restrictive territory, growth is sluggish, and the BoE's measure of underlying pressure continues to cool, giving the MPC reason to cut," he explains. "We think it's very likely there will be another 25bp cut in May and market pricing for that month appears too cautious."