Bank of England's Inflation Survey Should Set Off Alarm Bells

- Written by: Gary Howes

Image © Adobe Images

Inflation expectations are de-anchoring.

The Bank of England will be alarmed by a significant de-anchoring in inflation expectations.

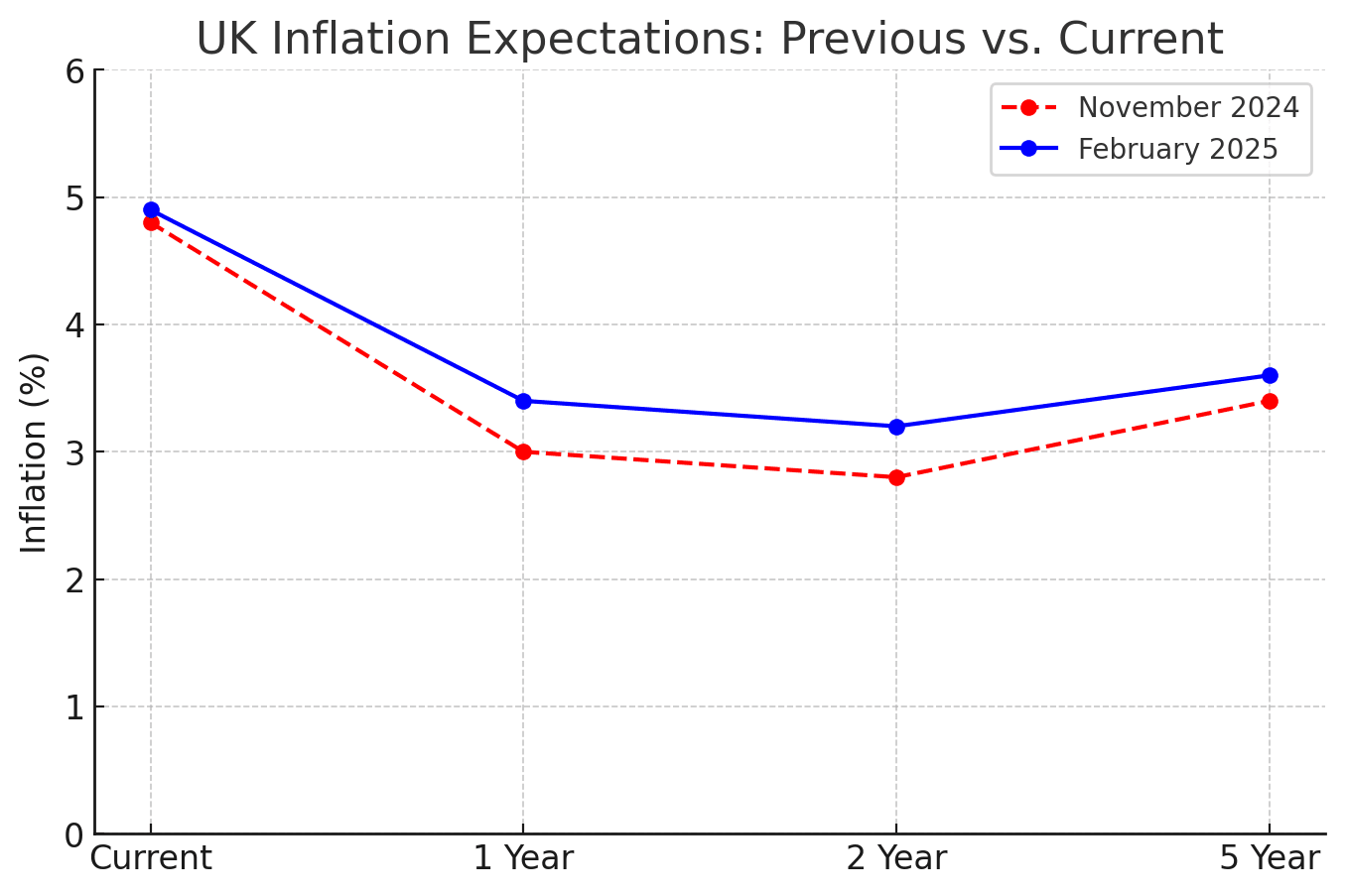

The Bank's own quarterly survey of the public's expectations for inflation shows a notable rise in Q1 as one-year inflation expectation surged to 3.4%, up from 3% in November 2024.

Two-year inflation expectation rose to 3.2%, up from 2.8% in the previous survey and the long-term inflation expectation (Five Years) rose to 3.6%, up from 3.4%.

"The latest Bank of England inflation attitudes survey shows long-term expectations high and rising, especially once we adjust for the structural break in the BoE data in 2020. The MPC is wrong to assume this year's inflation rise will have no second-round effects," say Rob Wood, Chief UK Economist at Pantheon Macroeconomics.

Inflation expectations are crucial for monetary policy: if consumers, workers and businesses think inflation is set to rise, they engage in behaviour that fuels inflation.

This includes demanding higher wages and setting higher prices.

The Bank of England believes that cutting and raising interest rates can impact inflation expectations. Rising interest rates lower inflation expectations, which in turn can lead to real-world outcomes.

The Bank's Monetary Policy Committee (MPC) has long warned against inflation expectations de-anchoring, arguing that interest rates must rise or stay high to combat this.

As recently as August 2024, the Bank's Governor Andrew Bailey declared victory in anchoring inflation expectations:

"Inflation expectations appear to be better anchored, which I put down in good part to the presence of independent central banks with clear mandates."

However, a series of rate cuts delivered in an environment of rising inflation suggests the Bank is losing credibility with the public.

The Bank's survey showed 34% of the public expected rates to rise over the next year (slightly up from 33%). 23% expected rates to remain unchanged (up from 22%).

Only 29% expected rates to fall, down from 34%.

Catherine Mann, a long-time proponent of the need to anchor inflation expectations, isn't helping, having recently complicated her approach to interest rates and inflation.

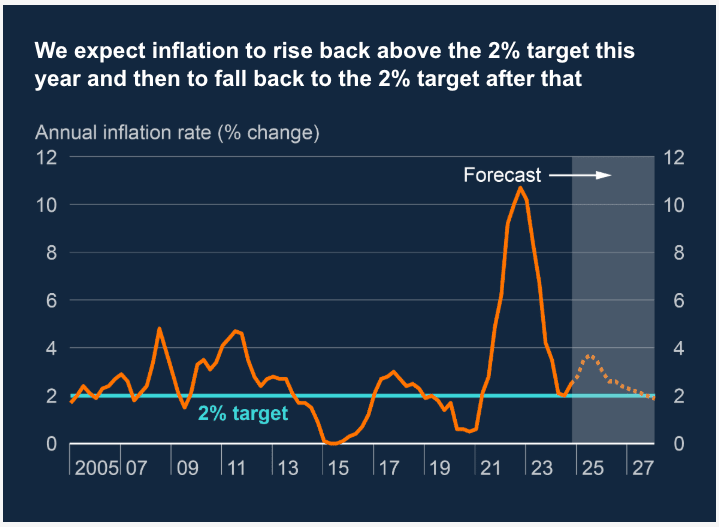

She voted in February to cut interest rates by 50 basis points, defying the consensus of MPC voters for a more contained 25bp cut, despite evidence of rising inflation and an eye-watering upgrade to its own inflation projections.

Above: The Bank of England raised its inflation forecasts in February.

And she told a conference just this month that, "the anchor [of inflation expectations] is a key achievement of monetary policy frameworks."

The Bank's MPC appears to be far more interested in growth dynamics, defying its primary mandate to bring inflation to 2.0% on a sustained basis.

Government policy is proving to be the primary driver of the UK's deteriorating growth dynamics, and these inflation expectations data shows the Bank of England is throwing away its credibility to prop up the government's fiscal policy mistakes.

"Inflation risks remain underappreciated, and the easing cycle may need to be paused later in the year," says Andrew Wishart, Senior UK Economist at Berenberg Bank.

The Bank of England meets again next week to decide whether or not to cut interest rates further.