The Bank of England's Eye-watering Inflation Forecast Hike

- Written by: Gary Howes

Image © Adobe Images

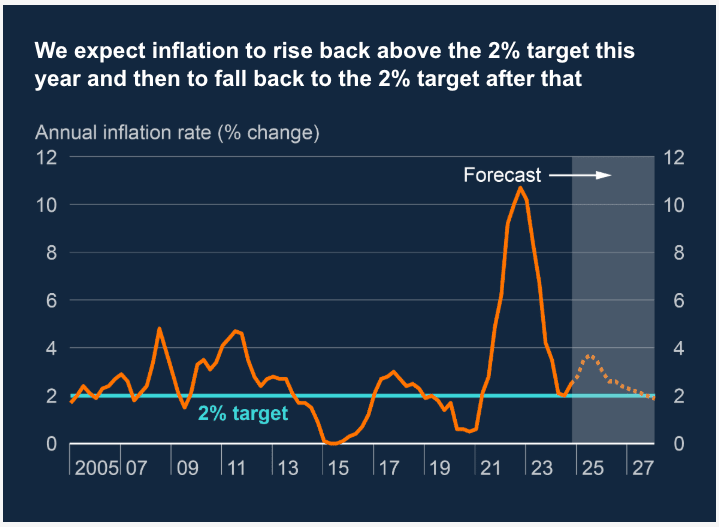

The Bank of England (BoE) has raised its inflation forecasts for the year ahead, warning that consumer prices will climb more sharply than previously expected due to rising global energy costs and regulated price increases.

February's Monetary Policy Report now projects CPI inflation to peak at 3.7% in Q3 2025, a significant revision from the 2.8% peak anticipated in November 2024.

According to the updated forecast, inflation is expected to rise sharply in the first three quarters of 2025, driven by higher wholesale energy costs and changes to government-regulated prices.

The BoE notes that this temporary surge will be followed by a gradual decline, with inflation expected to return to the 2% target by late 2027.

“Recent developments in energy markets and the continued persistence of domestic inflationary pressures suggest that the near-term inflation outlook is stronger than previously thought,” the BoE stated in its report. “However, we remain confident that as economic slack emerges in 2026, inflation will decline toward the 2% target.”

Above: The Bank's inflation forecast profile has been raised.

Comparing the New Forecast to November 2024 Projections

The BoE’s November 2024 Monetary Policy Report had forecasted a peak inflation rate of 2.8% in Q3 2025, followed by a decline to 2.7% by year-end. The latest revision adds nearly a full percentage point to the peak, with the forecast for 2026 also seeing an upward revision.

- 2025 Q3 CPI Forecast: Revised up to 3.7% (previously 2.8%)

- 2025 Q4 CPI Forecast: Now 3.5% (previously 2.7%)

- 2026 Q1 CPI Forecast: 3.0% (previously 2.6%)

- 2027 Q4 CPI Forecast: 2.0%, aligning with prior expectations

Despite this more aggressive near-term outlook, policymakers remain optimistic that inflation will be reined in over the medium term.

Key Drivers Behind the Forecast Upgrade

Energy Price Resurgence: Rising wholesale gas and oil prices are pushing up household energy costs, reversing some of the disinflationary benefits seen in 2023 and early 2024. The BoE now expects the direct energy price contribution to inflation to shift from -0.6 percentage points to +0.4 percentage points by Q3 2025.

- Regulated Price Increases: Various government-mandated price adjustments are expected to add to inflationary pressures. These include:

- Higher water and transport costs, with bus fare caps being lifted.

- VAT on private school fees, which could indirectly impact household budgets.

- Adjustments in National Insurance Contributions (NICs) for employers, which may be passed on to consumers.

- Labour Market & Wage Growth: While wage growth is slowing, it remains above pre-pandemic levels, contributing to elevated core inflation. The BoE’s latest data suggests private sector pay growth of 6% in late 2024, expected to slow to 3.75% by the end of 2025.

Looking Ahead

With global energy prices volatile and uncertainty surrounding domestic wage growth, inflation remains a critical challenge for policymakers.

While the BoE maintains confidence in its long-term inflation trajectory, the path to the 2% target is now expected to be more turbulent than previously thought and raises questions about why two members of the Monetary Policy Committee voted to cut rates by 50 basis points.

Economists and financial markets will closely watch incoming data in the coming months, particularly around labour market trends and consumer spending, to gauge whether further adjustments to the inflation forecast will be necessary.