OBR Raises Inflation Forecast But Halves Growth

- Written by: Sam Coventry

Image: HM Treasury.

The Office for Budget Responsibility has cut the UK's growth and productivity projections for this year while hiking inflation and debt projections.

The developments presented the Chancellor of the Exchequer with a choice of either cutting spending or raising taxes to ensure she meets her rule that debt falls in the coming years.

Rachel Reeves chose to cut welfare spending and, in doing so, regained a wafer-thin £9.9BN in headroom on her debt rule.

"The Chancellor has replenished the fiscal headroom back to £9.9bn (spending rule), which may provide some relief in the short term, but this is a temporary fix, kicking the can down the road. Longer term, budgetary challenges remain as higher interest rates and weaker growth persist," says Shamil Gohil, fixed income portfolio manager at Fidelity International.

The market reaction is relatively contained, with the benchmark ten-year bond yield spiking and then settling back to levels it was at earlier in the day (4.73%).

The Pound is weaker across the board, but this is almost all down to the release of below-expectation CPI inflation numbers for February.

Here are the major forecast developments put forward by the OBR:

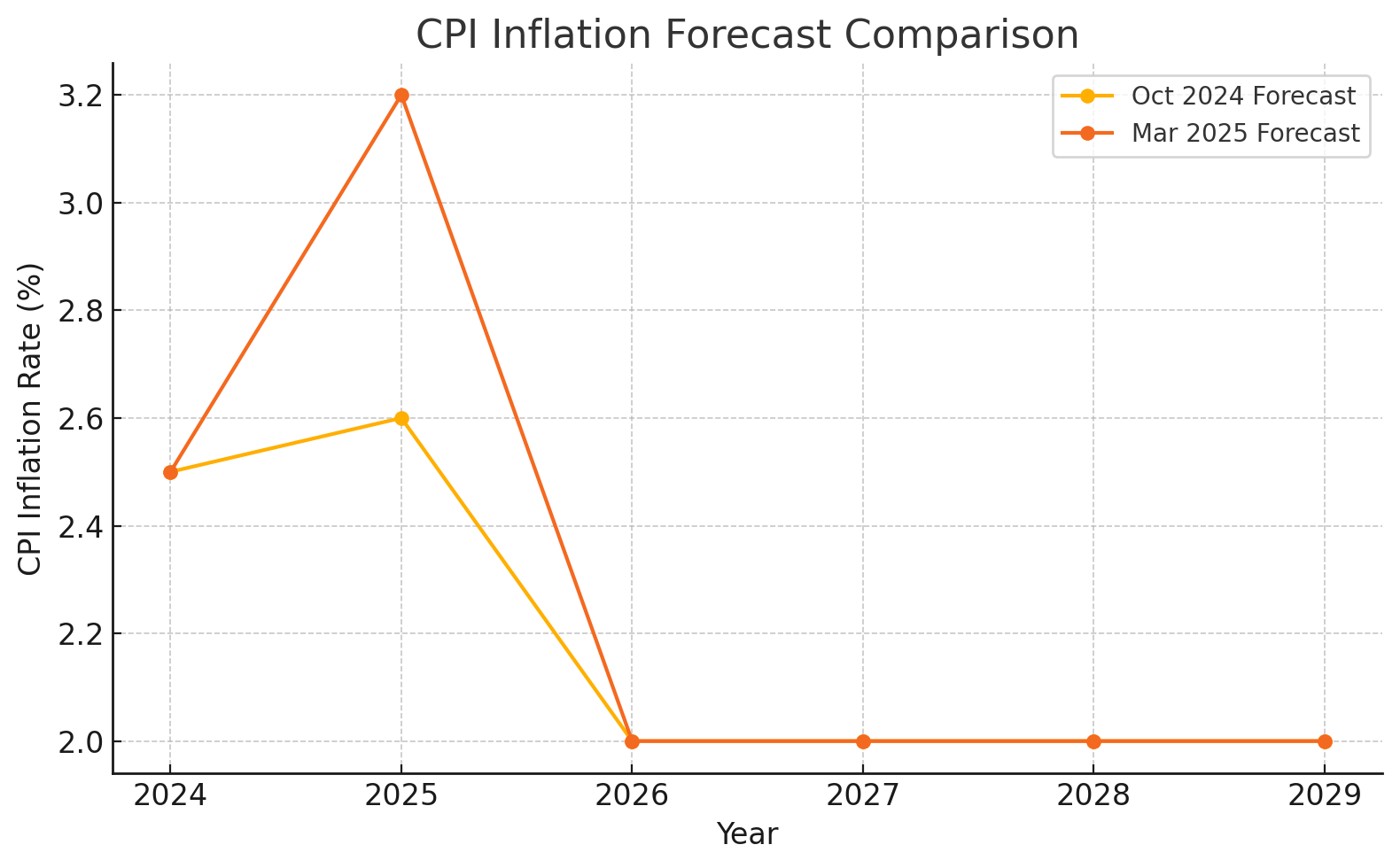

🔺 Inflation Forecasts

CPI inflation is forecast to rise from 2.5% in 2024 to 3.2% in 2025, higher than the previous 2.6% forecast in October 2024.

Monthly CPI inflation is projected to peak at 3.8% in July 2025 due to:

- Higher wholesale gas prices (up 30% from the October forecast).

- Increases in Ofgem’s energy price cap.

- Elevated food and regulated water prices.

Inflation is expected to return to the 2.0% target from 2026 onwards as energy and food prices stabilise and wage pressures ease.

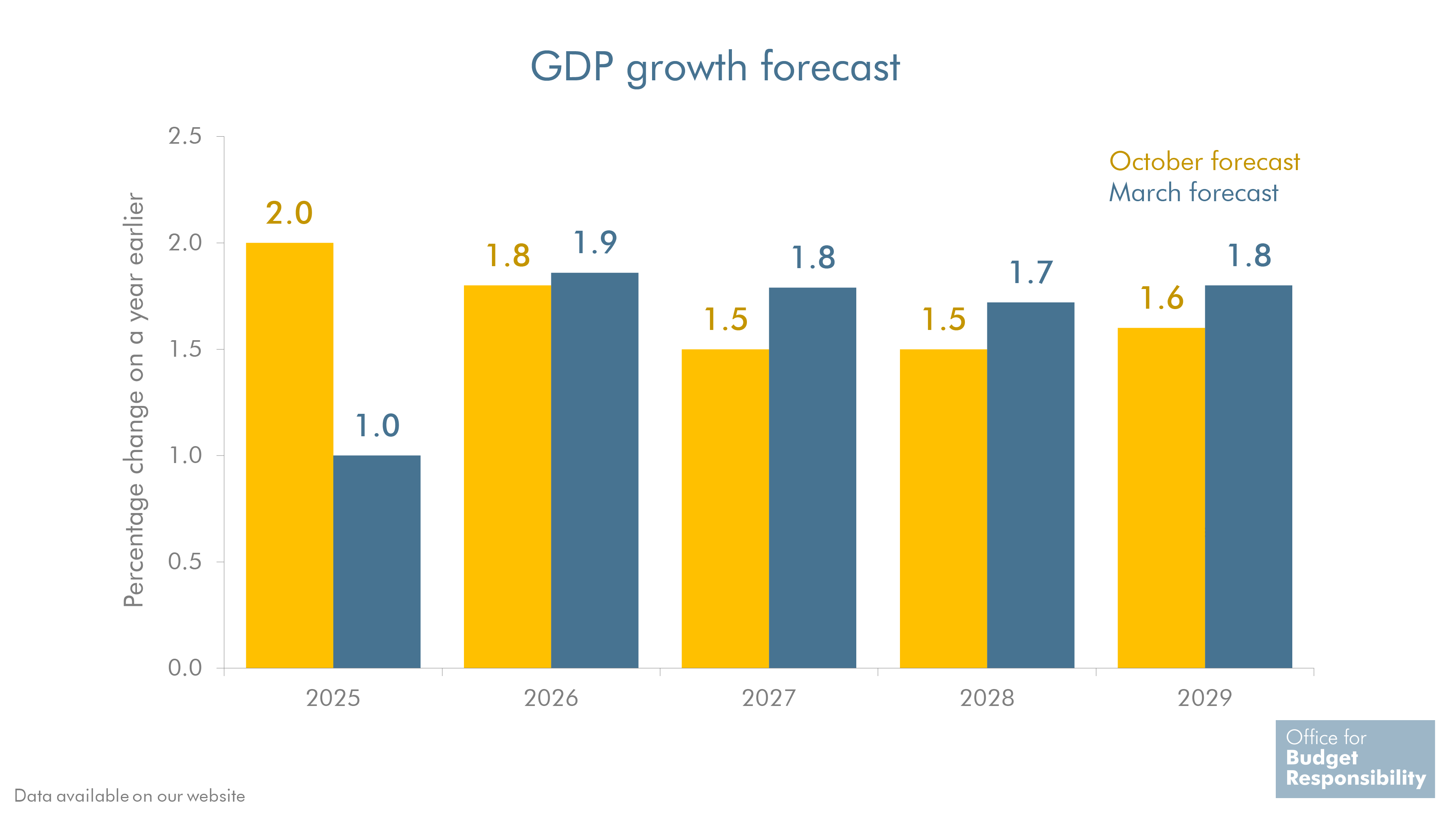

📉 2) Growth Forecasts

2025 real GDP growth was downgraded sharply to 1.0% from 2.0% in the October 2024 forecast.

One-third of the downgrade is due to structural issues, especially weaker productivity (see below).

Two-thirds are attributed to cyclical factors like tighter monetary policy, rising energy costs, and economic uncertainty.

Growth rebounds to 1.9% in 2026, then averages 1.75% over the remainder of the decade, never cracking the 2.0% level.

Real GDP per person is forecast to grow by 0.3% in 2025 and then 1.4% annually from 2026–2029.

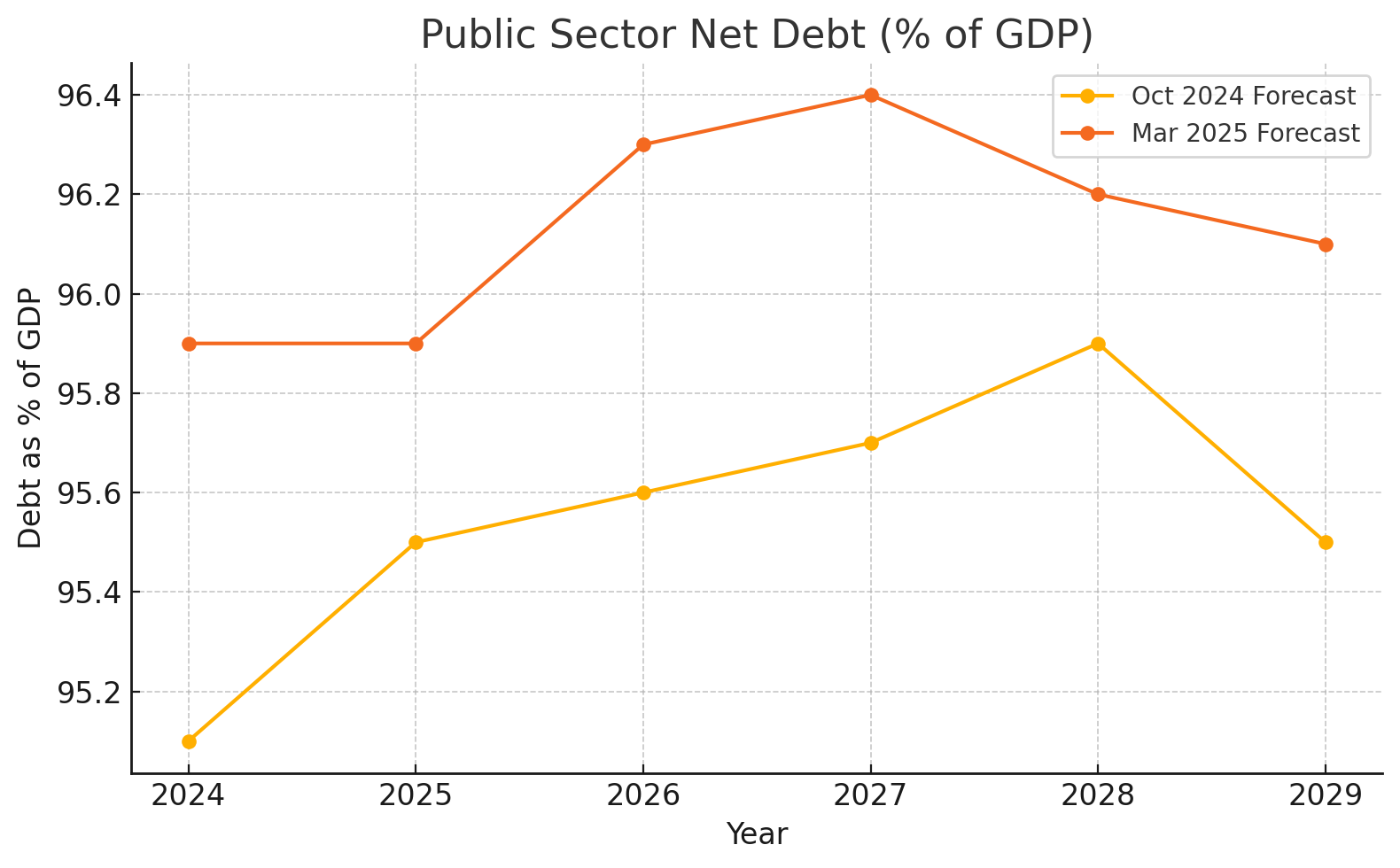

💸 3) Debt Forecasts

Public sector net debt (PSND) remains high:

0.6 percentage points higher than projected in October 2024 due to elevated borrowing.

Public sector net borrowing (PSNB) is expected to fall from £137.3bn (4.8% of GDP) in 2024–25 to £74.0bn (2.1%) by 2029–30.

However, borrowing in 2029–30 is now £3.5bn higher than the previous forecast.

Debt interest costs are up due to higher Bank Rate, gilt yields, and inflation, adding £10.1bn to borrowing by 2029–30.

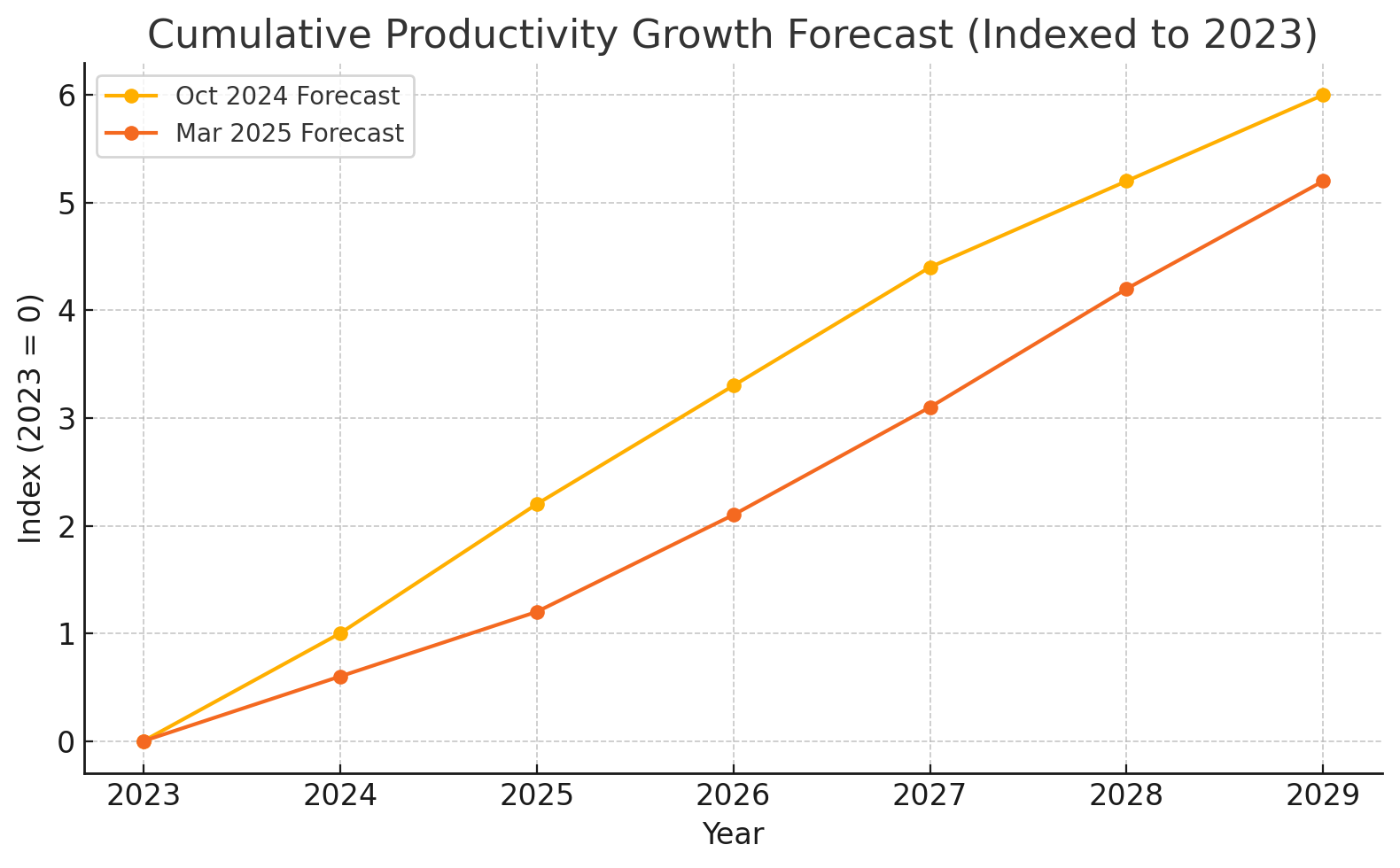

⚙️ 4) Productivity Forecasts

Trend productivity growth (output per hour) is now expected to average just 1.0% per year.

The level of productivity in 2029 is projected to be over 1% lower than forecast in October 2024.

Cumulative productivity growth from 2023 to 2029 was revised down from 6.0% to 5.2%.

The OBR warns that if recent weakness in productivity persists, output would be 3.2% lower and the budget deficit 1.4% of GDP in 2029–30.

Planning reforms are forecast to add 0.2% to potential output by 2029, with long-run benefits rising to 0.4% by 2034–35.