Pound Sterling Drops Against Euro and Dollar on Temporary Inflation Undershoot

- Written by: Gary Howes

Image © Pound Sterling Live

UK inflation figures for February were cooler than expected.

The British Pound fell against the Euro, Dollar, and other major currencies after the ONS said UK monthly CPI inflation rose by 0.4% month-on-month, less than the consensus expectation of 0.5%.

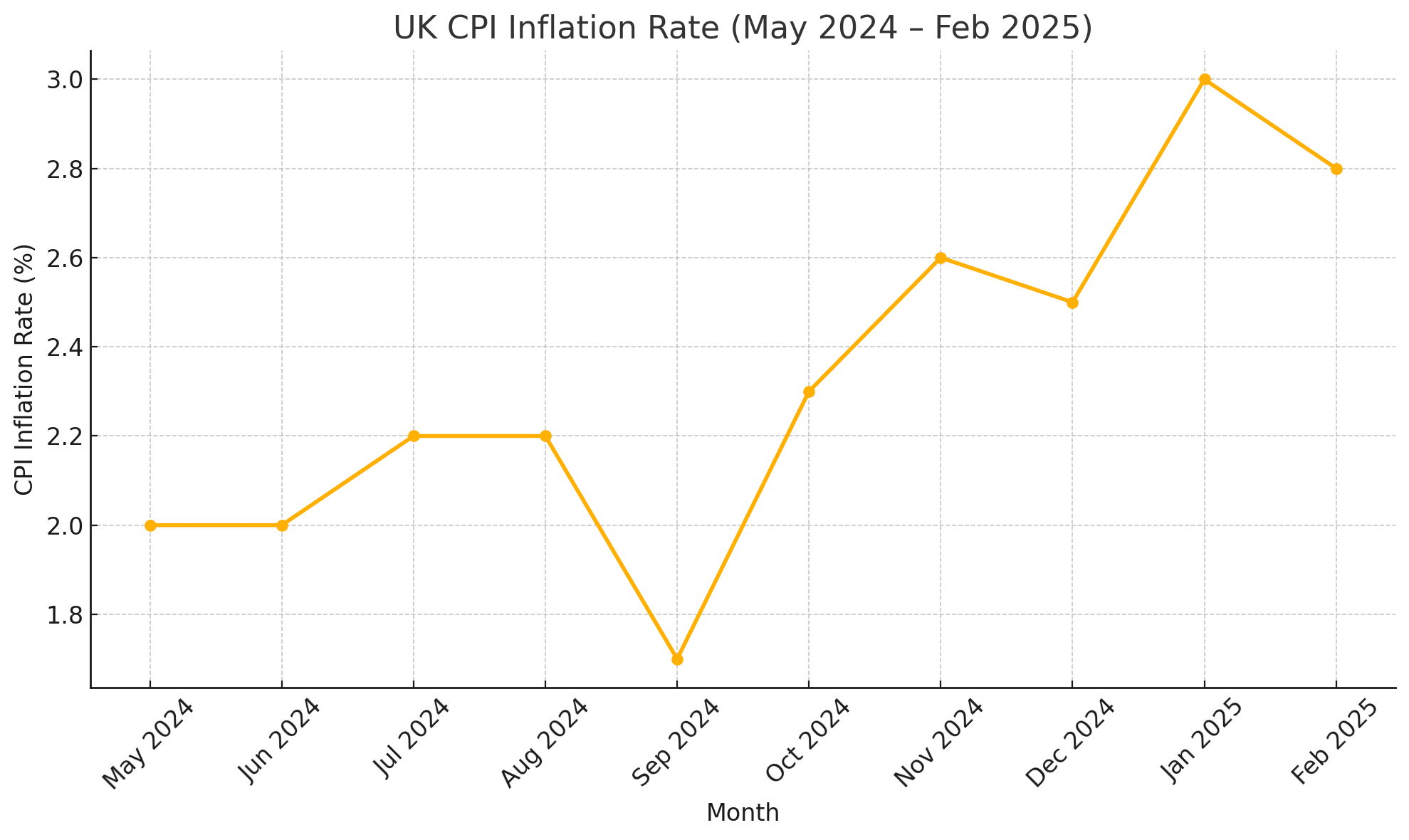

Annual CPI inflation fell to 2.8% from 3.0% in January 2025, whereas the expectation was for a rise of 2.9%. The decline was mainly driven by clothing and footwear, which saw prices fall year-on-year (-0.6%), making for the first negative rate since October 2021.

CPI services inflation, which is closely watched by the Bank of England, remained steady at 5.0%.

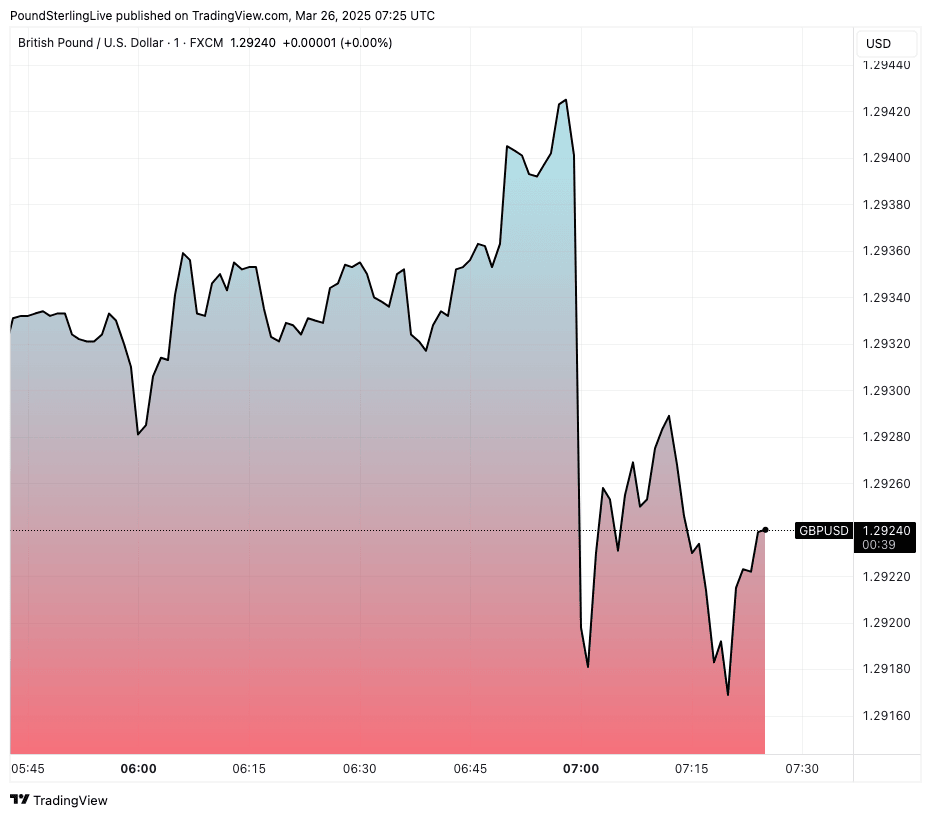

Above: GBP/USD drops on the inflation release.

Core CPI inflation, another important measure for the Bank, eased to 3.5% in February 2025, down from 3.7% in January and below expectation for 3.6%.

While inflation is clearly still well above the Bank of England's 2.0% target, the undershoot relative to expectations has triggered a downside currency reaction.

The Pound-to-Euro exchange rate dipped in the wake of the release to 1.1982 from 1.20 (this means it is still expensive relative to the consensus quarterly forecast from the major investment banks). The Pound-to-Dollar exchange rate fell from 1.2940 to 1.2920.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Following the release of the figures, traders topped up bets for another interest rate cut at the Bank of England in May to an 80% chance.

The rising odds of a May cut reflect a tick lower in UK bond yields and a decline in the Pound.

However, the Bank of England will remain constrained in its ability to cut interest rates on too many occasions as inflation is still stubbornly high, and economists warn it will rise further.

Above: CPI inflation has been rising for a year now.

In fact, Andrew Sentance, a former member of the Bank of England's Monetary Policy Committee, says higher National Insurance contributions and energy & water prices are likely to push CPI inflation above 4%.

"5% plus on the cards for the autumn," he says.

Inflationary pressures are high, and this will limit downside in UK bond yields and Pound exchange rates.

However, not all economists are in agreement that inflation pressures will continue to build.

Deutsche Bank's UK economist, Sanjay Raja, says he sees signs that services inflation will come off the boil, allowing the Bank to accelerate rate cuts.

"All told, today’s inflation data should be music to the MPC’s ears. Inflation momentum is slowing. Services prices – once deemed too sticky in the UK – are coming off faster than expected," he notes.

Deutsche Bank thinks the case for sequential rate cuts is rising.

"The MPC can start to contemplate a faster dial of restrictive policy. As we’ve noted many times, risks are skewed to a faster drop in Bank Rate over the next 6-9 months," says Raja.

If Raja is right, then a faster fall in Bank Rate over the coming months is in store, which will weigh on the Pound in the coming year.

In fact, an accelerated fall in UK interest rates is a key reason many major foreign currency forecasters are forecasting a softer Pound in the coming quarters.