Pound Sterling Faces a Summer of Fear and Loathing

- Written by: Gary Howes

Above: Changes to employment laws championed by Angela Rayner were not considered by the OBR when making its latest forecasts.

The near-term trajectory remains supportive, but significant headwinds build into the Autumn budget where further tax hikes are likely.

A nervous summer awaits UK households, businesses and the Pound as all signs point to further tax increases in the autumn.

The Chancellor of the Exchequer has very limited headroom against her fiscal targets following Wednesday's Spring Statement that saw her announce measures and forecasts that restore it to exactly where it was at the October Budget, £9.9bn.

Rachel Reeves announced £4.8BN of cuts to welfare payments and £3.6BN of reductions to departmental spending.

But economists are already lining up to say the £9.9BN headroom is so unfeasibly small she will soon be back to raise taxes and cut spending further.

"That continues to leave her plans vulnerable to events outside her control and is likely to extend uncertainty around fiscal policy to the next fiscal event in the Autumn," says RBC Capital Markets.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Further tax rises are starting to feel inevitable," says Paul Dales, Chief UK Economist at Capital Economics. "The inevitable conclusion is that at some point the government may have to break its election promises and raise taxes for households."

The threat of more taxes will stir uncertainty amongst businesses and consumers, which will contribute to negative feedback loops for the economy.

After Labour's July victory, Prime Minister Keir Starmer and Reeves immediately got to work warning of the need to hike taxes. The grim warnings caused a collapse in confidence and an immediate slide in economic growth.

The coming months could see more of the same as businesses and households 'batten down the hatches' in anticipation of further pain, which is hardly constructive for the British pound.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

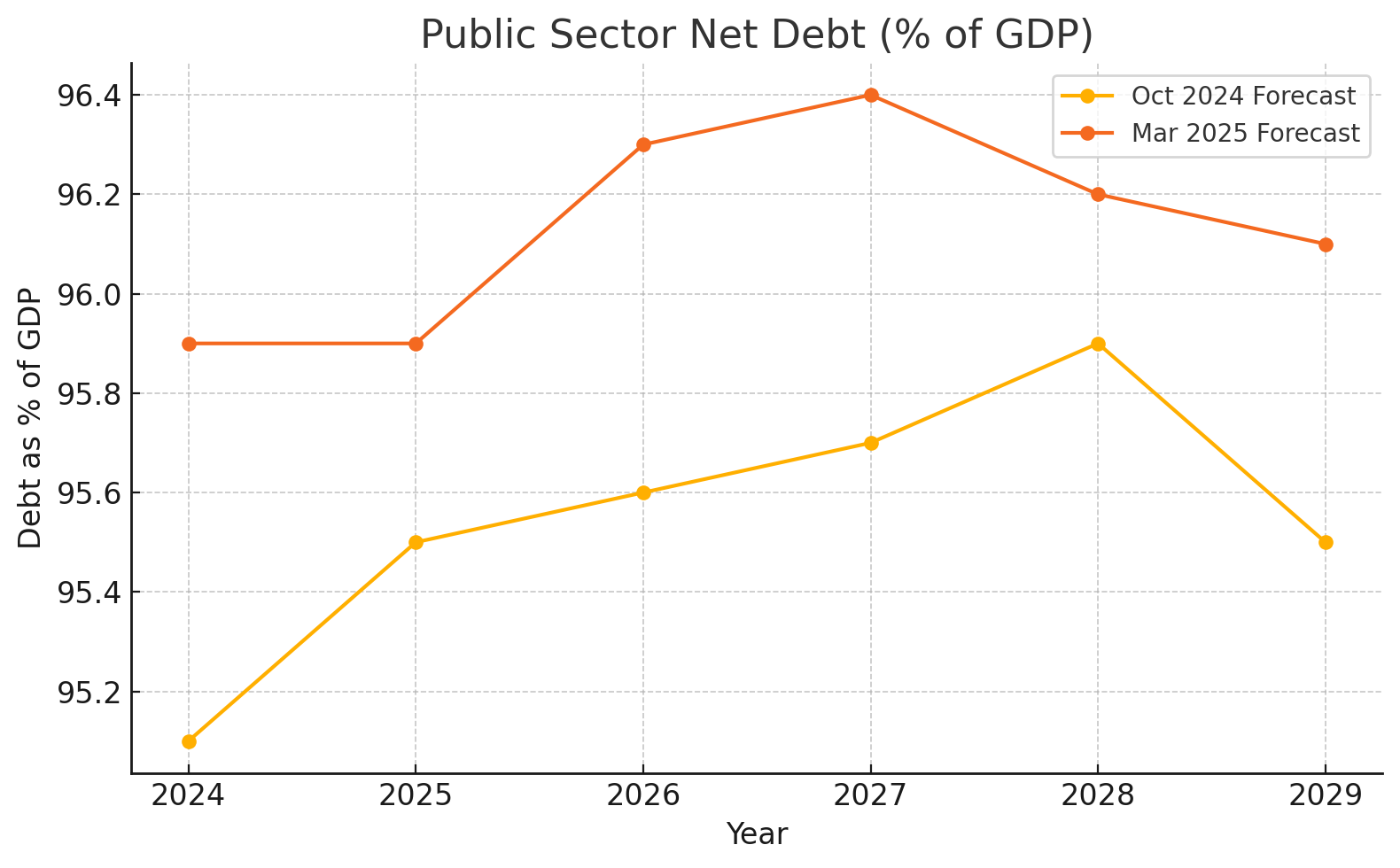

"In our view, debt-sustainability worries are not off the table and the Spring Statement hasn’t changed the picture. The Chancellor has exhausted most of the leeway she had regarding spending cuts (with tax increases now on the table for Autumn)," says Evelyne Gomez-Liechti, Multi-Asset Strategist at Mizuho International Plc.

"The UK is flashing up on our dashboard as a potential stagflation risk. Much will depend on the post-April outlook because of tax changes," says Kamal Sharma, FX analyst at Bank of America.

Bank of America maintains a bullish stance on Pound Sterling, but warns it is not as high conviction as it once was.

Goldman Sachs Lowers Pound-Euro Forecast

JP Morgan's London-based GBP trader wrote to clients on March 27, saying there might not be a smoking gun for Sterling following the Chancellor's statement, but "I struggle to see GBP in a positive light."

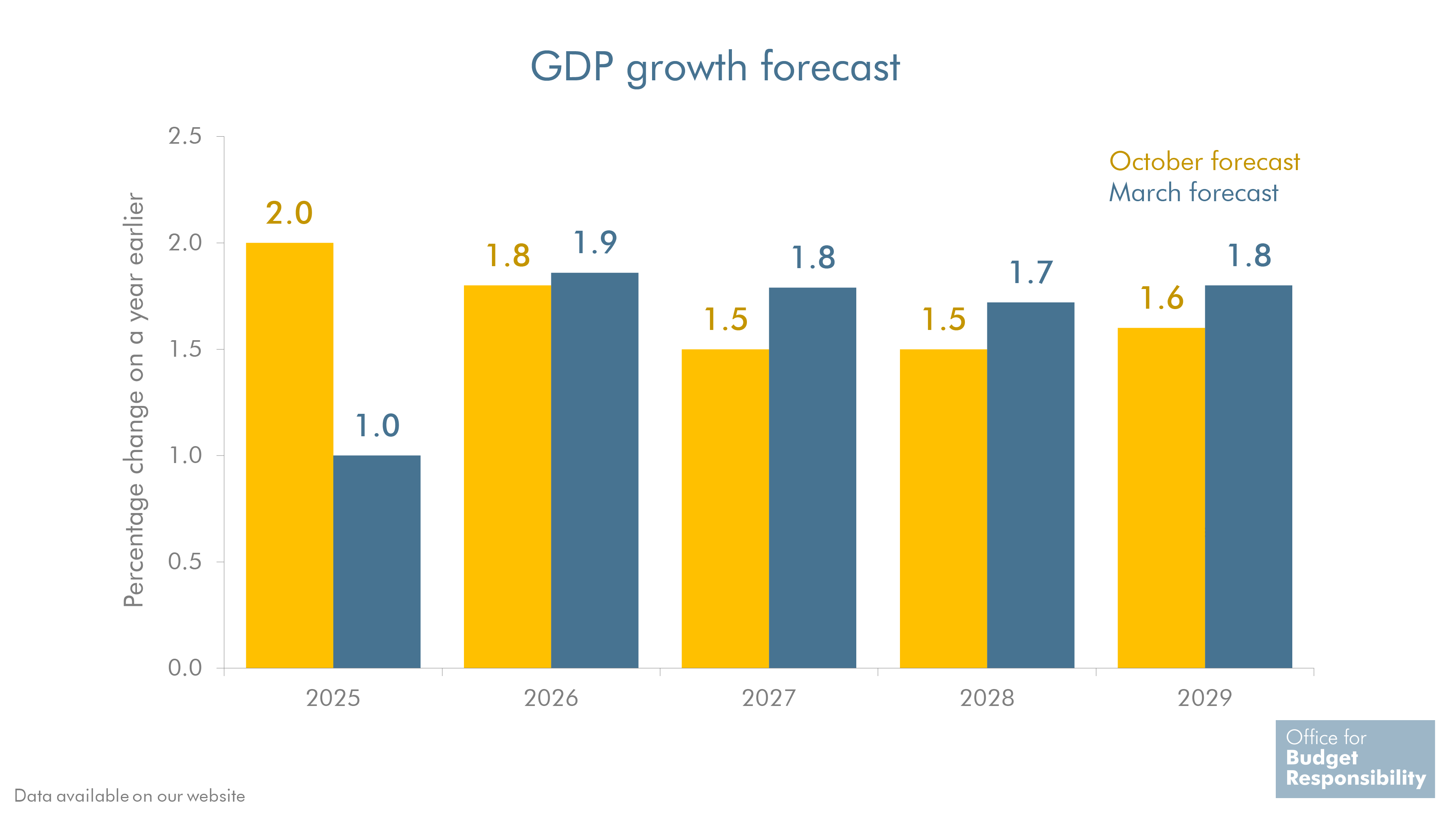

For him and colleagues, the Office for Budget Responsibility is testing the limits of credibility with its optimistic UK growth and productivity forecasts, on which the trajectory of UK debt hinges.

The ability to raise taxes to fund borrowing rests on economic growth; without it, it won't happen.

On Wednesday, the OBR announced it had halved the growth forecasts for 2025 made just five months prior, yet it is asking markets to believe it when it says growth forecasts for 2026 through 2030 will be higher than previously thought.

"Stressing that it’s okayed by the UK Office for Budget Responsibility (OBR) isn't the best sales argument given the OBR’s track record of painting a too rosy economic picture," says Mathias Van der Jeugt, an analyst at KBC Markets.

The same applies to inflation: a meaningful upgrade to near-term forecasts was issued, but according to the OBR, it's happy days from 2026 when inflation trends back down at 2.0%.

"No-one is asking the crucial question: If the OBR has made such a hash of forecasting this year’s GDP growth, why should we believe any of their revised forecasts - for this year and the next 4 years?" queries Andrew Sentance, an economist and former member of the Bank of England's Monetary Policy Committee.

But the OBR doesn't give the verdict of credibility; the financial market does.

Above: The UK debt burden was upgraded by the OBR.

The OBR also confirmed its latest growth predictions don't take into account the looming Employment Rights Bill, Championed by Angela Rayner, which will see significant burdens placed on the UK's employers just as they grapple with a significant increase in employment taxes.

"Some of the proposals are deeply worrying for employers. There's a high risk of unintended consequences that could limit employment opportunities and economic growth," says Jane Gratton, Deputy Director for Public Policy at the British Chambers of Commerce.

Despite the significant change facing employers, the OBR's employment forecasts are outright constructive. Unemployment will peak in 2025 at 4.5% before steadily declining to 4.1% in 2028.

The risks for disappointment in the wake of National Insurance increases, and the deployment of the Employment Rights Bill are large.

Investors will be watching Sterling's relationship with bond yields for signs of market unease over the economic trajectory.

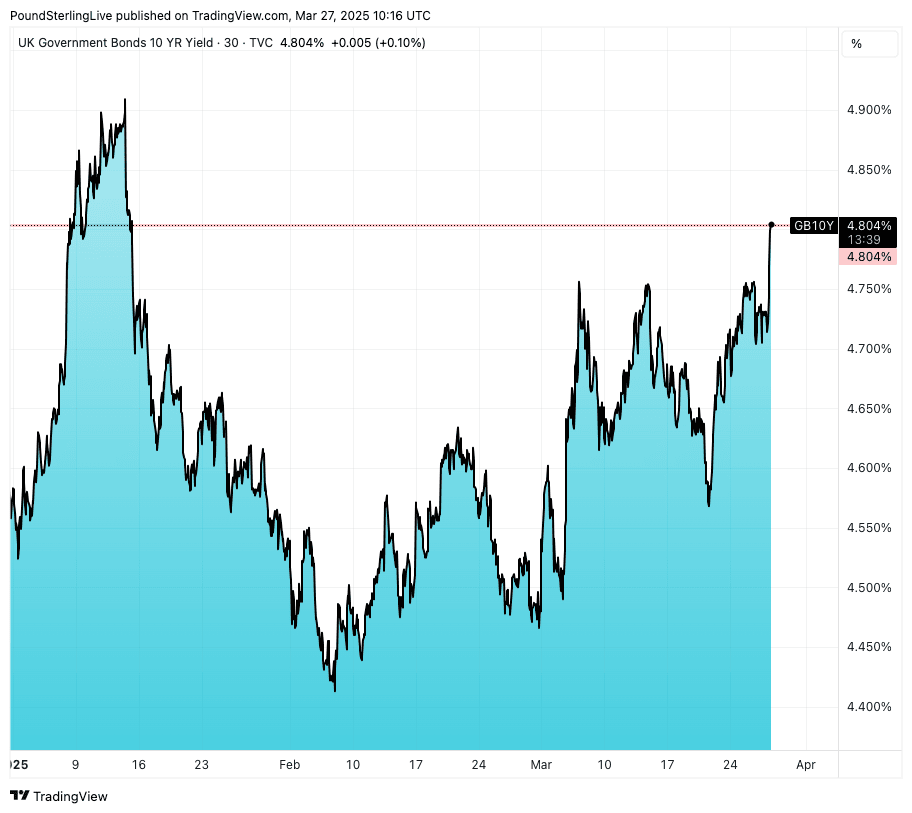

Above: UK ten-year yields are rising back to January highs and are now well above Liz Truss era levels.

The rule of thumb is that rising yields should prompt a rise in the Pound. However, when rising yields trigger currency weakness, we know that it is a sign that markets are starting to panic.

We saw this behaviour during the Liz Truss mini-budget turmoil and again briefly in January when yields spiked and the Pound fell.

In January, we noted that the behaviour was due to concerns over the UK's economic growth trajectory, as growth underpins the sustainability of UK debt.

Fears of a faltering economy could prompt investors to sell UK debt (bonds), which spikes their yield. In these instances, the currency also falls.

Since Thursday's Spring Statement, UK debt yields have steadily risen, in what must be an ominous sign for Reeves.

"The UK 10-yr yield touched 4.8% for only the second time since 2008 following a brief period higher in January," notes van der Jeugt.

"Either more economic pain in the Autumn update (tax hikes, spending cuts) or choosing for the 'easy' way by giving up fiscal rules. Today’s Gilt sell-off suggests markets take the second route more and more into account," he adds.