Pound Sterling Drops Against Euro and Dollar After GDP Confirms "Stagflation Looms Large"

- Written by: Gary Howes

File image of Labour leader Keir Starmer and Chancellor of the Exchequer Rachel Reeves. Image © Keir Starmer.

The UK economy is entering a period of low growth and high inflation, also known as stagflation. This does not bode well for Sterling.

The British Pound fell against the Euro and Dollar after the ONS said the UK economy grew by just 0.1% month-on-month in November.

The expectation was that growth had recovered to 0.2%, dragging the year-on-year rate down to 1.0%.

"The spectre of stagnation now looms large in the UK. Budget uncertainty coupled with disruptive weather will add to the disappointing growth data we've seen in recent months," says Sanjay Raja, Senior Economist at Deutsche Bank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

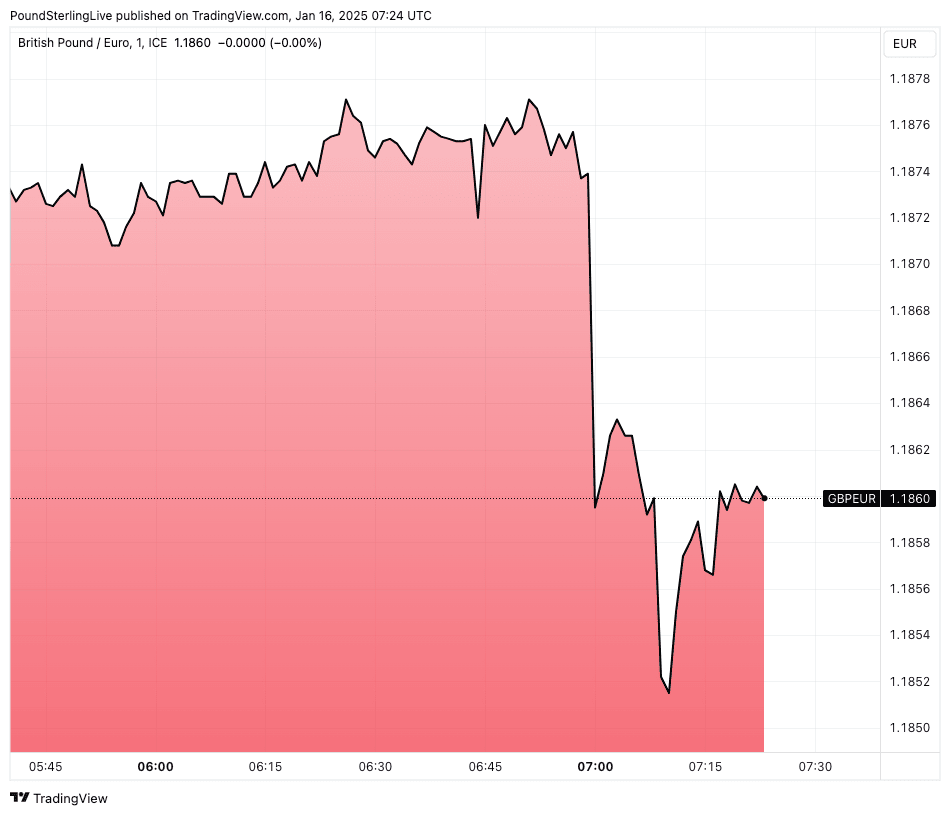

The Pound to Euro exchange rate dropped to 1.1864 on the news, undoing more than half of the previous day's relief rally that was linked to softer than expected inflation readings in the UK and, more importantly, the U.S.

The Pound to Dollar exchange rate is down 0.20% on the day at 1.2206, with momentum pointed resolutely lower.

"Storm Bert will have disrupted activity, bringing with it torrential rainfall, snow, and floods, impacting all sectors in the UK economy," says Sanjay Raja, Senior Economist at Deutsche Bank.

Deutsche Bank's quarterly nowcast models point to a stagnant fourth quarter, despite some pick-up in activity expected over December.

Above: GBP/EUR dropped on the release of the GDP data.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"With the ONS revising down its estimate of Q3-24 GDP growth to 0% q-o-q (from 0.1%), we now see the UK economy stalling entirely in the second half of the year," says Raja.

This is unwelcome news for Chancellor Rachel Reeves, who is counting on economic growth to boost her coffers to fund a significant increase in expenditure in the next four years.

Markets have grown concerned that without growth, the UK's debt dynamics will become increasingly difficult, which has resulted in a selloff of UK debt and the Pound.

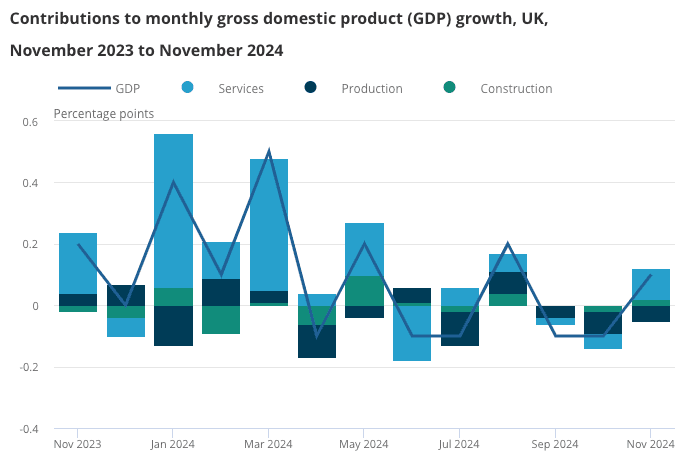

The UK economy was the fastest-growing G7 economy in the year's first half; models show it will effectively flatline in the second half, with the ONS confirming no growth was recorded in the three months to November 2024, compared with the three months to August 2024.

Helping the economy splutter out some positive growth in the month of November was the services sector (+0.1%) and construction (+0.3%). Production output fell by 0.4% in November, following an unrevised fall of 0.6% in October 2024.

On taking power, Prime Minister Keir Starmer and Reeves warned of the need to make "tough decisions" that involved raising taxes, which immediately put businesses and consumers on the defensive. The subsequent tax hikes announced at the budget, alongside other regulatory changes, have forced businesses to retrench spending plans, raise prices and cut jobs.

"Mood in the business community has been decimated due to current government policy. The business owners I speak to are asking why they should take risks, why carry on hiring, why invest when growth is not there, and why take on more fixed costs. They're also wondering whether their customers will accept further price rises," says Rakesh Dua, CEO at DUA Accountancy & Business Consultancy.

The slowdown in economic activity will mean tax receipts disappoint, forcing Reeves to raise taxes and cut spending again, which will only further depress sentiment.

The outlook for the Pound now looks equally depressed.