Pound to Euro Rate A Big Winner of the U.S. Inflation Undershoot

- Written by: Gary Howes

Image © Adobe Images

A surprisingly soft UK inflation figure helped steady Pound Sterling against the Euro, but it was the soft U.S. inflation undershoot that really got the recovery going.

Stocks, bonds and the Pound to Euro (GBP/EUR) exchange rate are rallying following a shift in global market sentiment that follows a below-consensus U.S. inflation print.

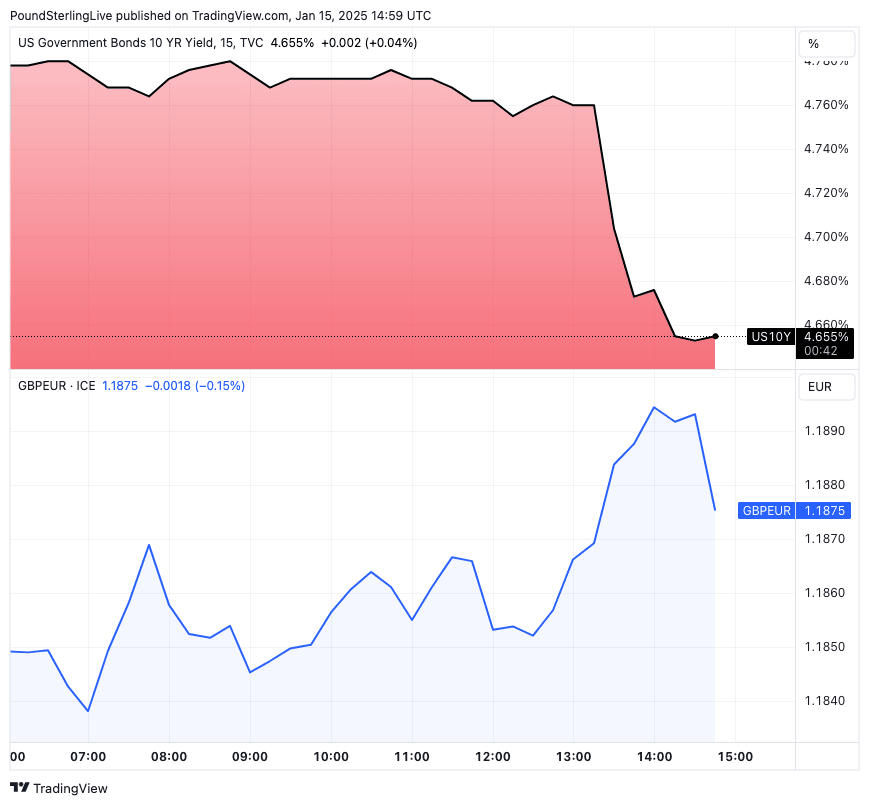

The U.S. reported CPI inflation rose to 2.9% year-on-year and that core inflation fell to 3.2% from 3.3%. This prompted the market to raise bets of a June interest rate cut at the Federal Reserve, which has temporarily snuffed out a rise in U.S. bond yields.

It was this rise in yields - which are effectively the benchmark for interest rates across the economy - that had put pressure on U.S. and global stock markets at the start of 2025, and it is no surprise that markets are rallying as yields come down.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

In fact, analysts at Oxford Economics reckon the recent bout of weakness in the British Pound had more to do with these rising U.S. yields than concerns about the UK's debt position.

"The main cause of recent UK market weakness is the abrupt shift in US interest rate expectations and bond yields, and resultant dollar strength. The UK, with twin deficits, is relatively exposed to perceptions of a shift to a higher global real interest rate outlook," says Michael Saunders, a senior adviser to Oxford Economics and a former member of the Bank of England's Monetary Policy Committee.

The retreat in U.S. bond yields is pressuring global bond yields, including those in the UK, and what we are seeing is that Pound exchange rates are responding positively to falling UK yields.

This translates into a broad recovery in Pound Sterling following days of pressure, and GBP/EUR is up 0.66% on the day at 1.1894.

Above: U.S. yields are down (top) and the Pound is up.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

To be sure, Wednesday's gain doesn't even cover Tuesday's losses, and there is a significant climb ahead if Sterling is to recover 2025's losses to date. But, the prospect of consolidation has risen considerably.

The Pound rose after UK inflation surprised on Wednesday by printing below expectations, only for the U.S. print to follow suit. Tellingly, it is the U.S. print that has had the biggest impact on GBP/EUR.

The U.S. economy has been outperforming expectations since October, pressuring investors to incrementally reduce expectations for U.S. interest rate cuts to the extent that markets entered Wednesday seeing just one rate cut over the entirety of 2025.

It is little wonder, then, that U.S. bond yields have risen to their highest levels since 2023.

UK and Pound Caught in the U.S. Slipstream

Higher yields mean higher funding costs for U.S. and global firms and households, which is negative for growth. It also means the attractiveness of U.S. bonds increases relative to stocks.

This creates a cocktail of negativity that invariably weighs on the Pound, which tends to have a strong positive correlation with global investor sentiment.

"The main driver of recent market moves is the shift in market expectations to reduced Fed easing – partly reflecting recent resilience in activity," says Saunders. "This has been reflected in a sharp rise in US bond yields (both front-end and long-end) and broad-based dollar strength. The UK, like other markets, is caught in the slipstream."

Should U.S. bond yields settle, then the Pound could find itself in a position to stage a more meaningful recovery.

Recovery to Recent Highs Unlikely

However, a return to 2024 highs for GBP/EUR remains unlikely as UK economic data continues to disappoint, raising questions about whether or not the government can adequately fund its huge borrowing.

"The UK, as a smallish open economy with sizeable fiscal and current account deficits, is relatively vulnerable to a global shift to higher real yields," explains Saunders.

In times gone by, when interest rates were at rock bottom, governments could get away with expansive borrowing. But we now live in a world where there is far less leeway.

Developments in the U.S. have given the Pound a reprieve, but it will likely remain on shaky ground until markets see signs of a clear improvement in the UK's economic fundamentals.