Bank of England Tipped to Get Away With Four More Cuts

- Written by: Gary Howes

Image © Adobe Images

The Bank of England will comfortably pass a 25 basis point cut next month and could get in a couple more before year-end.

Markets are pricing in more by way of interest rate cuts at the Bank of England following news UK inflation fell to 2.5% in December from 2.6% while undershooting the consensus estimate for a 2.7% increase.

Bolstering expectations for rate cuts was the fall in services inflation - an all-important measure that the Bank watches - from 5.0% to 4.4%.

"The Bank will especially welcome the fall in services inflation," says Julian Jessop, Economics Fellow at the Institute of Economic Affairs. "With monetary growth subdued, economic activity stalling, and the labour market weakening sharply, the Bank should cut rates again in February and keep cutting throughout the year."

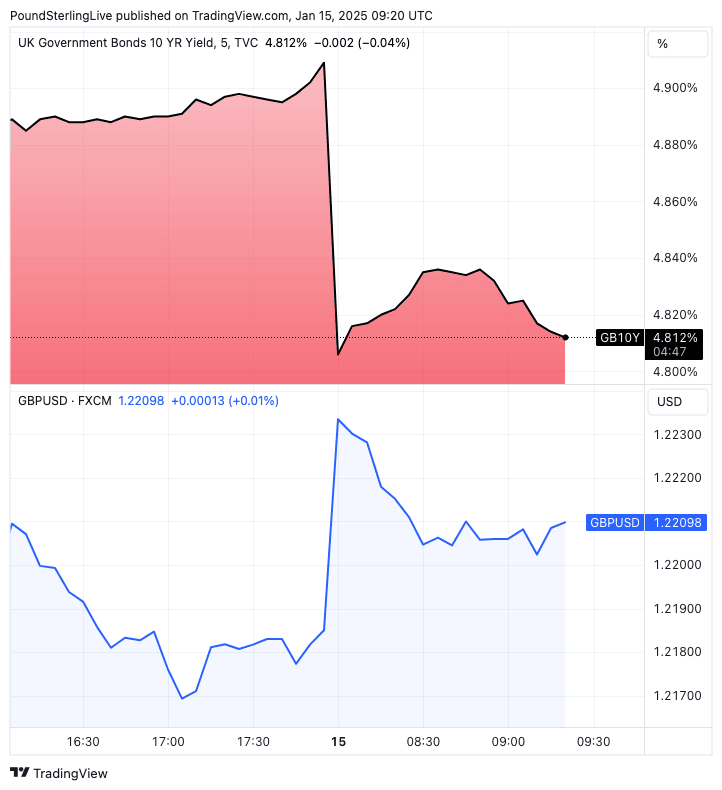

Rising expectations for rate cuts have prompted a fall in UK bond yields, with the ten-year benchmark sliding from 4.90% on Tuesday to 4.809 in midweek trade, a move that has helped the Pound stabilise following a torrif few days.

Above: UK ten-year bond yields (top panel) have fallen, leading to a rise in the pound.

George Buckley, an economist at Nomura, says service sector prices look to have lost momentum recently "and at current rates can be viewed as being compatible with meeting the 2% inflation target on an ongoing basis."

The Bank faces a slowing economy and rising unemployment, which can be partly mitigated by the support lower interest rates provide.

If the Bank is confident inflation will fall to target in the coming months it will continue to lower rates in order to help the economy.

UK money markets were positioned for approximately two interest rate cuts in 2025 amidst signs of persistent inflationary pressures, which would deny the Bank the ability to cut too fast.

Most economists have pencilled in four cuts for the year, judging the Bank will want to maintain a quarterly pace of cuts. These data push the probabilities towards this outcome.

Inflation to Hit 3% Before 2%

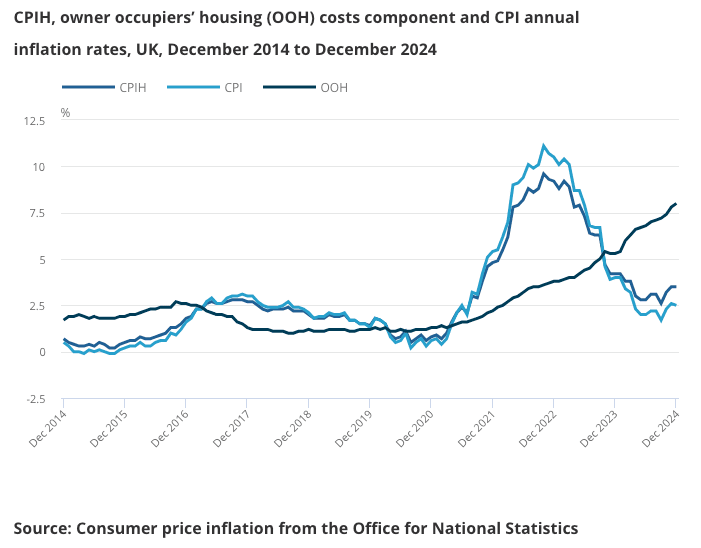

However, the Bank of England will struggle to deliver more than four cuts as it will be challenged by a potential rise in inflation in early 2025.

Importantly, December's data collection anomaly flatters the underlying picture. Robert Wood, Chief U.K. Economist at Pantheon Macroeconomics, says December's inflation undershoot is "a temporary reprieve", and the reason the data undershot was because of an early ONS price collection date on December 10 which avoided some price increases later in then month.

Above: The disinflation process in the UK has stalled well above the Bank of England's 2.0% target, limiting the scope for interest rate cuts to about 100 basis points.

The new government's budget will also have a significant impact going forward.

"Inflation to rise to around 3%, helped by budget decisions," says Nomura's Buckley, citing the following factors:

- unfavourable base effects

- rising energy prices

- increased bus fares from January)

- VAT on school fees from January

- rise in alcohol duty from February

- higher water charges from April

- rising vehicle excise duty from April

- higher national insurance contributions from April

- a large rise in the national living wage, also due in April)

- a rise in university tuition fees from October

The British Retail Consortium has released a survey today showing two-thirds of chief financial officers will pass on costs from the increase to employer national insurance contributions and other budget related costs.

More than half said they would reduce staff hours, including overtime, while 46% said they would reduce store headcount.

The Bank of England has warned it is still not sure how the tax increases will impact inflation, pondering whether firms will absorb the costs by accepting tighter margins or pass them on to customers, which would raise inflation.

The incoming survey suggest the latter, which will have implications for interest rates.

Research from the British Chambers of Commerce (BCC) shows UK firms are having to make "difficult decisions" to manage the upcoming rises in national insurance contributions and the minimum wage.

Its latest survey shows most firms expect to raise their prices in the next three months, while business confidence has dipped to 2022 levels. Labour cost pressures have grown significantly and are particularly acute in the hospitality sector.