Reeves Has to Tackle the £100BN Sickness Benefit Timebomb to Get Markets Onside

- Written by: Gary Howes

Image © Adobe Images

The numbers claiming benefits due to stress and anxiety could break the economy unless the benefits system is urgently reformed.

The UK's balooning debt pile is front-and-centre for global markets at the start of 2025, with bond market stresses emerging over fears the country will struggle to cover its debts.

Chancellor Rachel Reeves knows there is a problem and has promised to squeeze savings out of government departments and boost economic growth to restore confidence.

But with the tax burden at post-war highs and departmental budgets already cut to the bone, the reality will dawn that unless she cuts the UK's benefits bill, she will fail to stop the emergence of a fiscal doom loop.

"The sooner she bites the bullet on spending, the sooner Britain can break free from this self-inflicted fiscal trap," says Darwin Friend, the head of research at the Taxpayers' Alliance.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The Telegraph reported on Tuesday, "Rachel Reeves is facing a £100bn-a-year problem" unless she fails to stem the rising cost of health and disability benefits.

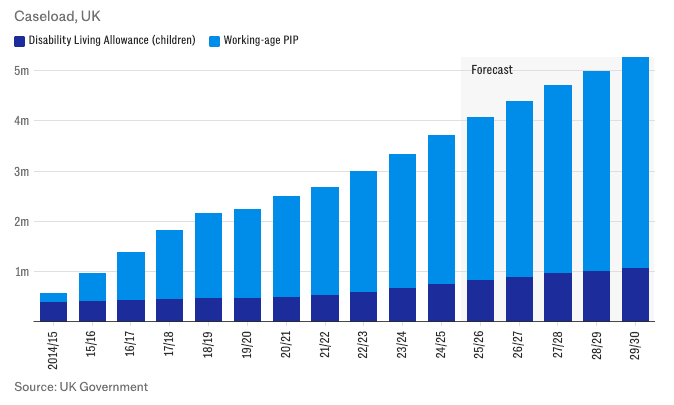

The observation references a Department for Work and Pensions analysis that reveals disability benefit claims among working-age people are expected to rise by a quarter of a million each year until 2030, while just over 4.2M adults will be claiming personal independence payment (PIP) over the same timeframe, up from just over 3M today.

The Office for Budget Responsibility (OBR) says spending on health-related and sickness benefits will surpass £100BN by 2030, or 3.4% of economic output.

The number of people claiming Universal Credit for health reasons is also expected to climb from 2.1M this year to 3.5M by the end of the decade.

The rise is being driven by a surge of people claiming disability for mental health reasons: 500K adults are now claiming PIP for anxiety and depression, while around two-thirds of people who access Universal Credit for health reasons cite mental health as a reason.

"You really cannot afford to be spending the amount of money we're spending on mental health," warned former Prime Minister Tony Blair on Monday.

The Labour Party announced a significant surge in borrowing and spending in October's budget, promising that it would also boost economic growth to pay for the increase in liabilities. However, economic data has revealed economic growth has flatlined since the election, making markets nervous that the fiscal web will unravel.

UK government bonds - the vehicle the government uses to borrow money - are the key indicator of stress. Bonds of all durations are falling in value as investors shy away from UK debt amidst fears for the sustainability of the country's finances.

The 'anxiety crisis' is laid bare by figures showing the number of 16 to 24-year-olds neither in work nor education is now close to a million.

This is a group of the population that is particularly prone to the rise in media messaging that has told young people that anxiety is a medical problem that should be remedied by disengaging the source of stress.

In so far as the workplace is a source of stress, a parallel can be drawn between falling workplace participation and the increase in demand for state benefits owing to anxiety.

"You’ve got to be careful of translating those [challenges] into a mental health condition and losing your own agency, in a way, to govern your own life… Life has its ups and downs and everybody experiences those. And you’ve got to be careful of encouraging people to think they’ve got some sort of condition other than simply confronting the challenges of life," Blair told Jimmy’s Jobs of the Future podcast.

"The fact that there are people quite early into their adult life in receipt of health and disability benefits is concerning because these people have a whole lifetime ahead of them," says Louise Murphy, an economist at the Resolution Foundation.