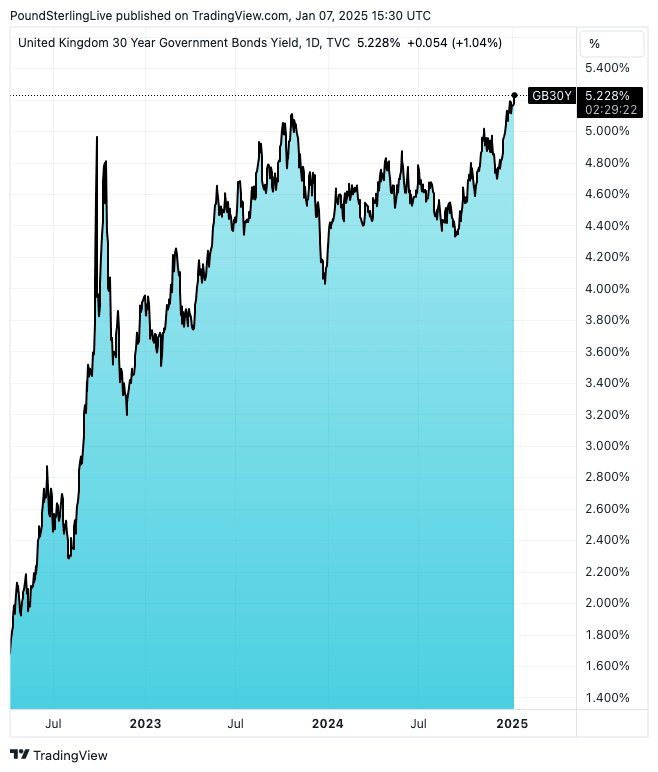

Government Debt Fears Drive Borrowing Costs to 1998 Highs

- Written by: Gary Howes

File image of Rachel Reeves. Picture by Simon Dawson / No 10 Downing Street.

Fears of a looming economic crisis have risen after borrowing costs surge to multi-decade highs.

Another tax raid by the government is looking increasingly likely as the debt repayment costs eat away Chancellor Rachel Reeves' fiscal headroom.

The government borrowed £2BN from the market on Tuesday, to be repaid over 30 years, and ended up paying the highest interest rate on the debt since 1998.

The yield on the 30-year bond hit 5.198%, its highest level since the Debt Management Office was created in 1998. The yield on the ten-year bond yield - which markets fondly referenced when Liz Truss was Prime Minister - has hit a new 15-month peak at 4.66%.

For context, when the market rejected Truss' budget, the yield rose to 4.63%.

Above: British 30-year bond yields reach a new record as the government's debt woes mount.

"An economic crisis in the UK is looming," says economist Andrew Sentance, a former member of the Bank of England's Monetary Policy Committee. "Lack of confidence in financial markets is a big issue for Rachel Reeves. But she shows no interest in the issue and ploughs on regardless."

As the BBC's Economics Editor, Faisal Islam notes, "the post Budget spike in gilt yields more generally, initially faded, but has since restarted in a way that if it continues for the next few weeks, will have a material impact on OBR numbers in March, and could mean Chancellor pondering some more spending cuts to meet her rules."

Kathleen Brooks, research director at XTB, says global yields have picked up more generally since the start of December, however, yields in France, the UK and the U.S. have been moving at a faster pace than German and Spanish yields.

"This is significant since the UK, the US and France have far higher budget deficits than Germany and Spain, which could be why long-term bonds are selling off. Investors may be using the bond market to express displeasure at the high levels of government debt. This could force a rethink from governments and ultimately a scaling back of public spending or tax increases that could hinder growth," says Brooks.

The government will need growth to pick up materially in order for the economy to churn out the tax revenues the government needs to fund its borrowing.

However, economic growth has ground to a standstill since Labour threatened and subsequently delivered a significant increase in business taxes.

In response, businesses are shedding jobs and lowering investment intentions, suggesting growth will undershoot the government's predictions.

"The UK's debt dynamics are among the worst of the advanced economies, and higher market interest rates have already eaten some of the headroom against the fiscal rules. The Chancellor will come under pressure to implement further tax hikes," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

Goodwin says day-to-day spending pressures will intensify in 2025, particularly if an unforeseen economic shock occurs. The Chancellor already has very limited fiscal headroom to meet her fiscal rules.

Growth is looking weak, and the Office for Budget Responsibility may have overestimated growth in 2025, which could mean tax collection disappoints.

This Spring's spending review could be when the next bout of pain lands.