Australian Interest Rate Cut Looks Set for February

- Written by: Gary Howes

Image © Adobe Images

The odds of a February rate cut at the Reserve Bank of Australia (RBA) rose after a monthly measure of core inflation fell further than expected.

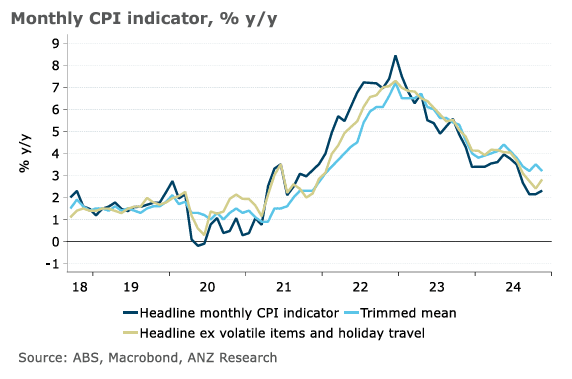

The Australian Bureau of Statistics released its monthly inflation indicator and said CPI for November rose to 2.3% year-on-year from 2.1% in October.

However, much of the appreciation was due to government electricity rebates, which offer little signalling power to the Reserve RBA.

The annual trimmed mean measure of inflation was 3.2% in November, down from 3.5% in October, extending a move closer to the RBA’s 2-3% inflation target.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

This measure of inflation is more relevant to the RBA as it gives a core reading of inflation that removes the volatility in electricity price movements. It will be based on dynamics here that will decide whether the RBA sits on its hands in February or joins the global easing cycle.

After holding its policy rate unchanged at 4.35% since November 2023, markets now see a chance of about 75% of an inaugural 25 basis point rate cut on February 18.

Economist Catherine Birch at ANZ says the outcome of November's monthly CPI indicator points to downside risk the RBA's Q4 trimmed mean CPI forecasts (0.7% q/q and 3.4% y/y).

"This raises the probability of a February rate cut," says Birch.

Australia's monthly inflation indicator differs from the monthly inflation data we see in other comparable countries. Instead, the more comprehensive figure is published at quarterly intervals. So while the monthly release offers a guide, it doesn't always give a clear indication of where the quarterly outturn will land.

This means the RBA will still be looking to the Q4 release when determining whether to cut rates in February.

Economist Justin Smirk at Westpac explains the quarterly CPI is not a simple average of the Monthly CPI Indicator and history has taught that a simple "face value" estimate can be misleading.

He explains the bounce in electricity prices was a lot larger than had been expected and falling dwelling prices will only provide a partial offset.

"As such, we see an upside risk to our current December quarter CPI near-cast of 0.2%qtr/2.4%yr," says Smirk.