Pound Sterling Routed as a Truss 2.0 Episode Gets Underway

- Written by: Gary Howes

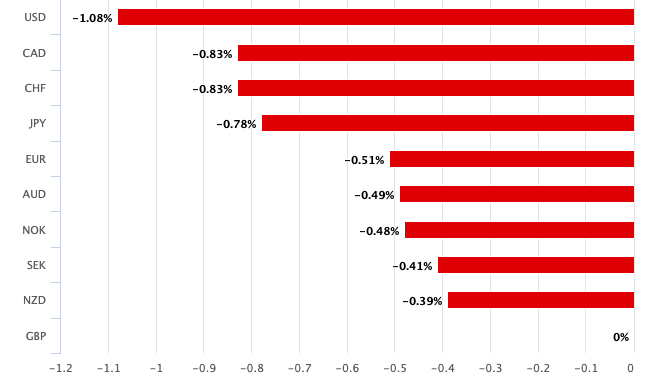

Above: GBP is down against all G10 peers.

The British Pound is dumped and bond yields are rocketing: we are seeing a repeat of the Liz Truss-inspired market ructions.

A massive selloff strikes the British Pound in midweek trade, and all signs point to anxieties over the UK's rising debt as being the culprit.

Pound Sterling is being sold across the board and is registering sharp losses against all its G10 rivals.

The selloff is sudden and broad-based: we know this weakness is specifically targeted at the Pound because all GBP pairs are selling off.

The benchmark ten-year bond yield has risen to 4.76, exceeding levels seen during the Liz Truss era, confirming the government is paying more and more to service its debts:

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

We have been reporting for days now that UK borrowing costs have been surging, which will put the governments finances under severe pressure in the coming months.

However, despite long-term debt yields reaching 30-year highs, the FX market has been relatively sanguine.

It looks as though FX has suddenly taken notice.

"A UK asset selloff has led the pound over 1% lower this morning as 10-year gilt yields have spiked to the highest level since 2008, inflation breakevens have risen to 3.58%, and 10bps in Bank of England cuts have been priced out for 2025," says Kyle Chapman, FX Markets Analyst at Ballinger Group.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Typically rising bond yields would be associated with a stronger currency, but we are not seeing this:

The Pound to Dollar exchange rate has dropped to a daily loss of 1% taking it to 1.2345, the Pound to Euro exchange rate is down 0.5% at 1.20.

"One of the biggest red flags in macro markets - and a sign of fiscal un-anchoring - is yields up and currency down. This is happening again in the UK (the last proper time we saw this was Q4 '22... after 'that' Budget). Looks ominous," says Viraj Patel, a strategist at Vanda Research, referencing the Pound.

The last time bond yields and the Pound saw a breakdown of the traditionally positive relationship was when Liz Truss tried to pass her budget. Markets judged Truss was intent on spending too much (electricity subsidies) and tax too little (a raft of rate cuts), making for an unfunded budget.

When investors borrow from the UK government, they want to be sure they will be repaid. As doubts about the government's finances grow, the cost of servicing that debt grows.

Chancellor Rachel Reeves is facing a moment whereby markets are expressing significant doubts about the UK's ability to service its debt.

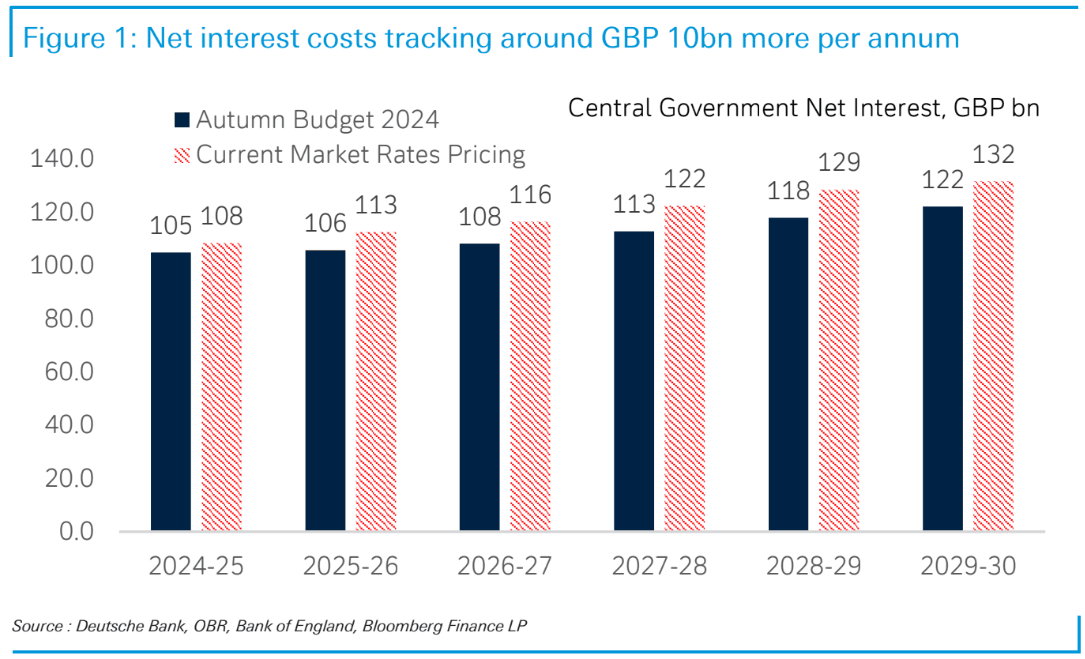

"Gilt yields have continue to rise sharply to start the year. So even before the OBR can put pen to paper, Chancellor Reeves has a big problem. The razor thin headroom left in the Autumn Budget has likely all evaporated," says Sanjay Raja, Senior Economist at Deutsche Bank.

Reeves massively expanded government spending and sought to pay for it via increased borrowing and higher business taxes in the October budget. As a result, economic growth has fallen to a standstill.

And without economic growth, the Treasury won't get the tax receipts it had anticipated.

In all likelihood, Reeves must raise taxes again, thereby risking creating a negative doom-loop of ever-lower growth and widening budget deficits.

"It is hard to say the bond vigilantes forcing the issue on UK fiscal strategy is the dominant market theme. But the possibility that such a dynamic becomes more high profile in the run up to the OBR spring forecast on 26 March can’t be ruled out if yields keep rising. The Chancellor is likely to come under pressure to outline an approach for restoring fiscal headroom," says Sam Hill, Head of Market Insights at Lloyds.

Capital Economics calculates that the £10bn of fiscal headroom Rachel Reeves gave herself in the Budget last autumn is likely now just £1bn, thanks to no growth and rising borrowing costs.

Most economists surveyed by the FT at the start of the year now think more tax rises are inevitable.

"Sterling is suffering from what I refer to as a 'bad' rise in gilt yields. Typically, higher inflation expectations or a hawkish adjustment to the BoE policy stance drive yields higher, and that is bullish for the pound. In this case, the move is driven not by the macro data, but by heavy gilt supply, concerns about the UK government’s debt sustainability, and the inflationary impacts of the extra fiscal spending in the pipeline," explains Ballinger's Kyle Chapman.