Australian Dollar Rally Against the Pound Only Half Done

- Written by: Gary Howes

Image © Adobe Stock

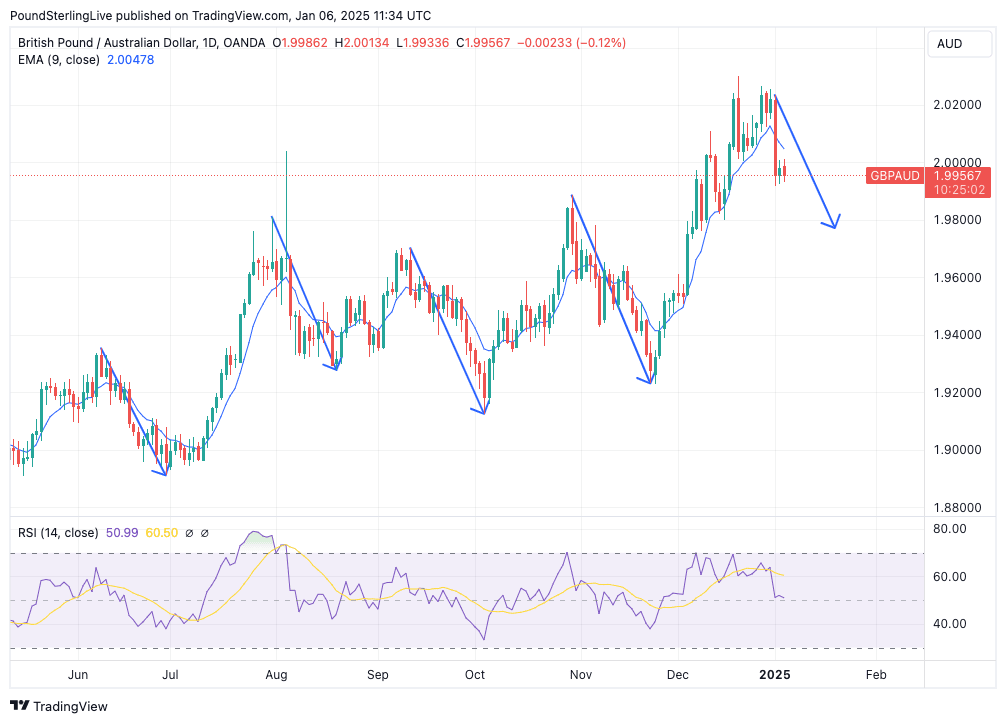

The Pound to Australian Dollar (GBP/AUD) exchange rate is in a pullback that needs room to extend.

GBP/AUD saw a spectacular selloff last week that seemingly came out of the blue as it happened in the void of news or data that typically characterises a new year. This was a GBP decline and not an AUD rally, which shook the technical setup and negated a short-term uptrend, setting the exchange rate on a softer footing ahead of the first full week of trade of 2025.

Following a 1.30% decline, GBP/AUD is now looking to compose itself and form a base, but we are wary that history shows pullbacks in GBP/AUD are typically quite deep and can persist for a couple of weeks at a time:

If the 1.30% fall is the precursor to such an event, then we would not be surprised to see the retreat extend to 1.98 by early February.

Some consolidation is possible in the coming hours and couple of days as the pair must close a large divergence from its nine-day exponential moving average (EMA) - located at 2.0050 - which followed last week's slump.

This creates scope for a recovery back above 2.0 before that pullback we are looking for extends towards 1.98.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Keep in mind, though, that the bigger picture is one of a rising GBP/AUD on a multi-year basis and the pullback could ultimately give way to another leg higher later on during the first quarter, if not sooner.

Also keep in mind that this month sees the U.S. Presidential Inauguration (Jan. 20) which is almost surely to be followed by pronouncements that could shake global markets.

The prospect for volatility is high, but the trend since Trump's November victory has been one of AUD weakness and GBP/AUD gains. Should this theme be rejuvenated by the changeover at the White House, then the pullback we are anticipating in GBP/AUD might prove shallower than would otherwise have been expected.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

There is little on the data docket in Australia and the UK this week, although Thursday's retail sales figures from Australia could be of interest. Here, 1% monthly growth is expected for November, with the expectation being a stronger number will help AUD strengthen.

Thursday's Chinese inflation numbers will potentially be bigger news for AUD, as this should show how Australia's most important trading partner is performing. Should inflation beat expectations of 0.1% y/y growth, China-focused assets like AUD can rise.

Rising inflation would be consistent with improvements in underlying demand and activity, which might suggest the efforts by Chinese authorities to bolster the economy are paying off.

Friday's U.S. non-farm payroll report will be an important driver of global FX sentiment. This marquee data release could bolster the Aussie Dollar if it undershoots expectations.

Analysts expect U.S. job gains to have remained elevated in December at 180k, registering only a modest slowdown from a 227k print in November.

U.S. data has been outperforming expectations since October and the bar really is quite high for upside surprises. This leaves increased scope for the bigger market reactions to follow underwhelming data. In these scenarios, even on-target data can result in disappointment.

This could leave USD at risk of a setback as any disappointment would bolster bets that the Federal Reserve can cut rates on more than one occasion this year.

This would boost the Australian Dollar across the board, in turn pressuring GBP/AUD.