Hot U.S. Economy Scuppers Pound to Dollar Exchange Rate's Rebound

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling has retreated amidst a U.S. Dollar recovery linked to above-consensus U.S. economic data.

U.S. bond yields and the Dollar rose after new data confirmed inflationary pressures in the U.S. economy continue to build, lowering the odds of a Federal Reserve interest rate cut.

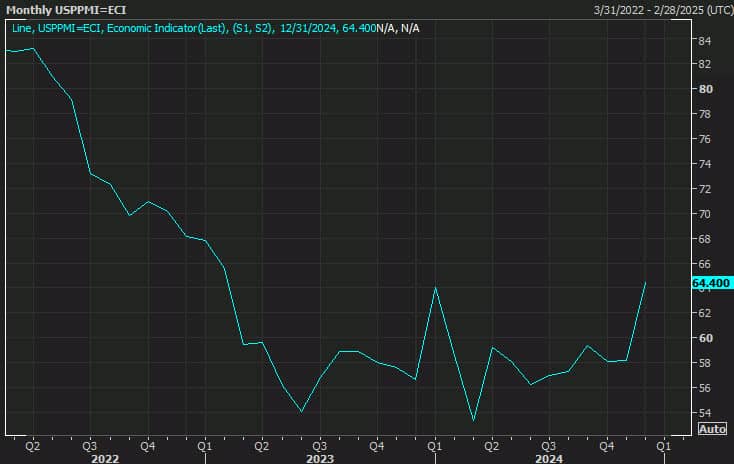

This after the ISM services PMI survey showed that prices paid by businesses reached the highest level since February 2023.

"Most sub-components notched gains, but none rivaled the 6.2 point jump in the prices paid component, which signaled the broadest increase in service sector costs since February 2023," says Tim Quinlan, an economist at Wells Fargo.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The market now thinks the Fed won't cut interest rates again before July, underscoring the 'higher for longer' interest rate thesis that has underpinned the Dollar rally which has been in place since October 2024.

This after the U.S. ISM Non-Manufacturing PMI headlined at 54.1 in December, up from 52.1 in November and ahead of consensus estimates for 53.5.

Above: PMI prices paid points to rising inflationary pressures.

Elsewhere, U.S. JOLTS Job Openings increased to a six-month high of 8.098MN in November, easily beating expectations for 7.740MN and the previous month's 7.744MN.

The Pound to Dollar exchange rate fell back to 1.25 in the wake of these data that pointed to a heating U.S. economy, which constrasts notably with the stagnating UK economy.

"Today's data suggests that the economy is maintaining its strong momentum and that inflation continues to be sticky," says James Knightley, Chief International Economist at ING Bank.

"The combination of decent growth, elevated inflation concerns and a slowing, but not collapsing jobs market continues to see the market reducing the pricing on potential interest rate cuts this year. Only 35bp is priced with the first rate cut not fully discounted until July," he adds.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The Dollar will also stay supported amidst market uncertainty linked to President-elect Donald Trump's tariff plans.

There was talk Monday that he was watering down plans, but the man himself refuted such rumours, which prompted the U.S. Dollar to recover from earlier losses.

"It does feel like this could well set the tone for the year ahead – plenty of conflicting ‘sources’ reporting, with a ton of Trump social media posts in the mix as well, all creating a messy backdrop for traders to operate in," says Michael Brown, Senior Research Strategist at Pepperstone.