Dollar Pares Losses After Trump Hits Back Against Tariff Rumours

- Written by: Gary Howes

Above: Donald Trump campaigned on an universal tariff.

The USD was ripe for correction, and this tariff news has triggered it.

The Dollar slumped on news President-elect Donald Trump was watering down his plans for universal tariffs, but it soon recovered some of that lost ground when Trump hit the airwaves to deny the rumours.

"The roller coaster ride begins and the USD seems to be one of the central focal points," says W. Brad Bechtel, Global Head of FX at Jefferies LLC, following indications Donald Trump has watered down his tariff ambitions.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Washington Post reported President-elect Donald Trump is considering imposing tariffs on only critical imports from all countries.

"The current discussions centre on imposing tariffs only on certain sectors deemed critical to national or economic security," the newspaper reported.

"The story in the Washington Post, quoting so-called anonymous sources, which don’t exist, incorrectly states that my tariff policy will be pared back. That is wrong," Trump said in a rebuttal on Truth Social on Monday.

Trump campaigned for universal tariffs of between 10% and 20% on everything imported into the United States. The tariff on all goods from China would have been more significant.

News that the scope of the tariff might be restricted to 'critical' imports, suggests a shift in stance from Trump that will boost those assets most exposed to the universal tariff.

"A weaker USD gives global relief as it pushes back on intervention and holding rate policy to support FX elsewhere," says Bob Savage, Head of Markets Strategy at BNY.

The Dollar rallied in the wake of Trump's victory as markets saw universal tariffs being inflationary for the U.S. and a headwind to global growth.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Market relief unwinds some of the USD's recent rally and puts the Greenback on the back foot at the start of the first full trading week of 2025.

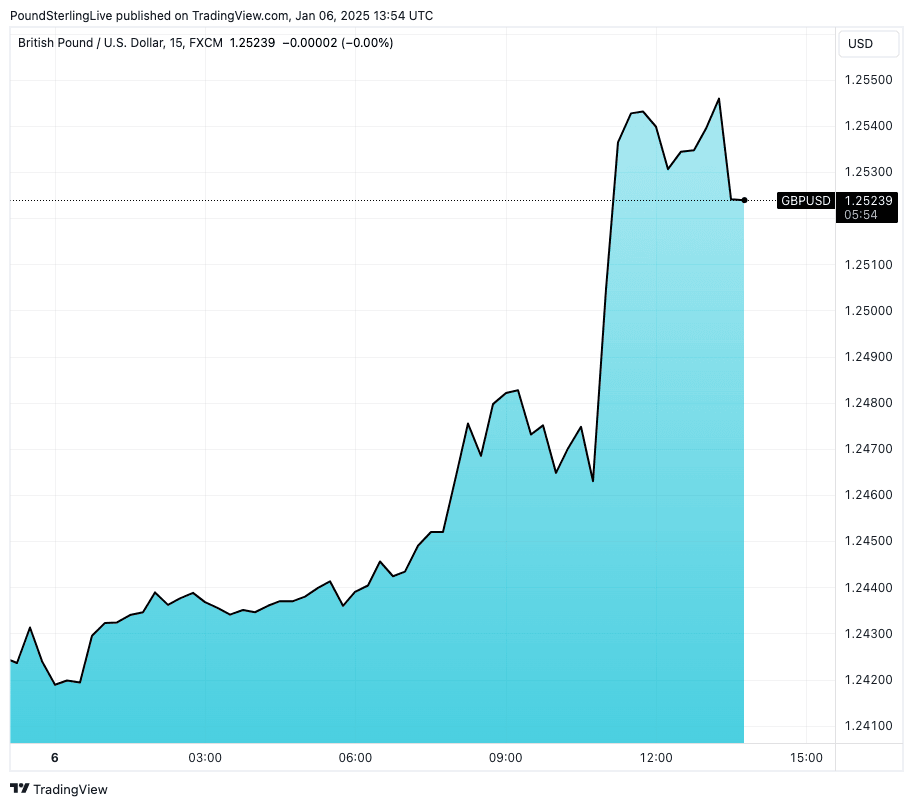

The Pound to Dollar exchange rate reflected this with a 1.0% rally, reaching 1.2533, before Trump's response set it back to 1.2500.

"The USD is reacting to the news," Bechtel, "but I would take a huge grain of salt in trusting this sort of article as I am sure they way things actually play out on tariffs will be far different from what is discussed in this article."

Bechtel says he has a feeling this is how 2025 will go, with random headlines from 'sources familiar with the matter' that will likely be refuted directly by Trump as soon as he wakes up.

The latest developments in the tariff saga form part of a pettern in which Trump pushes his agenda by creating an environment of uncertainty, as this allows him to stay on the front foot.

To be sure, there will be many twists and turns in the coming weeks, but what this latest episode could do is draw a tentative line under recent GBP/USD downside pressures as universal tariffs - a key underpinning of the late-2024 USD rally - now have a big question mark.

Recent gains also left the USD richly valued and increasingly prone to a corrective move lower. However, in FX markets, a trigger is usually required to cause a correction.

This Tariff news is a perfect example of such a trigger. It does not turn the trend around, but it does open the door to a potentially decent pullback.