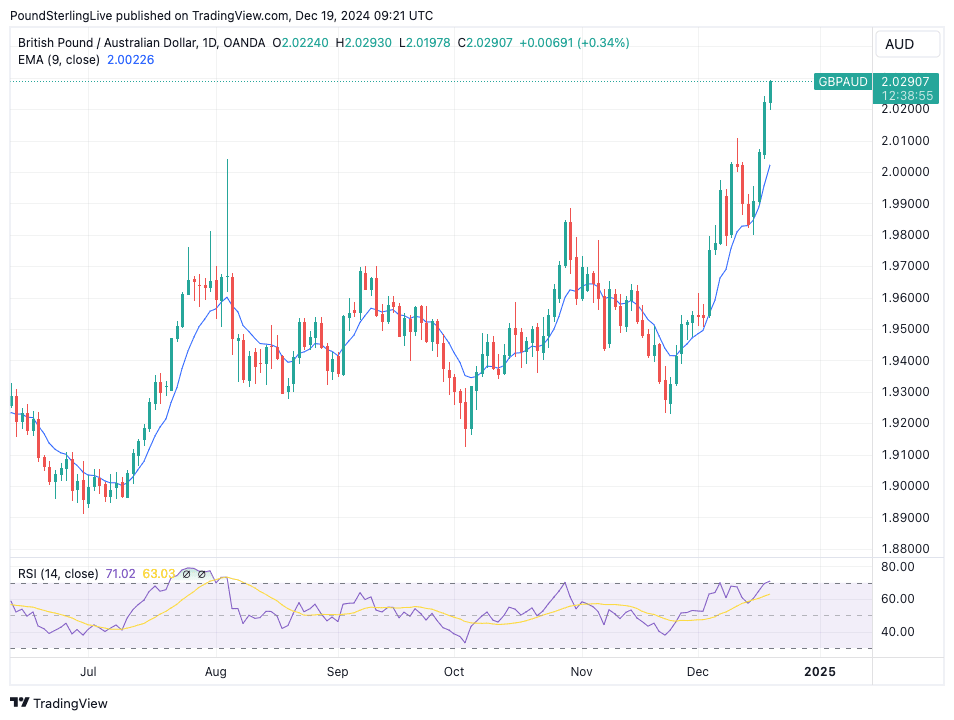

Pound to Australian Dollar Rate Surges Through 2.0, Now Overbought

- Written by: Gary Howes

Image © Adobe Images

The Pound has surged to a new four-year high against the Australian Dollar following the Federal Reserve's December policy update. However, GBP/AUD now screens as overbought.

A "hawkish cut" from the Federal Reserve sent stocks tumbling and bond yields rising, squeezing the optimism out of investors ahead of the Christmas break.

For sentiment-sensitive currencies such as Australia's Dollar, this presents a significant headwind and losses ensued.

With the Fed now only predicting two interest rate cuts in 2025, the Pound to Australian Dollar (GBP/AUD) exchange rate shot through the 2.0 roof and follow-through selling pressures on Thursday take it to 2.0288.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

This represents the best exchange rate for AUD buyers since 2020.

Australia's Dollar is sensitive to global investor sentiment, tending to fall when stocks come under pressure.

The Fed on Thursday cut the midpoint of the target rate for Fed Funds by 25bps to 4.375%, as expected, meaning the financial market reaction was always going to be a function of the updated guidance.

Investors have already lowered expectations for the quantum of cuts to come in 2025, however, their expectations were proven to be too optimistic.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The Fed's new projections showed to expected two 25 basis points of cuts through the entirety of the year, wrongfooting a market that saw three cuts.

The recalibration that follows is as expected: lower stocks, higher global bond yields and lower commodity prices. For FX, high-beta currencies such as AUD and NZD are selling off, and safe havens are in demand.

Those currencies that have a central bank with high interest rates are faring better. This means the Pound is benefiting as the Bank of England's base interest rate sits above that of the Reserve Bank of Australia.

GBP/AUD's rally is looking stretched at current levels, with the daily RSI now reading at 70.72. Anything above 70 suggests overbought conditions are in place and a mean reversion in the exchange rate must occur to unwind these extremes.

This could offer some hope of a pullback, although betting on such an outcome could be premature at this point in time.

Bear in mind GBP/AUD only has to stay still for a day or two for these conditions to correct, suggesting a consolidation is also possible near current highs.