Australian Dollar At Risk if Trump Shifts Tariff Gaze

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar could be at risk of decline when Donald Trump takes aim at Chinese imports, warn analysts.

The Aussie Dollar traded softer midweek after Trump said overnight that his administration would impose 10% tariffs on all imports from China as soon as February.

"We're talking about a tariff of 10% on China, based on the fact that they’re sending fentanyl to Mexico and Canada,” Trump said during an event at the White House. "Probably February 1st is the date we’re looking at."

The Australian Dollar is considered the G10 currency most exposed to Chinese sentiment, with analysts saying any negative impacts on China caused by tariffs could reflect in weaker AUD valuations.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"The AUD is often seen as a proxy that traders use to express their views on China, given our tight trade relationship and deep, liquid FX market," says Luci Ellis, Chief Economist Westpac Group. "To the extent that the outlook in China has genuinely worsened, the exchange rate depreciated."

Looking at the immediate market response, AUD is softer on the day, tracking a fall in Chinese stocks: the CSI 300 Index is heading for its first decline in five days, and the Hang Seng China Enterprises Index is the worst performer in Asia.

"It is still highly likely that considerable tariff actions are coming but in what way and exactly when remain unclear," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank Ltd.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

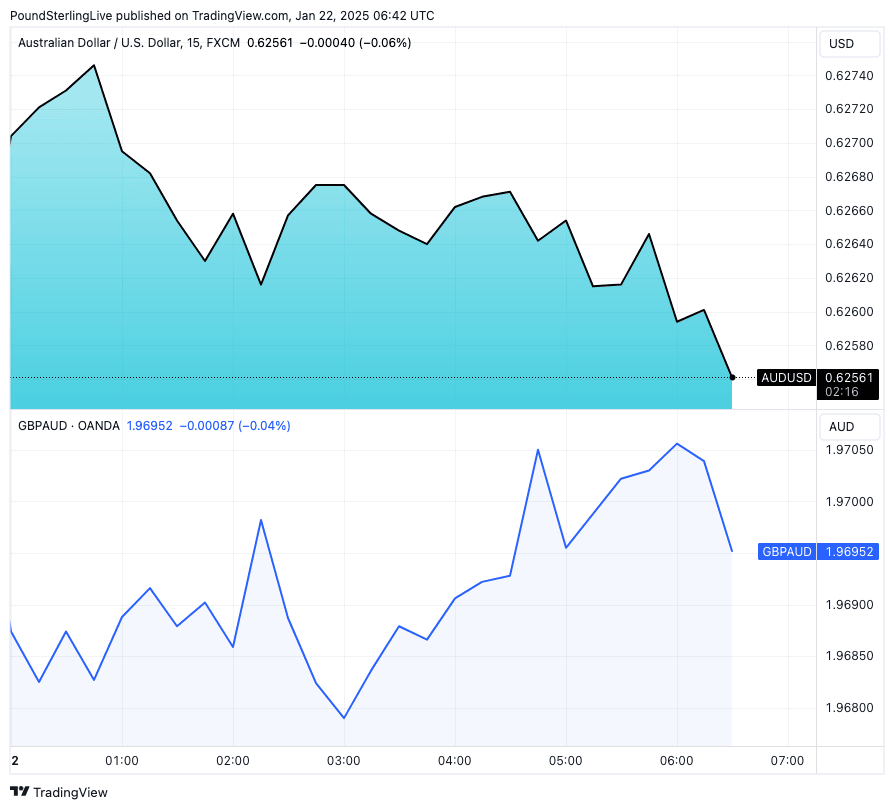

The Australian-U.S. Dollar exchange rate is a quarter of a per cent lower on the day at 0.6256, and the Pound-Australian Dollar exchange rate is at 1.9704.

Trump suggested taxing Chinese imports at 60% during his election campaign, but a more nuanced approach is being adopted after taking power. The new president confirmed a review of the Phase 1 trade deal with China and plans to review the Permanent Normal Trade Relations with China, the USMCA deal, and the adoption of export controls.

These reviews are scheduled to report by 1st April. "A larger issue for AUD/USD would be a US‑China trade war," says Joseph Capurso, Head of International and Sustainable Economics at Commonwealth Bank of Australia.

The president's initial focus has been on the USA's two neighbours, Canada and Mexico, whom Trump wants to pressure into stemming illegal immigrant and drug flows.

"AUD and NZD get a bit more of a reprieve while the focus isn't on China, but you sense that will change before long," says Kit Juckes at Société Générale.

Above: AUD/USD and GBP/AUD (lower panel) at 15-minute intervals.

Trump's day-one business was addressing pressing domestic issues, including immigration and drugs. In this regard, tariff threats made on Mexico and Canada can be considered part of the domestic agenda.

He also wants to stop the flow of fentanyl across the border, which he says is largely manufactured in China.

An initial 10% tariff hike on Mexico, Canada and China should be viewed from a domestic perspective and potentially precede further tariffs that would form part of a broader trade agenda.

Despite a midweek dip, the Australian Dollar is in a short-term multi-day uptrend against the U.S. Dollar and has been one of the better performers since Trump took office.

This suggests that investors think the tariff decisions that have been announced are a watered-down version of the fire and brimstone Trump promised during the election rally.

In this regard, a case could be made that AUD already incorporates much tariff risk, which lessens downside risks near-term.