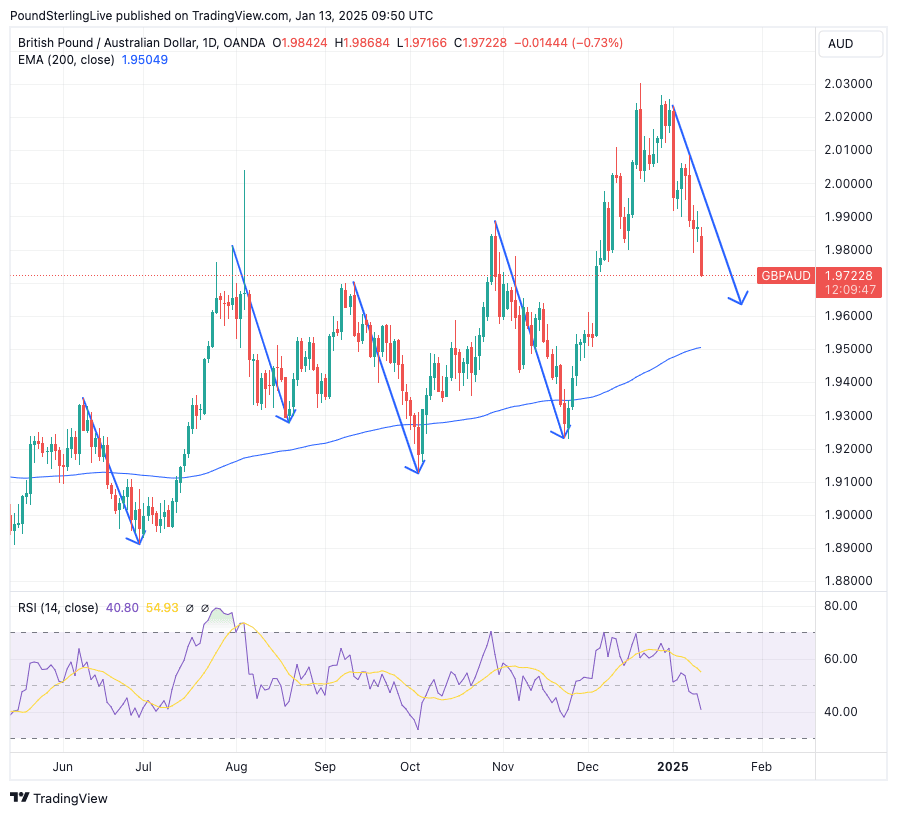

Pound to Australian Dollar Week Ahead Forecast: 1.96

- Written by: Gary Howes

Image © Adobe Images

The Pound to Australian Dollar (GBP/AUD) exchange rate looks set to extend its pullback in the coming days.

The Australian Dollar is advancing in value agains the British Pound and the trend looks set to extend.

GBP/AUD hit a high at 2.0301 in mid-December, but this looks to be the interim top, and the retreat we are observing looks to be consistent with previous pullbacks:

If the current decline in GBP/AUD is a mere pullback in the uptrend, as per the previous episodes illustrated in the above chart, then the retreat is close to completing.

It could extend to 1.96 and then begin to slowly recover before resuming the multi-year rally that remains intact from a technical perspective.

Should GBP/AUD extend below 1.96 we would be seeing an initial signal that a broader, more sustained change in trend is underway.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The other key level to watch is the 200-day exponential moving average (EMA), located at 1.95. A general rule of thumb we use is that an asset is in a medium-term uptrend while above the 200 EMA, and a downtrend when below.

The 200 EMA is still rising, so it should more or less converge on the 1.96 level with the spot exchange rate in the coming days, providing a key level of support.

So, all signs point to further GBP/AUD weakness, but it is still too soon to say the bigger more relevant GBP/AUD uptrend is over.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Theres is some interest in Australia this week with the release of monthly employment statistics for December. Here, the market looks for a seasonal slowdown to just 10K positions, down from 33K in November. The country's unemployment rate is anticipated to increase slightly to 4%.

Of more relevance to the Aussie Dollar is China, where the domestic currency is under pressure and where market nervousness about Donald Trump's ascension to the White House is rife.

"Perhaps the most significant battleground today is in China. Here, USD/CNY onshore is pressing the +2% trading band around the daily fixing. The People's Bank of China (PBoC) seems to be announcing new measures each day in an attempt to support the renminbi," says Chris Turner, Head of FX Research at ING.

"On Friday, it was a large PBoC sale (planned for Wednesday) of CNH bills in order to drain liquidity. Today it is a relaxation of macro-capital measures that now allows Chinese corporates and financial institutions to raise more money overseas," says Turner.

The Australian Dollar is a G10 proxy for China and the Chinese Yuan, meaning pressures here inevitably translate into Aussie Dollar weakness, which could limit GBP/AUD downside

"Commodity and emerging currencies should take the brunt of the higher US rate story. Indeed, AUD/USD is not far from 0.60, where we could start to hear speculation over impending Reserve Bank of Australia FX intervention," aadds Turner.

GBP Mood Change

Chancellor Rachel Reeves returns from China, and investors will be waiting on any policy announcements. Picture by Brompton, shared and licensed to Gov.UK.

There is a definite shift in sentiment towards the GBP underway, which could mean this time, the pullback in GBP/AUD will be more concerted, and a trend-turn is potentially underway.

Pound exchange rates sold off significantly last week as investors grew increasingly concerned about the UK's debt dynamics. The UK ten-year bond yield rose again on Monday and is at its highest level since the turn of the millennium, which speaks of acute pressures on the UK's finances.

The bond yield represents the interest rate the UK government pays its creditors; as they rise so the UK government must scramble for more money.

Economists think the UK will now need £10BN more just to service debts than was anticipated in October when Chancellor Rachel Reeves set out her budget. To stick to her fiscal rules, she must now find more money via taxation or cut spending.

News publications indicate that, for now, Reeves thinks she can find some loose change by telling government departments to cut spending.

However, departmental budgets have already been cut drastically, and there will be limited success in this strategy.

Until she goes after the balooning benefits bill, success on the expenditure side of the books will not be forthcoming. We think markets would reward a clear commitment to reducing this bill.

However, for Labour, this is a particularly unappetising approach to take, and we doubt it will be forthcoming.

As such, GBP weakness looks to remain a feature of early 2025.