Pound to Canadian Dollar Week Ahead Forecast: Short-term Rebound Potential

- Written by: Gary Howes

Image © Pound Sterling Live

Pound Sterling has entered a downtrend against the Canadian Dollar, but some dip-buying might occur in the coming days as it unwinds oversold conditions.

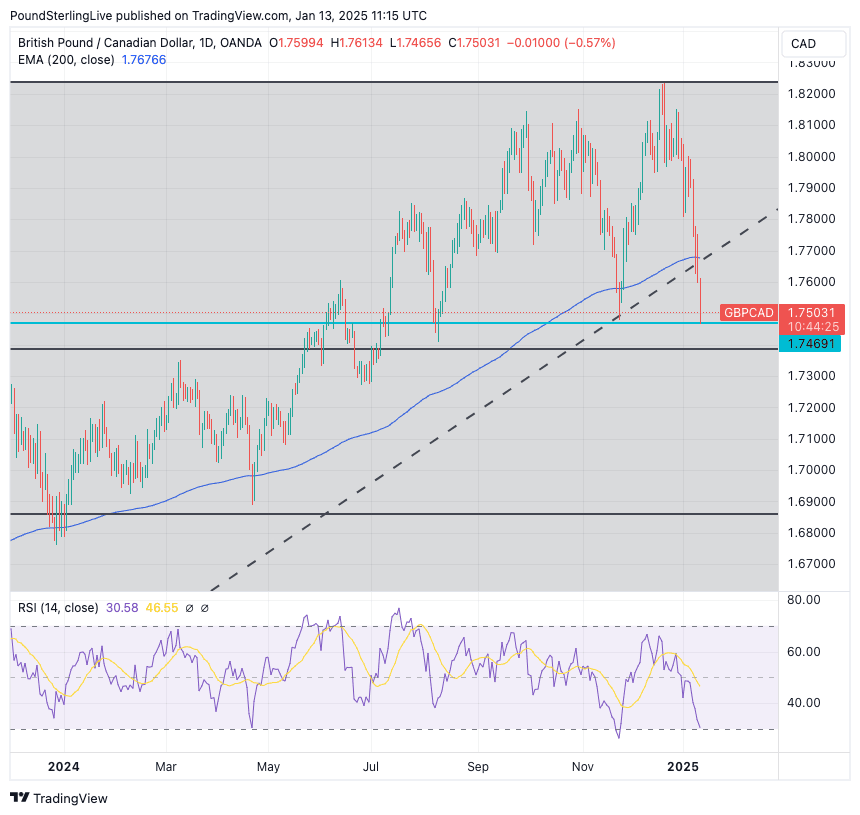

The Pound to Canadian Dollar exchange rate (GBP/CAD) can find some near-term support as the recent selloff has hit oversold conditions, with the Relative Strength Index hitting 30 on Monday.

The RSI mean reverts when it reaches such an extreme, which would imply GBP/CAD must either recover or consolidate around current levels for a short period.

Oversold conditions come as a selloff, in place since late December, accelerates to 1.7503 at the start of the new week.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

Losses now take GBP/CAD below the 200-day moving average (DMA), which we consider a signal that a trend change has occurred.

Our rule of thumb is that an asset is in an uptrend when it is above the 200 DMA, and it is in a downtrend when it is below. This development could mean that further losses over the coming weeks are expected.

The initial target for an extension of the downtrend is the 23.6% Fibonacci retracement of the 2022-2024 uptrend at 1.7385, where some buying support might emerge. Below here lies the 38.2% retracement level at 1.6859, which would form a multi-week target.

Above: GBP/CAD at daily intervals with Fib retracement levels and the RSI (lower panel).

The weakness in GBP is well documented on this site, but the CAD is showing a genuine run of outperformance, which means GBP/CAD has fallen further and faster than other commodity bloc pairs, such as GBP/AUD and GBP/NZD.

CAD outperformance follows a surprisingly strong consensus-beating employment report from Canada on Friday.

Canada created 90.9K jobs in December, the biggest increase in two years and up from 50.5K in November. This was ahead of consensus estimates of 25K, signalling that the economy might have turned a corner.

This lowers the odds of a consecutive Bank of Canada interest rate cut, which is helping Canadian bond yields and the Canadian Dollar rise.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

"The huge gain in employment in December supports our view that labour market conditions are strengthening," says Bradley Saunders, North America Economist at Capital Economics. "We are forecasting the unemployment rate to peak at 7.0% before falling back again towards the end of the year."

Canada has seen a run of poor economic data through the second half of 2024, which naturally weighed on CAD.

However, this might be in the price, and a recovery in the Canadian Dollar hints that maybe a nadir in sentiment has been reached, which offers scope for a recovery as brow-beaten CAD sentiment recovers.

The main risk to CAD is incoming President Donald Trump, who has shown a 'hawkish' approach to relations with Canada, ranging from a desire to impose import tariffs to effectively making Canada another U.S. state.