Pound to New Zealand Dollar Week Ahead Forecast: 2.16

- Written by: Gary Howes

Image © Adobe Images

The Pound looks set to weaken against the New Zealand Dollar in the coming five days; however, the multi-year uptrend remains intact.

The Pound to New Zealand Dollar exchange rate (GBP/NZD) starts a new week with losses, reaching 2.1845, as it extends a near-term pullback that will take the losing streak to five consecutive days.

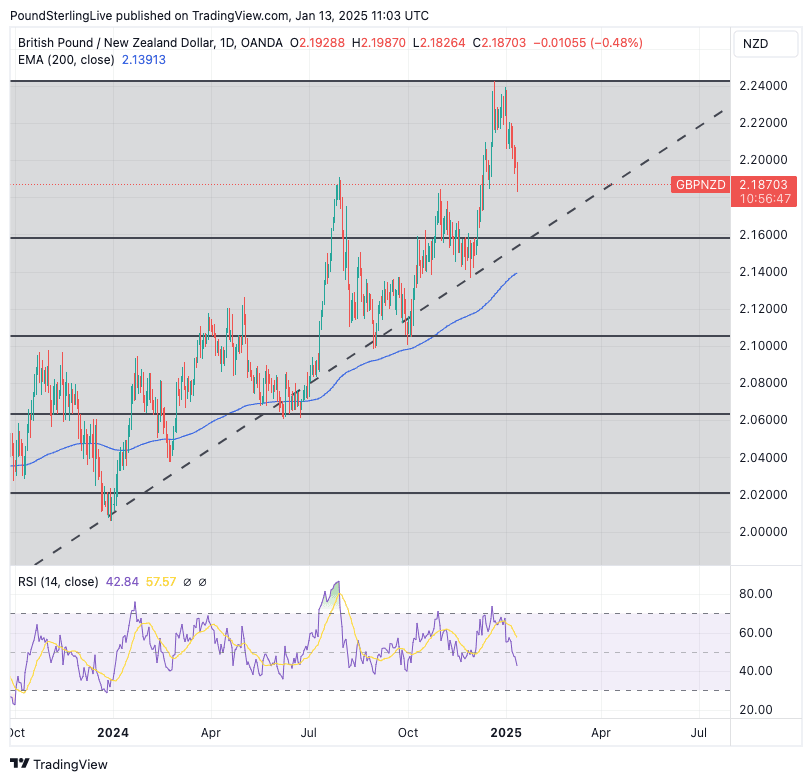

GBP/NZD peaked at 2.24 in mid-December but has since retreated; however, it is too soon to declare the end of a multi-year rise in GBP/NZD.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

For now, we think a correction within the trend higher is underway and only a retreat below the 200-day moving average at 2.10 would invalidate the bullish setup.

Within this setup, the current setback has room to extend further, and an initial target is set at 2.16, which brings us close to the 23.8% Fibonacci retracement of the big 2023-2024 rise in GBP/NZD (currently at 1.1578).

Above: GBPNZD at daily intervals with RSI momentum (which is showing downside momentum) in the lower panel and the Fib levels for the 2023-2024 rally.

The Pound is selling off, but external pressures are also bearing down on the NZD and will limit GBP/NZD weakness.

Importantly, China is struggling to defend the Renminbi amidst the charge forward by the U.S. Dollar. This has implications for the antipodeans: the Australian Dollar, and to an extent, the NZ Dollar, are China proxies.

"Perhaps the most significant battleground today is in China. Here, USD/CNY onshore is pressing the +2% trading band around the daily fixing. The People's Bank of China (PBoC) seems to be announcing new measures each day in an attempt to support the renminbi," says Chris Turner, Head of FX Research at ING.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"On Friday, it was a large PBoC sale (planned for Wednesday) of CNH bills in order to drain liquidity. Today it is a relaxation of macro-capital measures that now allows Chinese corporates and financial institutions to raise more money overseas," says Turner.

Further weakness in the Renminbi inevitably translates into Kiwi Dollar weakness, which could limit the extent of GBP/NZD downside.

The Chinese and antipodean currencies are under pressure as the U.S. Dollar train steams ahead: Ongoing strength and rising global bond yields are the result of U.S. economic strength relative to elsewhere in the world.

Friday's U.S. job report was just the latest reminder not to bet against U.S. exceptionalism which leaves markets now expecting just one interest rate cut from the Federal Reserve for the entirety of 2025.

But, the USD is looking stretched heading into this week, and markets have made a sizeable adjustment and are already very well priced for the ongoing U.S. economic strength heading into the midweek release of U.S. inflation data.

We suspect that an undershoot in these inflation data, or even an on-target print, can trigger a short-term USD correction.

The Aussie and Kiwi Dollars look best placed to take advantage of this as they have a high beta to U.S. Dollar weakness.

However, the underfire Pound could also be due for a correction this week, as it is now looking heavily oversold against the Dollar.

GBP strength is unlikely to be long-lasting, as we think it will take some concrete action by the government to shift the narrative on UK assets.

Pound exchange rates sold off significantly last week as investors grew increasingly concerned about the UK's debt dynamics. The UK ten-year bond yield rose again on Monday and is at its highest level since the turn of the millennium, which speaks of acute pressures on the UK's finances.

The bond yield represents the interest rate the UK government pays its creditors; as they rise so the UK government must scramble for more money.

Economists think the UK will now need £10BN more just to service debts than was anticipated in October when Chancellor Rachel Reeves set out her budget. To stick to her fiscal rules, she must now find more money via taxation or cut spending.

News publications indicate that, for now, Reeves thinks she can find some loose change by telling government departments to cut spending.

However, departmental budgets have already been cut drastically, and there will be limited success in this strategy.

Until she goes after the balooning benefits bill, success on the expenditure side of the books will not be forthcoming. We think markets would reward a clear commitment to reducing this bill.