Pound Sterling Selloff Resumes, GBP/USD Eyes 2023 Lows This Week

- Written by: Gary Howes

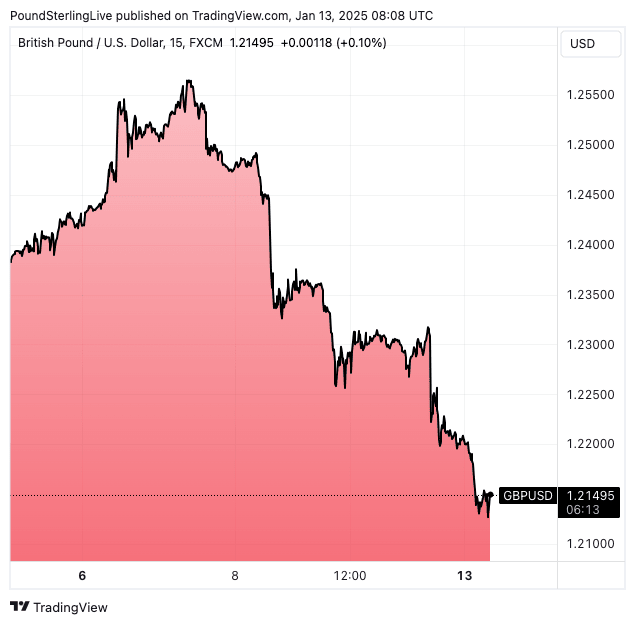

Pound Sterling starts the new week weaker and looks set to test 2023 lows against the U.S. Dollar.

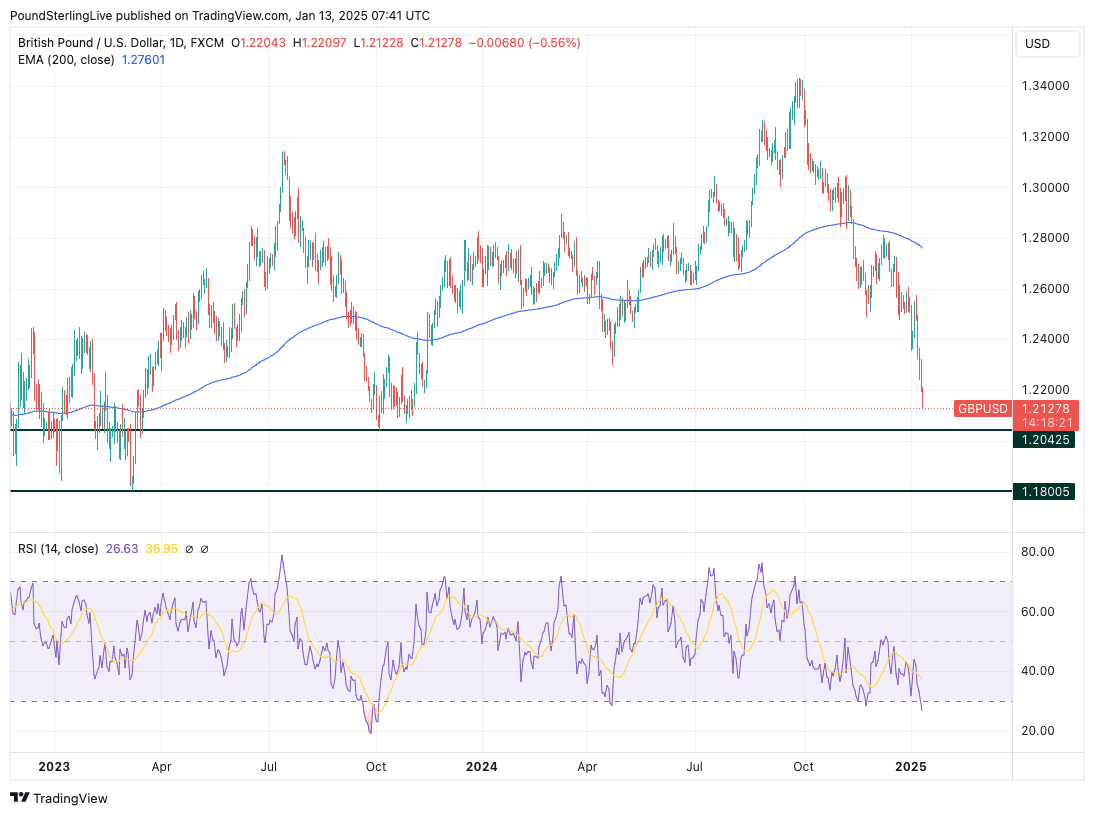

The Pound to Dollar (GBP/USD) exchange rate faces the prospect of a fifth daily decline and is forecast to remain under pressure in the coming week. The initial target is 1.2042, which forms a graphical horizontal support line from October 2023.

Beyond here is 1.18, which can be achieved over the next couple of weeks.

"The pound is holding near a 14-month low against the dollar as markets take an increasingly skeptical view on the Labour government’s fiscal plans, with higher gilt yields expected to force a pullback in growth-positive spending initiatives," says Karl Schamotta, head of FX strategy at Copray.

The outlook is downbeat and the route of least resistance is to the downside. "With technical conditions deteriorating, a push lower is certainly possible," says Schamotta.

However, GBP/USD is now starting to screen as being technically oversold, with the Relative Strength Index hitting 30, which advocates for either a recovery or a period of consolidation.

This by no means suggests a strong rebound is likely and all signs point to any GBP strength being tepid in the absence of a decisive fundamental shift in sentiment.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

For that to happen, Chancellor Rachel Reeves should announce a significant shift in policy aimed at stabilising the UK's finances.

There is talk of cuts to the benefits bill being in the pipeline, which would represent the first major step in shrinking the bloated British state.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Chancellor Reeves announced a significant boost to spending in the October budget, which would be financed by taxes and increased borrowing. Markets stomached the announcement as Reeves said her budget would boost growth in 2025, which meant the economy would fund the debt.

But, the post-budget data is coming in, and investors don't like what they see: economic growth has stalled and unemployment is rising, raising serious questions about the UK's debt dynamics.

As a small, open economy, the UK doesn't have the same leeway as the U.S. and Eurozone to engage in frivolous fiscal experiments. The surge in UK debt costs seen this year and the fall in the Pound is the market's way of pulling the reins and course-correcting the UK.

Reeves returns from a trip to China this week, and investors are clearly waiting to hear details of how the UK will navigate the current uncertainty.

UK inflation is due for release on Wednesday, where a figure of 2.6% is expected. Economists will likely update forecasts in the wake of the data to show UK inflation is headed to 3.0%, taking it further away from the Bank of England's 2.0% target.

The Bank of England looks set to cut interest rates again in February, as the slowdown in the economy and rise in unemployment warrant this action.

However, the decision will prove controversial, as the Bank risks losing credibility by raising interest rates as inflation rises, destabilising UK inflation expectations.

It is difficult to say how the Pound might react to the inflation data: the rule of thumb says an above-consensus reading would boost the GBP as it implies higher interest rates for longer at the Bank of England. But in the current climate, the dynamic has been turned on its head, and we wonder if a lower reading would, in fact, benefit Sterling.

Either way, any positive reaction in GBP/USD should prove short-lived, given the overall strength of the downtrend.

Thursday sees the release of UK GDP data, and there is the risk that the UK will release a third consecutive monthly decline in GDP, following September and October's -0.1% prints. Recall, it is stalling growth that is a significant factor behind the market's desire to sell UK bonds and the Pound.

An above-consensus reading could be what is needed to stoke a relief rally in the Pound.

Friday brings UK retail sales for December, which also offers the prospect of a positive surprise. Markets look for a strong rebound in the annual figure to 3.3% growth from 0.5%. The monthly figure is anticipated to show a doubling in growth from 0.2% m/m to 0.4%.

A beat would offer GBP/USD a welcome respite ahead of the weekeend.