Euro to Dollar Week Ahead Forecast: Selling Pressure to Ease Temporarily

- Written by: Gary Howes

Image © European Union - European Parliament.

A lack of Eurozone data keeps all eyes on U.S. exceptionalism and the midweek release of inflation data.

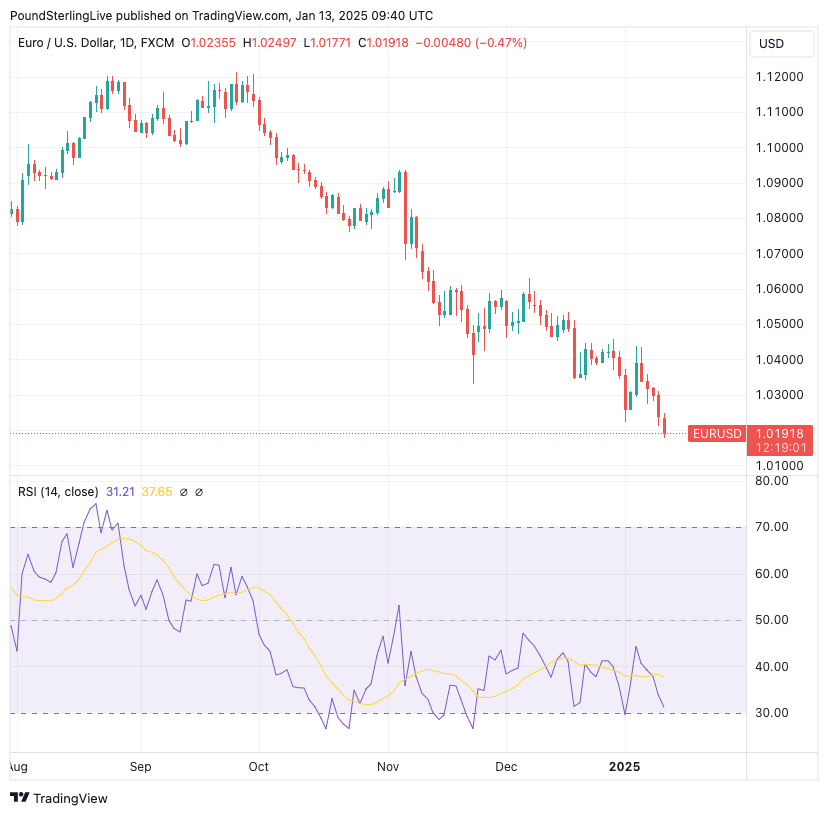

The Euro reached a new two-year low against the Dollar on Monday and further weakness is anticipated in the coming days, with technical momentum indicators advocating for further downside.

The Euro to Dollar (EUR/USD) exchange rate hit 1.0206 and traded below its key moving averages, leaving analysts resigned to a potential test of parity in the second half of January.

However, EUR/USD has now reached technically oversold conditions with the RSI reading at 30, which suggests a correction will occur in the next couple of days.

The technically oversold nature of the currency leaves us thinking a recovery or consolidation is likely in the short-term, and this is the key theme we look to play out this week.

However, strength will be tepid and a period of consolidation around current levels is all that is required to allow oversold conditions to unwind.

EUR/USD losses will likely restart following any consolidation, with weakness being a function of U.S. Dollar strength linked to improving U.S. economic strength and rising inflation, which contrasts with stagnation in the Eurozone.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"Friday's strong U.S. jobs release has provided another leg higher for the dollar. It is hard to see the dollar trend changing this week," says Chris Turner, lead FX analyst at ING.

Dollar exchange rates jumped after it was reported the U.S. created 256K jobs in December, up from 212K in November and breezing past an estimate for 160K.

In addition to the strong headline figure, the unemployment rate unexpectedly retreated to 4.1% from 4.2%, confirming the economy was in robust shape heading into the new year.

The data saw money markets price out the prospect of another Federal Reserve rate cut by mid-year, with only one cut now seen over the course of the year.

This is far less than what is expected from the European Central Bank, creating an interest rate divergence that naturally works against Euro-Dollar.

The highlight in the coming week is the Wednesday release of U.S. inflation data, where markets expect inflation to rise from 2.7% to 2.8% year-on-year in December.

"The prospect of another strong set of US inflation data, which will increasingly raise the question of whether the Fed needs to cut rates this year at all," says Turner.

Markets will be particularly interested in the status of core inflation, where a 0.3% month-on-month rise is expected.

The big surprise would be a below-consensus print, which would have the effect of unwinding recent bullishness in the Euro-Dollar and triggering a profit-taking response that can allow currencies such as the euro and pound the chance to recover.

Euro-Dollar rallies are likely to be short-lived and limited in scope as the broader trend remains one of dollar dominance, and for this to be challenged will require a significant policy shift.

Perhaps incoming president Donald Trump will deliver this as he won't want to see such a strong Dollar as he looks to rebalance the U.S. economy away from import dependency.

However, it remains hard to see him achieving this, and only a downturn in the U.S. data pulse will materially influence the Dollar outlook.

The turning point will come, but probably not until the second half of the year.