Euro-Dollar Ultimate Target is 0.9747: Analyst

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate could fall to an "ultimate target" below 1.00 according to a new analysis.

The next leg lower in the Euro-Dollar selloff could be close, with the pair starting the new year close to the November low at 1.0331.

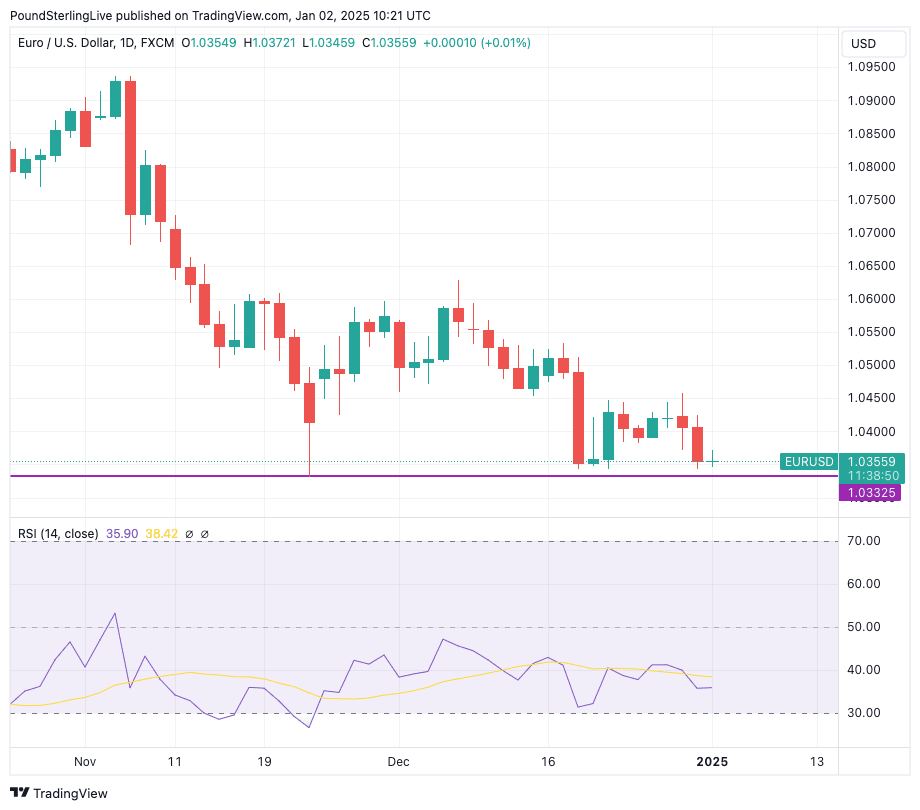

The exchange rate is quoted at 1.0332 at the time of writing on January 02, and a floor of support is found from here to that low at 1.0331:

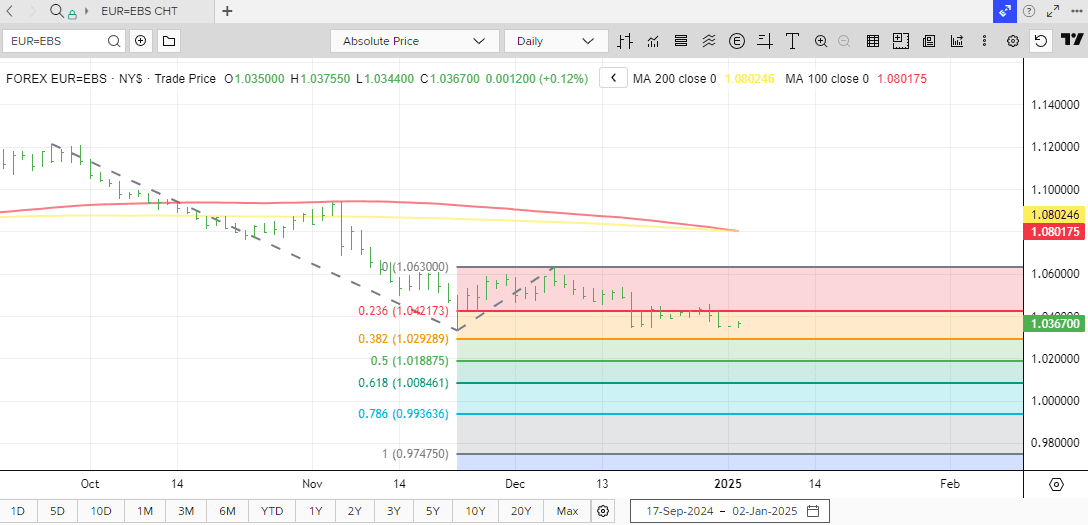

The floor could yet hold over the coming days, but a break below here looks to be the most likely directional outcome. This would open the door to a more protracted selloff, with Reuters analyst Jeremy Boulton saying the first EUR/USD target would be 1.0293.

"Subsequent targets at 1.0189, 1.0085 and 0.9936," he says. "The ultimate target lies at 0.9747."

Looking at the daily chart, Boulton says a death cross is seen unfolding where the 100-DMA drops below 200-DMA.

In addition, the oversold conditions that helped ease selling pressure in November through December have now been alleviated, potentially opening the door to a resumption of selling interest.

The Relative Strength Index - an indicator widely followed by technical specialists - reached an oversold sub-30 reading in November but has since recovered. However, it is below 50 and at risk of pointing lower, suggesting downside momentum is building again.

"EUR/USD looks set to drop further in January and thanks to the pair's prominence as the most highly traded pairing, a slide will influence other currencies which are also likely to lose more ground against the U.S. dollar," says Boulton.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Analysts think the trends of late 2024 can extend for a few more months, which would provide the fundamental essence to drive the technical moves that analysts such as Boulton are divining from the charts.

"The fundamental landscape for the U.S. currency remains the same. A hawkish Fed, scaling back its rate cut projections to signal only two quarter-point reductions by December, resulted in narrowing yield differentials between the US and other major economies, whose central banks began leaning towards a more dovish stance towards the end of 2024," says Charalampos Pissouros, Senior Market Analyst at XM.com.

The Dollar is entrenched in a period of outperformance against the Euro; as Goldman Sachs says, "we are still living in a Dollar world."

The Federal Reserve's monetary policy, characterised by higher interest rates compared to those in the Eurozone, has attracted foreign capital, bolstering the USD relative to EUR. Eurozone economic underperformance relative to the U.S. was a stark feature of 2024, and this can continue.

However, the Eurozone data pulse looks to be at a floor, while that of the U.S. is elevated. There is the prospect of a convergence in performance occurring later in the year, which can rescue EUR/USD from the floor.

A new report from Bank of America (BofA) forecasts a divided performance for the U.S. dollar in 2025, characterised by strength in the first half of the year, followed by a weakening trend in the second half.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The report suggests that the USD will likely remain robust during the first six months of 2025, primarily due to continued U.S. economic growth and a moderate approach to easing by the Federal Reserve. However, the analysis indicates that the dollar is currently overvalued and that this bullish sentiment is widely held.

"Our G10 FX forecasts (ex-JPY & CHF) reflect this ultimate moderation in the USD occurring during H2, after trading close to current levels - on net - though mid-year," says Alex Cohen, FX Strategist at BofA.

The dollar's rally after the US election, which was driven by expectations of reflationary policies, is expected to wane as the new administration's policy agenda unfolds.

According to the report, the market may be underestimating the potential downside risks associated with these policies. Furthermore, the incoming administration's foreign exchange policy could shift, as they balance the benefits of a strong dollar with the advantages of the dollar’s reserve currency status.