Euro to Dollar Near-term Forecast: Staying Heavy, 1.0340 Eyed

- Written by: Gary Howes

ECB President Christine Lagarde signalled Monday confidence the battle against inflation was won. Image by Dominique HOMMEL. © European Union 2019 - Source: EP

The Euro will likely remain under pressure against the U.S. Dollar through the Christmas period.

The Euro to Dollar (EUR/USD) exchange rate stabilised at the end of the last week, but periods of strength are likely to be short-lived.

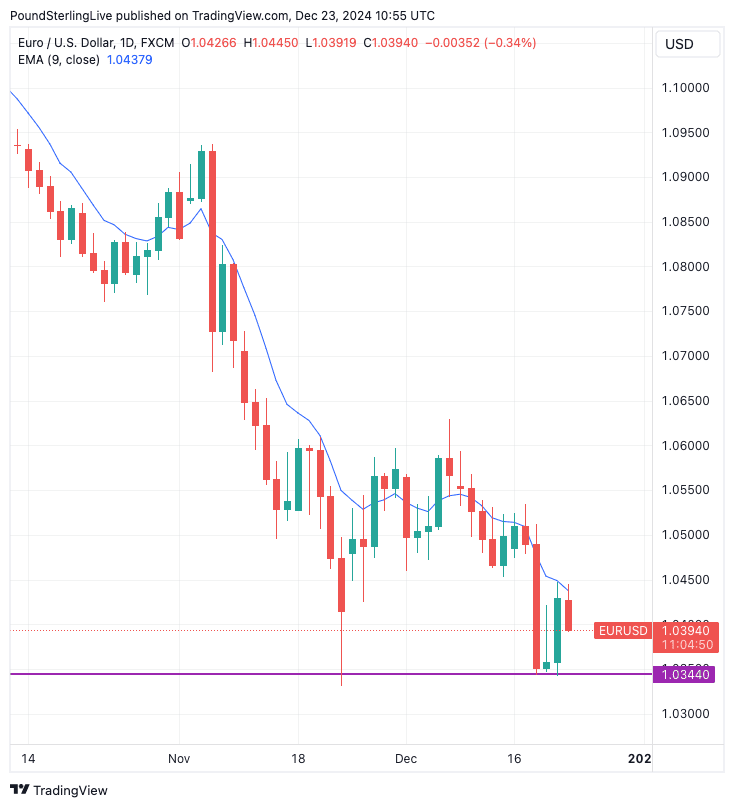

Decent support now exists at the 1.0344 horizontal support line, which is where last week's Euro weakness was bought on three consecutive days.

Any weakness in Euro-Dollar this week would first test this area and could again be bought into, allowing for a more consolidative tone.

Beware, however, that a break of 1.0344 would introduce us to 1.0230 within relatively short order.

Market conditions will be think in the coming two weeks, yet there are still some economic reports to digest. Thin liquidity can often result in outsized moves, suggesting we are not necessarily in for a snooze-fest.

Ahead, we have U.S. durable goods, Manufacturing ISM and jobless claims releases to digest.

"The risk of Q4 upside growth surprises dominates," says Bob Savage, Head of Markets Strategy and Insights at Bank of New York (BNY).

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Euro-Dollar is under pressure again on Monday, failing to extend last Friday's recovery, with European Central Bank (ECB) President Christine Lagarde telling the FT on Monday that she was optimistic that the central bank was on course to achieve its 2.0% inflation target.

Lagarde stated that "we are getting very close" to the point when "we have sustainably brought inflation to our medium-tern 2%."

The comments bolster the view that falling inflation will allow the ECB to 'outcut' its peer central banks in the coming months, keeping the Euro under pressure, particularly against the Dollar.

Last week the Federal Reserve indicated it would likely cut interest rates just twice next year amidst rebounding economic activity.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

However, the Dollar fell on Friday following the release of some below-expectation U.S. PCE inflation numbers, which deflated the Dollar's bull run.

Core PCE measure of U.S. inflation rose 0.1% month-on-month in November, which was half the 0.2% expected.

The year-on-year comparison was unchanged at 2.8% in November, whereas the market expected a rise to 2.9%.

This triggered some market relief and a selloff in the U.S. Dollar, which needs a steady supply of 'hawkish' data surprises to feed its rally. Any on-point or below-consensus data will, therefore, result in pullbacks.

That said, BNY's Savage thinks early 2025 could see EUR/USD weakness resume as further U.S. outperformance is confirmed. "The setup for markets into 2025 is good for a continuation of trends. The U.S. election and the pivot to a stronger USD received support from the FOMC, reducing expectations for rate cuts in 2025."

"Our view for the forecast profile for EUR/USD remains that the euro will drop to around the parity level in the first quarter of next year before then stabilising and recovering moderately in the second half of the year," says Derek Halpenny, Head of Research, Global Markets EMEA at MUFG Bank Ltd.

MUFG thinks this is due to a divergence in economic performance between the Eurozone and U.S. continuing through the early part of the year before fading.

"That divergence is quite well priced and hence the scope to the downside is not huge," says Halpenny.