Pound to Dollar Rate Swoons After Fed Dials Back Rate Cut Ambitions

- Written by: Gary Howes

Image © Adobe Stock

The Dollar rose across the board after the Federal Reserve cut interest rates by 25 basis points but signalled the end of a run of consecutive cuts.

The Pound to Dollar exchange rate (GBP/USD) dipped to 1.26012 (-0.65%) after the Fed "outhawked the hawks" and dialled back its anticipated rate cuts for next year.

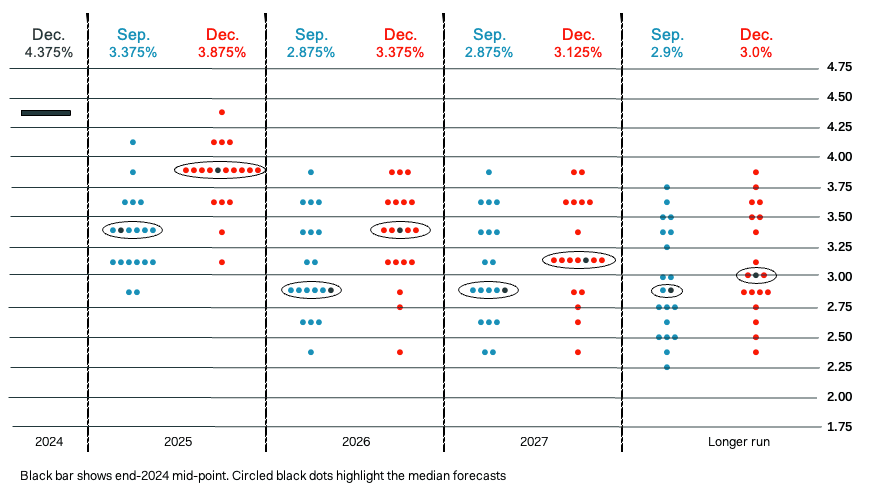

According to the statement, one member of the Federal Open Market Committee (FOMC) - Beth Hammack - voted to leave interest rates unchanged. New projections issued by the FOMC showed officials think fewer rate cuts are anticipated in 2025 and 2026.

They now anticipate that just 50 basis points of cuts will be necessary, making for two reductions, whereas the projections from September showed four were likely in 2025.

The Fed is now expected to cut twice again in 2026 and just once in 2027, taking the terminal rate to 3.1%.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

A higher base in the Fed funds rate will underpin U.S. bond yields, which influence commercial interest rates, thereby increasing the attractiveness of U.S. debt-based assets. This can attract inflows of foreign capital which boosts the value of the Dollar.

"FOMC participants have surprised by halving their expectations for further easing next year to just 50bp. This was far from a close call; 10 participants agree with the median forecast, while only five think it would be appropriate to ease by 75bp or more next year. A January pause is now overtly the Committee’s base case, and the revisions cast some doubt over a March easing too, though that remains our central expectation," says Samuel Tombs, Chief U.S. Economist at Pantheon Macroeconomics.

Image courtesy of Pantheon Macroeconomics.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The Fed also revised its economic projections, which underpinned the 'hawkish' message of the policy update.

"Initial price action in financial markets looks consistent with a relatively-hawkish interpretation of the Fed’s reaction function in 2025, with Treasury yields pushing higher, equities retreating, and the dollar advancing against its major counterparts," says Karl Schamotta, Chief Market Strategist at Corpay.

It raised its GDP growth forecasts for 2024 and 2025, with the economy seen expanding 2.1% in 2025, up from 2% previously. Unemployment is expected to end 2025 at 4.3%, down from the 4.4% estimated under the previous projection.

Inflation expectations were also revised upward for 2025 and 2026, indicating that the Fed expects inflation to remain above its 2% target for a longer period.

"The market reaction was immediate. The dollar strengthened significantly following the announcement, with the DXY index climbing 0.6%, while U.S. Treasury yields also rose. These movements reflect market surprise at a less accommodative tone than expected," says Quasar Elizundia, Expert Research Strategist at Pepperstone.