U.S. Dollar Dominance to End in 2025

- Written by: Gary Howes

Image © The White House

The U.S. dollar is poised for a promising start to 2025, however, a period of unchecked gains is likely to end as the year progresses.

Karl Schamotta, Chief Market Strategist at Corpay, suggests that the era of unchecked dollar gains may be nearing its end due to several factors that are expected to impact the US dollar's performance in the near future.

He says the U.S. economy is showing signs of slowing down; the delayed impact of the Federal Reserve's post-pandemic tightening is beginning to affect the housing market, and labour markets are cooling.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

After a period of strong growth, consumer demand is likely to decrease, and heightened policy uncertainty stemming from Donald Trump's agenda could erode business confidence.

Corpay expects the Fed's policy path to become less hawkish, which will present headwinds to the U.S. Dollar.

This is why by mid-year, projections for the Fed's policy path should begin ratcheting lower, which will reduce the dollar’s appeal suggests Schamotta. This shift towards a more dovish direction will be influenced by the slowing economy.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

In addition, Trump's desire to raise tariffs and pursue a protectionist agenda could lead to more fiscal stimulus in other economies.

"This could reinvigorate global growth, narrow expected growth differentials, and redirect capital flows away from dollar-denominated assets," says Schamotta.

Other economies may experience a rebound. For example, the analyst thinks the Eurozone could see a shift in fortunes as leaders begin boosting defence and infrastructure investments, and China may also see a rebound in exports.

These shifts could challenge the dollar's dominance.

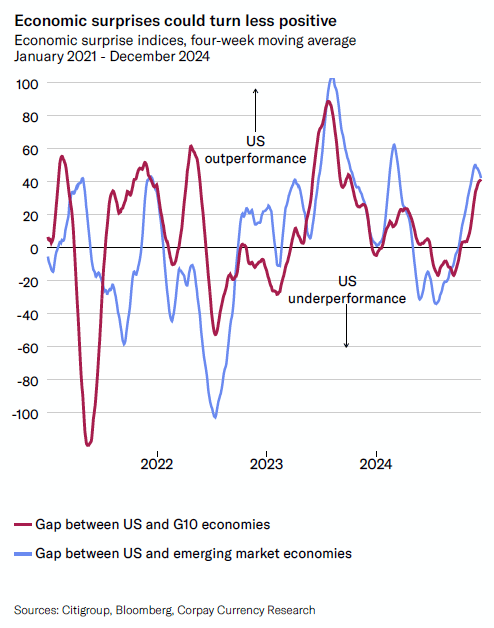

Foreign exchange markets are meanwhile seen as being vulnerable to a correction. "Markets are currently crowded into bets on a continuation in the 'US exceptionalism' theme, which makes them vulnerable to a correction and to a secular rise in volatility."

Corpay's research finds dollar's value is already elevated: the trade-weighted exchange rate is nearing multi-decade highs, which will make further outperformance more difficult.

EUR/USD and GBP/USD Forecasts

Corpay expects both EUR/USD and GBP/USD to face initial challenges but could potentially recover as the year progresses due to various factors, including economic shifts and policy changes.

Euro-Dollar Will See Shift in Fortunes

The euro is expected to begin the year under pressure, potentially falling below parity with the US dollar.

Corpay says this is due to the euro area's economic struggles, including an export-dependent economy strained by geopolitical tensions, elevated energy prices, and a move towards isolationism in the US.

The European Central Bank is expected to cut rates, which will widen interest rate differentials and further pressure the euro.

However, the euro could experience a shift in fortunes as the year progresses

This potential recovery is tied to the possibility of leaders in the Eurozone boosting defence and infrastructure investment in response to trade and security threats from the US.

Additionally, a rebound in exports, potentially due to similar dynamics playing out in China, could improve sentiment and boost consumer spending. An easing of the war in Ukraine could also positively impact the euro.

Corpay's forecast for the EUR/USD pair in the source is 1.04 in Q1, 1.05 in Q2, 1.06 in Q3, and 1.07 in Q4.

Pound-Dollar to End Stronger

Corpay expects the British pound to face a turbulent start to 2025 due to conflicting domestic and international forces.

The Bank of England is expected to cut rates more aggressively than markets anticipate, limiting the extent to which interest differentials can support the currency against the euro.

However, the UK's services-focused economy may offer some insulation against US protectionism.

The Labour government’s expansionary fiscal policy is expected to provide a tailwind to growth as the year progresses, and consumers should experience a substantial improvement in real disposable income.

If the US dollar gains in the first quarter, the pound could suffer alongside other global currencies. However, a recovery is expected as markets reevaluate US policy. A push above 1.30 against the dollar is considered possible by year end.

The forecast for the GBP/USD pair in the source is 1.27 in Q1, 1.28 in Q2, 1.29 in Q3, and 1.30 in Q4.