Pound Dumped as New Year Gets Underway

- Written by: Gary Howes

Image © Adobe Images

- Pound Sterling under pressure on 1st day of 2025 trade

- UK bond yields softer as markets price economic weakness

- Broad U.S. Dollar strengthening underway

The British Pound is softer against most of its major peers amidst softer UK bond yields.

The two-year bond yield has pulled back to 4.35% from its Christmas highs near 4.50% in a move that looks to be taking the Pound lower.

"Sterling has started the year on the defensive," says Jeremy Stretch, an analyst at CIBC Capital Markets. "The UK’s growth outlook has shifted from among the best in the G10 in H1 2024, to among the weakest in H2 2024. GBP front-end rates have yet to reflect that change."

Falling yields signal investors are pricing in more interest rate cuts from the Bank of England in 2025 than was anticipated during the closing stages of 2024. Bond yield changes can significantly influence the performance of GBP and other currencies due to the relationship between bond yields, investor sentiment, and capital flows.

The current market cycle is particularly focused on bond yield differentials and central bank policy. The general rule of thumb is that falling bond yields should weigh on a currency's performance, explaining why the Pound starts the new year on a softer footing.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound to Euro exchange rate is lower by a quarter of a per cent at 1.2066, and the Pound to Dollar rate is nearing its six-month lows at 1.2445 again.

Yet, UK bond yields still remain elevated relative to other countries as investors continue to see the Bank of England cutting interest rates at a slower pace than elsewhere in the coming months. It is for this reason that Sterling was the second-best performing G10 currency in 2024.

Most analysts we follow think the outperformance can continue in the coming year, which suggests that the soft start to the year should still be viewed as a pullback within a broader trend of outperformance.

However, a return to outperformance would require the UK economy to recover from a moribund second half of 2024. Risks on the horizon include a slowdown induced by the new government's hike in business taxes. From April, taxes on employer contributions to national insurance will rise, potentially raising unemployment and prompting the Bank of England to accelerate the pace of its interest rate cuts.

This would drag on yields and bring the Pound down alongside. "We could see BoE pricing shift more dovishly and drag GBP with it," says Stretch.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Economists have also warned that Chancellor Rachel Reeves might have to raise taxes at the spring spending review as a recent rise in the cost of financing UK debt means she is on course to miss her fiscal rules.

"The UK's debt dynamics are among the worst of the advanced economies, and higher market interest rates have already eaten some of the headroom against the fiscal rules. The Chancellor will come under pressure to implement further tax hikes," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

Dollar Strength a Sign of Intent

GBP/USD is approaching six-month lows, underscoring the ominous strengthening of the U.S. Dollar as 2025 begins.

"The fundamental landscape for the U.S. currency remains the same. A hawkish Fed, scaling back its rate cut projections to signal only two quarter-point reductions by December, resulted in narrowing yield differentials between the US and other major economies, whose central banks began leaning towards a more dovish stance towards the end of 2024," says Charalampos Pissouros, Senior Market Analyst at XM.com.

The Federal Reserve cut interest rates in December but indicated it would likely only cut rates on two more occasions in 2025. This puts the Fed firmly in the slow lane regarding rate cuts, which can bolster the U.S. currency.

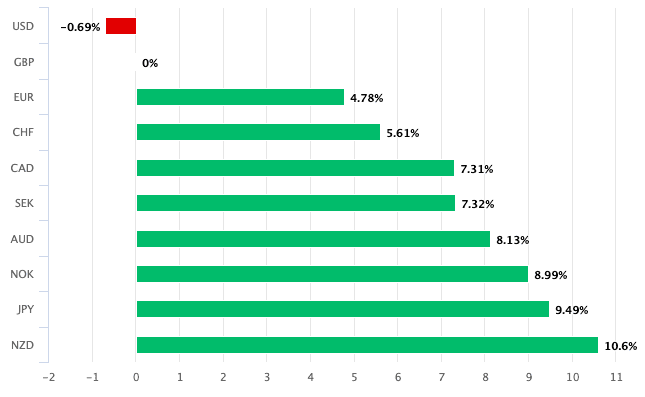

Above: Only the USD outperformed the GBP in 2024.

Some economists think there may be just one further cut from the Fed, which implies further USD strength ahead if correct.

January is also traditionally a period that favours the U.S. Dollar, meaning it could also benefit from seasonal tailwinds in the opening stages of the year.

Martin Miller, a Reuters market analyst, says the U.S. dollar looks set to rise further in January due to a combination of seasonal, fundamental and technical factors.

"FX traders should note that the dollar is usually in demand at the start of each year. An analysis of the January performance since 2000 of the USD index shows it has risen in 15 of the past 25 years," he says.

Rising U.S. Treasury yields have been a tailwind for the dollar, with the benchmark 10-year note hitting a more than seven-month high last week.

"The USD index, which tracks the dollar against a basket of six major currencies, has scope for an eventual probe of the major 108.962 Fibo, a 61.8% retrace of the 114.78 to 99.549 (2022 to 2023) drop. Fourteen-week momentum remains positive, reinforcing the overall bullish market structure," says Miller.

A move to such highs in the Dollar index would prompt the GBP/USD rate to seek fresh multi-month lows.