Pound to Euro Rate Held Aloft by Rising Bond Yields

- Written by: Gary Howes

Profile of Chancellor Rachel Reeves. Picture by Kirsty O'Connor / HM Treasury.

A rise in debt servicing costs has helped Pound Sterling hold gains against the Euro.

The Pound to Euro (GBP/EUR) exchange rate starts the new week at 1.2060 as it defends gains made late last week.

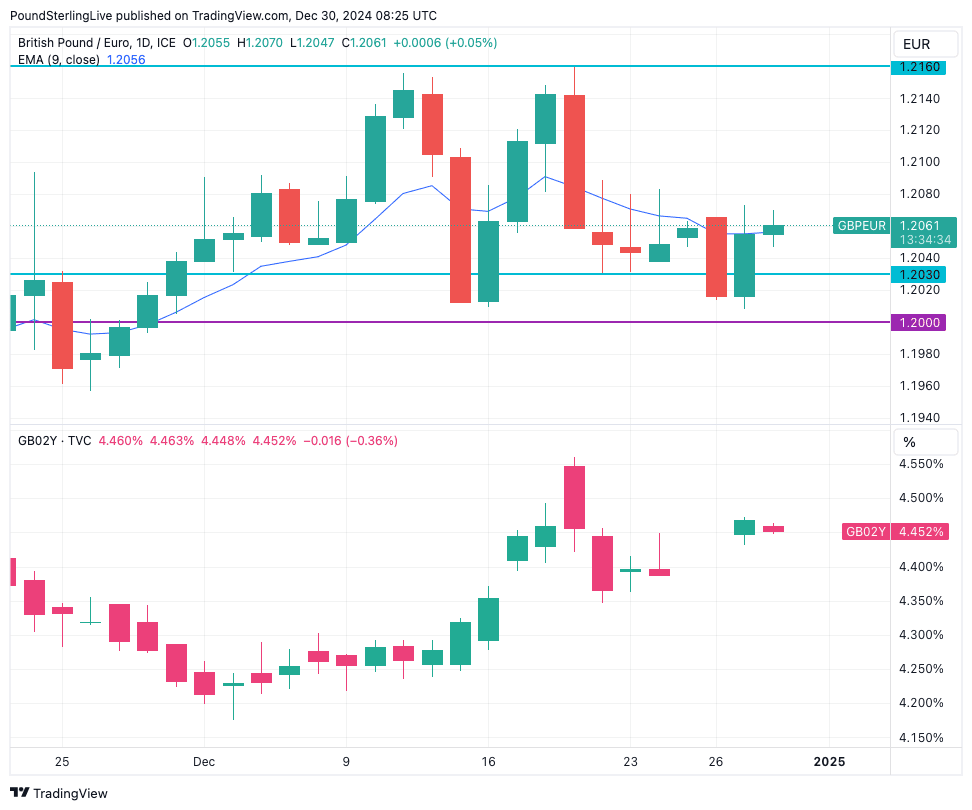

Helping the UK currency is a lift in the yield paid on two-year government bonds from 4.35% to 4.45%.

As the chart below shows, the two-year yield fell earlier in December, corresponding to a pullback in GBP/EUR. However, a stabilisation in the yield since then has helped GBP/EUR cement itself above 1.2030:

Why is the two-year bond yield rising again? The yield is the cost of financing government debt, which continues to rise as investors see UK inflation moving towards 3.0% and above in the coming year.

They believe this will require the Bank of England to keep interest rates at higher levels for longer (which makes for higher bond yields).

The bond market is a gigantic asset class that has a significant influence on currency movements. The rise in UK bond yields tends to attract inflows of foreign investor capital seeking better returns than elsewhere. This, in turn, creates a bid for the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Eurozone bond yields are particularly low (the German equivalent is half that of the UK's at 2.0%.

Although bond market developments look to be supportive for those looking to buy euros, they are worrying for Chancellor Rachel Reeves, as they confirm the government's debt base is becoming more expensive to maintain.

The ten-year bond yield is particularly important in this regard, and here, the yield is higher than it was under the Liz Truss era. In fact, at 4.63%, it is higher than at any time since the financial crisis.

Economists have warned Reeves might have to raise taxes in the Spring as the rising cost of financing the debt means she is on course to miss her fiscal rules.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"The UK's debt dynamics are among the worst of the advanced economies, and higher market interest rates have already eaten some of the headroom against the fiscal rules. The Chancellor will come under pressure to implement further tax hikes," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

However, Reeves has already hiked taxes on businesses as she seeks to boost public spending and economists say the decisions could result in falling employment and economic growth.

Economic growth and confidence have deteriorated as businesses anticipate these changes.

However, the new measures announced in the October budget will only be implemented in the new year, meaning the negative impact of Reeves' decisions is yet to be fully felt.

A weaker economy would prompt the Bank of England to cut interest rates faster than markets currently anticipate, weighing on UK bond yields.

With the Pound tracking bond yields, a decline in UK yields will pressure the Pound.

Next Spring's spending review could be when the next bout of pain lands.

On taking power, the Chancellor launched a multi-year Spending Review, which is to conclude in Spring 2025 and set spending plans for a minimum of three years of the five-year forecast period.

"To avoid worsening this situation, the Chancellor may need to raise taxes again in 2025, perhaps as soon as next spring's fiscal event if movements in market pricing further erode the Chancellor's headroom," says Goodwin.