UK House Prices Tipped to Accelerate in the Coming Year

- Written by: Gary Howes

Image © Adobe Images

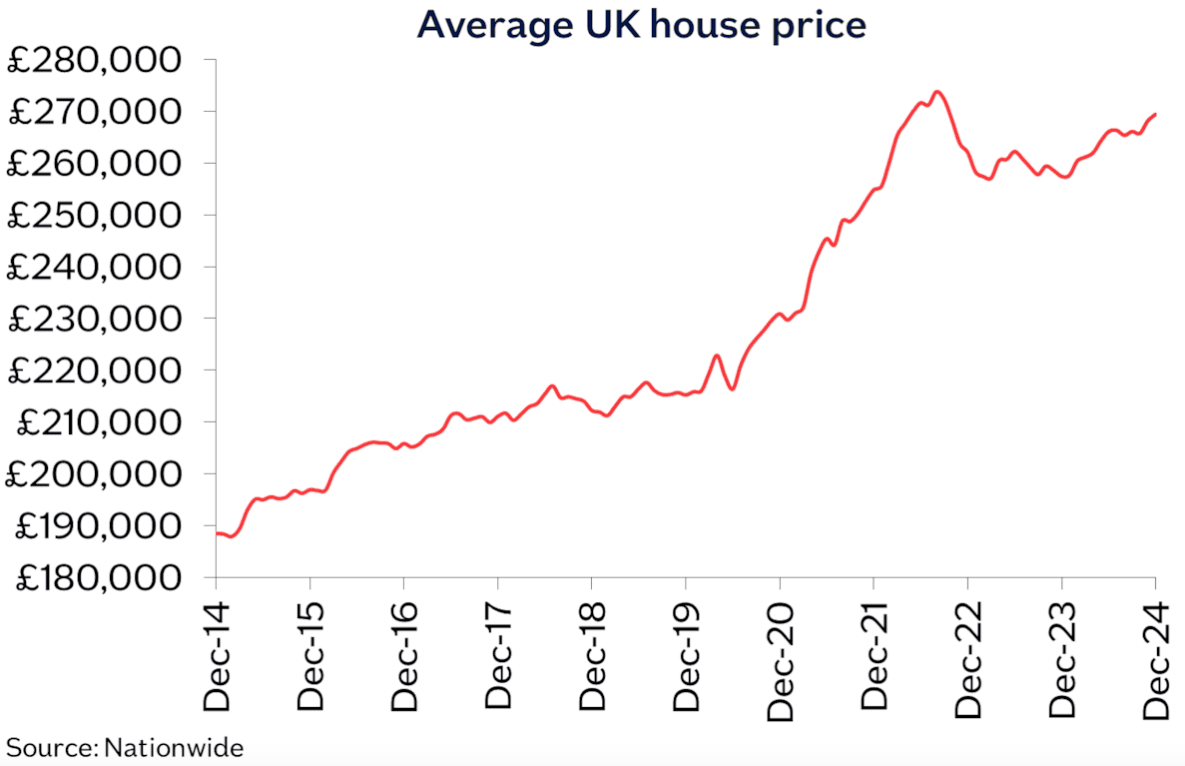

UK house prices are to accelerate in the coming year, according to a new analysis that follows news prices rose strongly in December.

The Nationwide House Price index jumped 0.7% month-on-month in December, beating a consensus estimate for 0.1%.

This is slightly lower than November's 1.2% increase. However, the monthly gain was enough to take the year-over-year growth rate to 4.7%, from 3.7% in November.

"House price inflation continued to gain momentum in the back end of 2024 as the MPC cut rates—three-month-on-three-month growth rose to 1.6% in December from 0.1% in June," says Elliott Jordan-Doak, Senior UK Economist at Pantheon Macroeconomics.

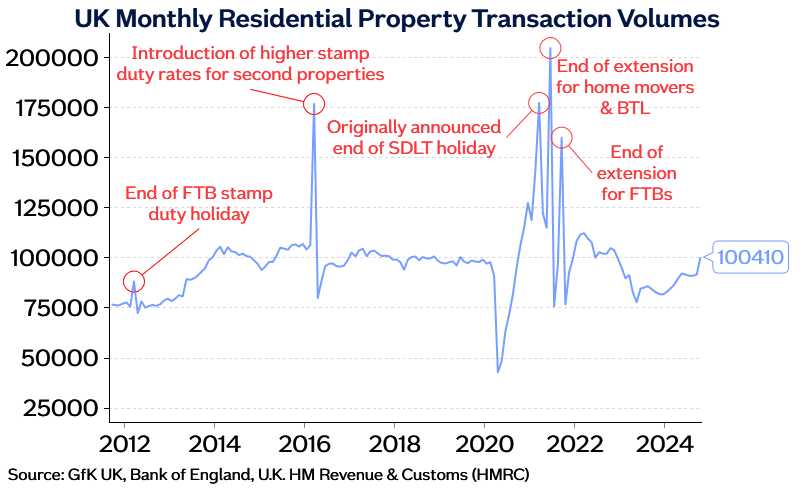

Analysts point out that recent strength comes as home buyers look to transact before taxes on house purchases rise in April.

"December continued to defy expectations, with house prices continuing to rise despite the usual seasonal slowdown. This reflects strong demand as buyers moved quickly to secure deals ahead of the April 2025 stamp duty threshold changes," says Nicky Stevenson, Managing Director at national estate agent group Fine & Country.

Stamp Duty Land Tax rates will rise on 1st April 2025 as temporary increases to the thresholds that were put in place in September 2022 come to an end. Analysts say it's first-time buyers who will be the most affected.

Currently, first-time buyers pay no stamp duty when buying a home worth £425,000. This threshold will drop to £300,000, meaning they will go from paying nothing to paying £6,250 on stamp duty.

Stevenson says the urgency of pre-April transactions may ease, potentially leading to a more balanced market later in the year.

"Rising living costs and inflation could encourage some buyers to take a measured approach," Stevenson explains.

Nationwide says upcoming changes to stamp duty are likely to generate volatility as buyers bring forward their purchases to avoid the additional tax.

"This will lead to a jump in transactions in the first three months of 2025 (especially in March) and a corresponding period of weakness in the following three to six months," says Robert Gardner, Nationwide's Chief Economist.

Mortgage affordability will remain challenging in 2025, with money markets reducing expectations for the number of interest rate cuts from the Bank of England in 2025. This could keep mortgage rates elevated for longer.

"The further rise in swap rates in December suggests that mortgage rates will climb higher over the next few months, and combined with past rises, that may eventually weigh on housing demand and prices," says Alex Kerr, UK Economist at Capital Economics.

However, Pantheon Macroeconomics predicts that house price gains will continue in 2025. "Forward-looking price indicators suggest that house price inflation will accelerate over the year ahead," says Jordan-Doak.

He explains that data from RICS shows price expectations at the 3-month and 12-month horizons are both consistent with year-over-year growth in house prices of around 5%.

"The housing market performed strongly in 2024 even with interest rates above 5% for most of the year. Small changes to Bank Rate had an outsized impact on house prices in 2024, so a repeat of this dynamic would represent an upside risk to our forecast of 4% year-over-year growth in the ONS measure of official house prices by December 2025," says Jordan-Doak.

Kerr at Capital Economics also thinks the market will perform strongly, helped by Bank of England rate cuts.

"If we’re right that Bank Rate is cut from 4.75% now to 3.50% in early 2026, rather than to the low of 4.00-4.25% that investors currently anticipate, mortgage rates may fall from 4.5% in November to around 4.0% in 2026," he explains, "That would support house prices this year and next and underpins our above-consensus forecast for house price growth of 3.5% in Q4 2025 and 4.5% in Q4 2026."

Stevenson says price growth may slow slightly from April as the market finds a better balance and enters a more sustainable trend.

"Long-term demand for housing remains strong, supported by enduring consumer needs. While price growth may slow slightly, this creates space for buyers to explore options, take their time, and make informed decisions," he says. "Despite some challenges, 2025 presents a chance for the market to stabilise and achieve more sustainable growth. Buyers and sellers alike will adapt, finding opportunities even amid uncertainty and paving the way for a more balanced housing market in the years ahead."