China's Stimulus Efforts Start to Bear Fruit

- Written by: Gary Howes

Image © Adobe Stock

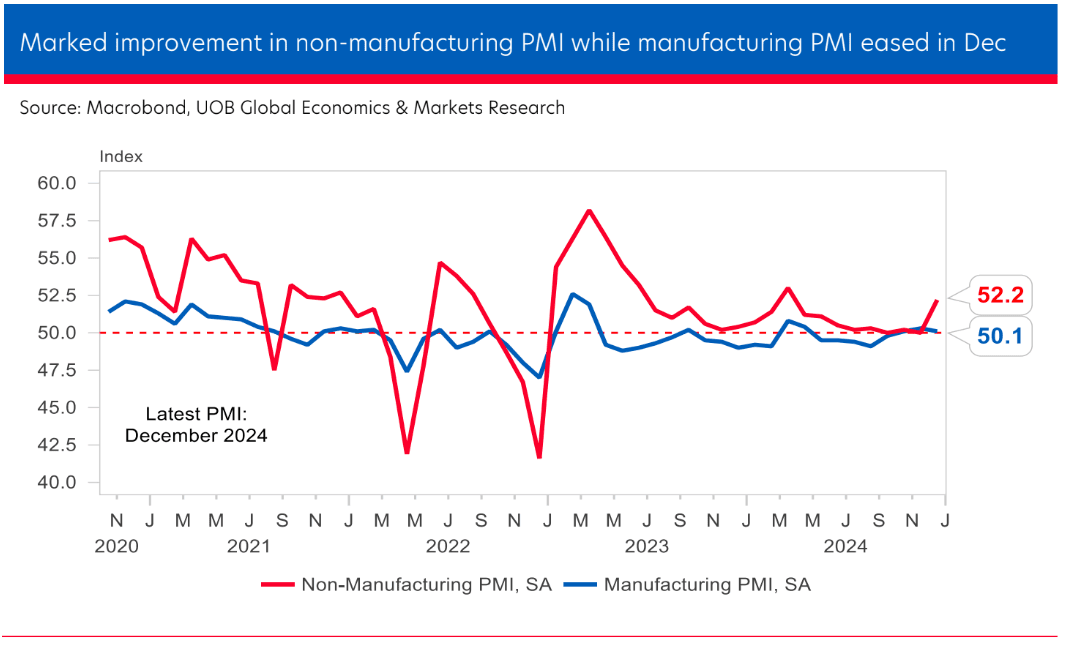

The official Chinese PMI survey reached a nine-month high in December, and economists say that stimulus measures are starting to make an impact.

New survey data shows China's economy gained momentum in December as the services and construction sectors boosted output while the manufacturing sector could also be turning a corner.

China's official construction PMI rose to 53.2 in December from 49.7 in November, consistent with a strong expansion.

"The increase appears to be largely stimulus-driven," says Kelvin Lam, Senior China+ Economist at Pantheon Macroeconomics. "A bright spot in the construction PMI was the sharp rise in new orders, with the sub-index surging 3.5 points to 53.2 in December, moving above the key threshold of 50."

Image courtesy of UOB.

Lam says this survey data points to stronger production and higher factory gate prices of construction materials, reflecting increased stimulus and seasonal demand.

Stimulus efforts could also be having an impact on consumption, as China's services PMI rose to 52.0 in December from 50.1 in November. The combined efforts of construction and services took the non-manufacturing PMI to 52.2 in December from 50.0, beating consensus at 50.2.

Within this bracket, financial services, telecommunications and travel sectors grew strongly.

China has announced significant monetary and fiscal stimulus efforts to bolster domestic growth. Whether these efforts succeed will be a key question global investors want answered in 2025.

If successful, China's stimulus-led economic revival can boost the global economy while raising commodity prices and China-linked currencies such as the Australian Dollar. The Eurozone's export economy would also benefit, while the Dollar would face a potential rally-ending headwind, as it is often non-U.S. growth outperformance that tends to weigh on the world's defacto reserve currency.

"Increased fiscal support should continue to lift economic growth in the near-term given that deficit spending is likely to be front-loaded at the start of next year," says Gabriel Ng, Assistant Economist at Capital Economics.

The Central Economic Work Conference (CEWC) in December pledged to strengthen policy support in 2025, including a "moderately loose" monetary policy and "more proactive" fiscal policy with the fiscal deficit ratio raised to increase the intensity of fiscal expenditures as well as expanding domestic consumption.

That being said, China's almighty manufacturing sector continues to struggle. The manufacturing PMI revealed a third consecutive month of manufacturing growth, coming in at 50.1 in December, down from 50.3 in November and just below the consensus forecast for 50.2.

However, Ng points out that the headline figure probably exaggerated weakness owing to a decline in the output component of the PMI.

"The rest of the breakdown was more encouraging and suggests that goods demand has continued to pick up – the overall new orders component rose to a 8-month high and the export orders index rose to its highest in four months," explains Ng.

Taking all the PMI components together takes the official composite PMI to 52.2 in December, a 9-month high, from 50.8 in November.

"China’s economy has continued to stabilise with the help of the government’s stimulus measures while the frontloading of exports to the US may have also provided a short-term boost to the manufacturing sector," says Ho Woei Chen, Economist at UOB.

Looking ahead, the next key event in the stimulus rollout will be the 14th National People’s Congress (NPC), which will open its third annual session on March 05.

"The recent policy push continued to provide near-term support for domestic economic activity, though more forthcoming

measures will be key to sustain the trend," says Taylor Wang, China Economist at HSBC.

HSBC expects domestic fiscal stimulus to take the lead in helping offset a possible external drag amid rising trade tensions in 2025. It expecs the official fiscal deficit expected to be raised to 4% of GDP.

"We also expect a RMB2trn of special central government bond issuance as well as a RMB4.2trn quota for SLGBs to be used for infrastructure, property purchases and debt repayments. Monetary policy easing may come through with 30bps of interest rate cuts and 50bps of RRR cuts next year," says Wang.

People's Bank of China Governor Pan encouraged rate cut expectations on Monday after telling the People's Daily that he believes China still has room to cut banks' reserve requirement ratio as the local industry average of about 6.6% is high compared with other major economies.