Sell U.S. Dollar Rallies, says Macro Hive

- Written by: Gary Howes

Image © Adobe Images

Sell the Dollar on strength amidst crowded positioning and improving technical considerations.

"We remain cautious and prudent but like selling USD rallies from here, with a view to the DXY (at least partially) correcting the runup seen since late September," says Richard Jones, a strategist at Macro Hive.

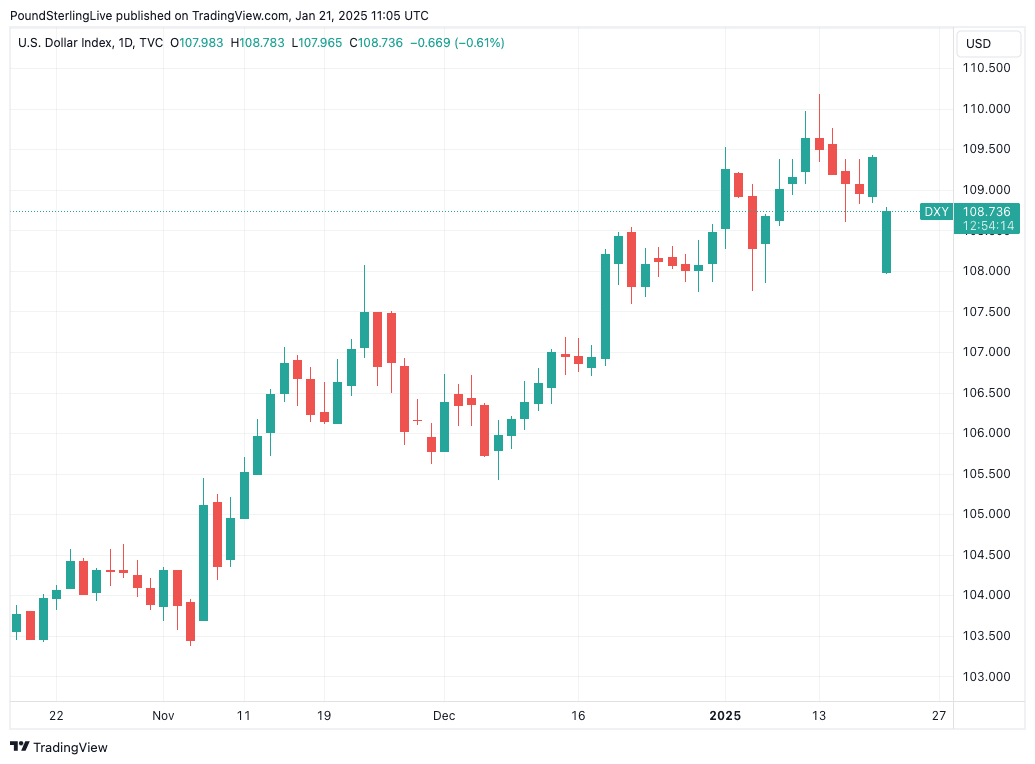

The US dollar index (DXY) - a measure of USD strength against a basket of currencies - has risen 9% since the start of the final quarter of 2024. Gains were fuelled by a run of above-consensus economic data that prompted markets to slash bets for the scale of Federal Reserve rate cuts in the outlook.

Upward momentum intensified following Trump’s election victory, with investors sensing a series of USD-positive policy initiatives. In fact, since November 05, DXY has rallied just over 6%.

Above: The Dollar index.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Jones says positioning in the Dollar now looks to be overextended, which can often prove to be a precursor of a reversal.

"Momentum players remain long USD across the board," explains Jones. "When seeing momentum players uniformly long USD across the majors, especially in EUR/USD and USD/JPY, we think fading this positioning looks attractive."

Jones says he looks for crowded positioning coupled with stretched technicals.

However, some caution is warranted, with Jones saying aggressively selling into the USD at this point is not attractive.

Instead, "we prefer to sell into USD strength, scaling into a short position patiently. Therefore, we think the USD is currently a sell-on-rallies."