South African Rand: "The Good Times are Back" says BofA

- Written by: Sam Coventry

Image © Adobe Images

The South African Rand is one of the most undervalued Emerging Market currencies and a strong rebound is likely.

This is according to a new analysis from Bank of America, where analysts think the Emerging Market currencies are about to turn a corner.

"Investors are very bearish EEMEA FX," says David Hauner, Global EM FI/FX Strategist at Bank of America. "This ties in with the all-time high in long USD/EM positions in our proprietary flow data.

Hauner explains that the universal consensus is a reliable contrarian indicator, and his team thinks EM and EEMEA FX should start to surprise to the upside from February/March.

"However, the broader USD might still be strong in the rest of January, in our view," he adds.

BofA says it is bullish on the Rand, noting that a weakening in the "USD should drive the ZAR stronger as it is one of the most undervalued EM currencies."

Tatonga Rusike, Sub-Saharan Africa Economist at BofA, says the Rand will also benefit from improving domestic fundamentals.

He predicts domestic inflation will stay below target for much of the year, allowing the South African Reserve Bank to cut the REPO rate below 7.75%.

October and November CPI data printed 2.8% and 2.9%, and BofA expects inflation prints to average 4.3% in 2025, which is below the SARB's 4.5% target.

The government also appears to have a firm grip on its finances than 12 months ago, helped by tax revenue growth of 5.3% compared to under 2% in November 2023.

"Good times are back," says Rusike.

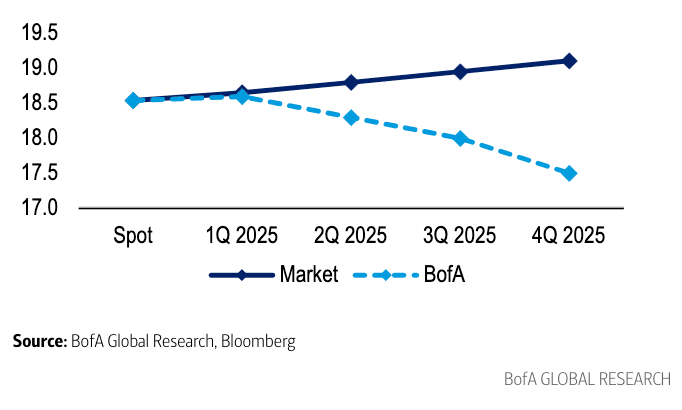

Forward contracts show the market is positioned for ongoing weakness in the Rand through the duration of 2025; however, Bank of America's forecast profile shows corporates with ZAR exposure should start hedging against ZAR strength:

BofA's USD/ZAR profile is for 18.60 by the end of the first quarter, 18.30 for the end of the second quarter and 17.50 for year-end.