Bond Crisis 90% Down to Reeves' Budget Say Small Businesses

- Written by: Gary Howes

Image © Adobe Images

UK government bonds, the Pound, and UK stocks are falling. Small businesses in the UK say Chancellor Rachel Reeves and her government must change course.

The cost of financing the UK government's debt has exploded, and all eyes are on how the government will react and attempt to restore order.

Concerns are mounting, with Martin Weale, a former member of the Bank of England's Monetary Policy Committee, saying ongoing events echo the 1976 debt crisis "nightmare" that forced the government to ask the International Monetary Fund for a bailout.

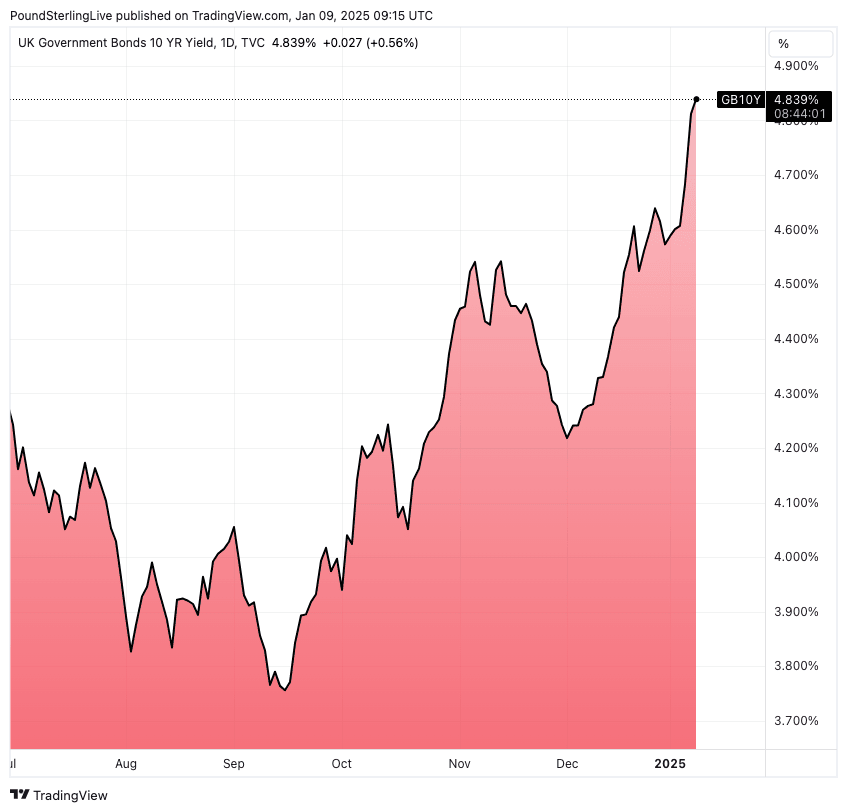

Above: UK debt costs hit fresh highs on Thursday. Pictured is the yield on the UK ten-year sovereign bond.

He says Labour may have to resort to austerity to reassure markets that it will address the UK's escalating debt burden.

Reeves has already raised taxes on businesses to try and improve the government's finances, but it looks as though it was those tax rises that killed economic growth that ultimately led the market to question the sustainability of the UK's debt dynamics.

"Rachel Reeves' ill-considered Budget is 90% of the cause as it is the exact opposite of what was required," says Roger Lane, CEO at Fort Advice Bureau.

"Add to that the continual downbeat messaging from Labour and their dreadful beginning in Government, it is no surprise things are deteriorating. Liz Truss's mini-Budget may have been a bit ill-conceived and incompetently presented, but the principle of tax less and small government had merit and may have been just what the UK needed. Perhaps the outlook now would be more positive if she hadn't been defenestrated so quickly," he explains.

Sacha Lord, Night Time Economy Adviser for Greater Manchester and Chair of the NTIA, says the Reeves tax raid is worse than the Covid crisis for the UK hospitality sector.

"It’s only 7th Jan and I’m already seeing a raft of Hospitality closures this morning," said Lord. "Sadly predicting we will see more at the start of this year, than we did during Covid."

Responding to Lord's observations, The Scottish Hospitality Group confirmed the trend and "unfortunately we will see more of across the year."

"Many decided to take Christmas & NY and then call time. The UK budget have been a nail in the coffin that the sector didn’t need during its slow recovery," said the Group.

Anita Wright, Chartered Financial Planner at Bolton James, says the UK is trapped in a vicious debt circle.

"It is almost impossible to get the deficits down. The Bank of England clearly hasn't got inflation under control, minimum wage and NI increases are being passed onto consumers in the form of higher prices. The bond market is saying, we’re pretty certain a second wave of inflation is coming back, similar to the 1970s."

In the 1970s, the UK was forced to apply to the IMF for a $3.9BN loan after large budget and trade deficits plunged the country into crisis.

In return, the government agreed to IMF-imposed austerity.

"Optimism for 2025 is melting faster than the January frost," says Iain Swatton, Managing Partner at Later Life Property. "Five-year swap rates hitting their highest since May at 4.26% shows traders are slamming the brakes on hopes of Bank Rate cuts. Long-term gilt yields are creeping up as markets brace for more tax hikes and stubborn inflation, making a BOE base rate cut feel like a distant dream."

The Bank of England's typical reaction function since the 2008 financial crisis was to slash interest rates at the first signs of financial or economic decline.

However, one message the bond market is telling us is that interest inflation is rising and will continue to do so. This leaves very limited room for manoeuvre at the Bank of England, given its task is to fight inflation by raising interest rates.

At the very least, the Bank will have to keep interest rates higher for longer, which will keep the pressure on consumers and businesses.

The Bank is also in the process of selling government bonds as it unwinds its quantitative easing programme from previous crises, which adds to the supply of bonds just as investor demand shows signs of cracking.

When heavy supply meets steady or declining demand, yields rise.

"Term premium, the additional yield investors demand for lending long-term money, has also been on the rise, with one factor being the pure level of uncertainty around the future path of inflation and the productive potential of the economy. However, a key factor remains the sheer size of the bond sales by both the UK government and the Bank of England that foreign investors typically mop up," says Lindsay James, investment strategist at Quilter Investors.

He explains that the Bank of England is reducing its Asset Purchase Facility (quantitative easing) to the tune of £100bn/year as part of its reversal of QE, alongside the government's hefty bond issuance that will push towards £300bn this fiscal year.

"The abundant supply of bonds also appears to be driving up yields at a time when the economy is showing cracks," says James.

He says Reeves will likely cut spending in the coming months to restore credibility:

"Spending cuts feel like the more likely outcome, with the Treasury declaring yesterday that meeting the fiscal rules remains non-negotiable. With public services already struggling and the investment budget seen as the source of future growth, the decision of where cuts could fall will be crucial. However, wherever the cuts may fall, her goal of raising economic growth has just become that bit harder."